Breaking News:

The Rise of the Middle Corridor Trade Route

The Ukraine war has catalyzed…

Net-Zero Ambitions Hit Major Roadblocks in Europe, UK, and US

Net-Zero transition targets touted so…

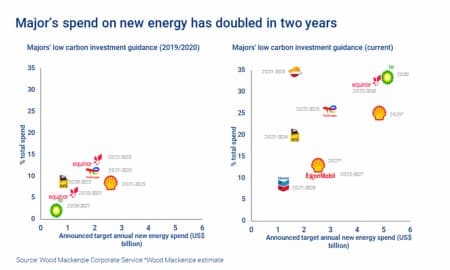

European Oil Majors Doubled Spending On Low-Carbon Energy Sources

In just two years, Europe’s oil and gas majors have doubled their planned spending on low-carbon energy—from 10 percent of capex in 2019 to 25 percent of overall spending per current expenditure plans, Wood Mackenzie said on Thursday.

In 2019, the European majors were targeting on average $2 billion each per year invested in alternative energy sources, or 10 percent of capex. In 2021, those companies now shoot for $4 billion annual investment on average in clean energy, or 25 percent of capex on average.

Spain’s Repsol has the most aggressive target of investment in low-carbon energy—at 35 percent of its total annual spending, Tom Ellacott and Greig Aitken of WoodMac’s Corporate Research team said.

Most European majors target renewables, especially solar, onshore and offshore wind, as those technologies are already commercial and scalable and can give Big Oil the exposure to low-carbon energy they seek, according to WoodMac’s experts.

Apart from the doubled investments in clean energy, a major difference from 2019 is that U.S. supermajors, ExxonMobil and Chevron, have also pledged investments in low-carbon energy, WoodMac notes.

The U.S. giants are betting on renewable fuels and carbon capture and storage (CCS) projects, but they are steering clear of solar and wind.

In Europe, BP, Shell, Eni, Equinor, and TotalEnergies boost investments in renewable energy generation, EV charging networks, hydrogen, and CCS. In the offshore wind sector, oil and gas majors say they have the capabilities and skills of their legacy business to develop offshore wind. All of those companies have submitted bids for the major ScotWind offshore wind tender in Scotland.

Equinor and Eni, together with SSE Renewables, are developing the Dogger Bank Wind Farm off northeast England, the world’s largest offshore wind farm, which will be capable of powering 6 million homes.

“The Majors are on a mission to reshape and futureproof the business. The commitment to new energy and low carbon is a long-term bet on an irreversible shift in the energy mix. And they need to do it now to stay investible,” Wood Mackenzie says.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- Guyana To Become The 11th Country To Produce Over 1 Million Bpd

- The Electric Vehicle Charging Market Could Be Worth As Much As $1.6 Trillion

- OPEC+ To Add 400,000 Bpd In January Despite Oil Price Plunge

Tsvetana Paraskova

Tsvetana is a writer for Oilprice.com with over a decade of experience writing for news outlets such as iNVEZZ and SeeNews.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

Hydrogene from electrolyse is only competitive based on cold fusion ot nuclear power like for e-cars no green energy surplus available from solar and wind power. Hydrogen can be easy changed into sabatier process double dense 700+ bar CNG out of H2 + gas centrifuge air CO2 also a cheap zero carbon cycle.

All combustion engines can run also with CNG like cars, buses, trucks, trains and airplanes.

Main coal.producer about 50%, consumer and importer is china with less reserves also much over countries in asia are using much coal.with no reserves importing much like japan south korea, hongkong etc. and india with reserves increasing production and import mainly from australia increasing, indonesia but also with less reserves, russia increasing. USA export coal wanted in asia not only LNG etc.

USA did not need more coal with mire gas setting also CO2 free exported.