Breaking News:

Tesla to Focus on Autonomy and AI as Earnings Disappoint

Tesla is facing a slowdown…

Oil Moves Higher on Crude, Fuel Inventory Draw

Crude oil prices ticked higher…

Fed Raises Interest Rates By Half Percentage Point

The Federal Reserve raised interest rates by half a percentage point at the conclusion of its two-day meeting Wednesday, in a move that represents a shrinking of the magnitude of rate hikes after Tuesday CPI data showing inflation had easy to 7.1% in the 12 months to November.

While the Federal Reserve Chairman was still speaking as of 2:22 p.m. EST, with investors paying close attention to any indications about future Fed policy, CNBC cited NatWest strategist John Briggs as calling the speech “hawkish” so far, referring to the Fed’s boosting of the terminal rate forecast above 5%, with just two officials forecasting below.

“That’s a hawkish surprise,” Briggs told CNBC. “It’s not like it’s a disperse [sic] group. I think we’re seeing a delayed reaction. We need to see how Powell characterizes it.”

This year has seen the Fed hike interest rates six times, with the last four increases a sizable 0.75 basis points each time.

Including today’s half-a-percentage-point increase, the Fed has raised interest rates this year at a pace that we have not seen since the 1980s.

While the smaller hike on Wednesday is in line with easing inflation, the Federal Reserve is still not close enough to achieving its 2% inflation goal and economists anticipate more rate hikes in the future.

Wall Street moved higher on Wednesday as the Fed decision neared, with most of the S&P 500 trading in the green and the dollar losing ground. However, energy sector stocks were trending lower, while oil prices were rising.

Oil prices gained $2 in Wednesday trading, largely on forecasts for an increase in demand for 2023 from both OPEC and the International Energy Agency (IEA), as well as because of expectations of slowing U.S. inflation and an easing of Fed rate hikes.

Ahead of the Fed’s decision, Brent crude was trading up nearly 2.5%, closing in on $83 per barrel. West Texas Intermediate (WTI) was trading up the same, over $77 per barrel.

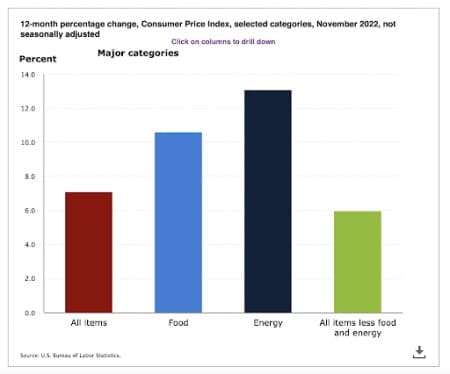

The Consumer Price Index (CPI) released by the Bureau of Labor Statistics on Tuesday, showed a 0.1% increase for November overall–a rise of 7.1% over the past 12 months to November. The 0.1% rise came against expectations of a higher increase of 0.3% and 7.3% for the past 12 months.

The energy index fell 1.6% for the month, partly because of a 2% decline in gasoline prices.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- House Democrats Accuse Big Oil Of Greenwashing

- Erdogan Discusses Grain, Energy Issues With Russia And Ukraine

- Is The Era Of Ever-Cheaper Lithium Batteries Over?

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B