Breaking News:

3 Solar Stocks To Watch as Earnings Season Starts

First Solar, Nextracker, and Sunrun…

Bad News From China Could Be The Harbinger For Lower Oil Prices

Despite some industrial sector gains,…

EU Considers $100 Billion Energy Relief Package For Companies

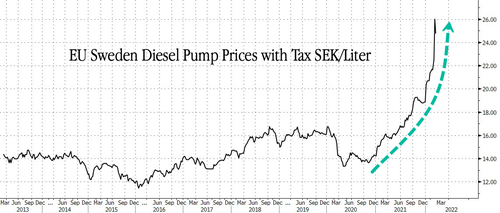

Europe faces an unprecedented energy crisis that requires extraordinary policy action, such as a possible 100 billion euro in relief funds to businesses hit the hardest by soaring energy prices.

Bloomberg cites MF daily that said the European Union on Wednesday is considering a massive 100 billion euro bond issuance for a new relief program that would provide relief funds to businesses hit hardest by rising gas and electricity prices, as criticism soars about out of control commodity inflation and the bloc's inability to tame prices.

MF didn't cite sources, though it said the issuance could be approved within the next 15 days.

The news comes as the European Commission has proposed a plan to make Europe independent from Russian fossil fuels following the invasion of Ukraine. Even before the invasion, many European countries were facing extraordinarily high natural gas, electricity, and fuel costs. There's even risks of a diesel shortage emerging. The latest developments from Ukraine have exacerbated the situation.

On Tuesday, a working group of Germany's coalition parties agreed on a relief package to strengthen Germany's energy independence and help alleviate the burden of high energy costs sources, told Reuters. This comes as Europe's biggest economy is attempting to decouple from Russian gas and oil due to the invasion of Ukraine.

Italian Premier Mario Draghi recently said the invasion of Ukraine had sparked high volatility for the markets for commodity markets, which were already at elevated prices before the conflict. He said, "We must intervene right away."

Spanish Prime Minister Pedro Sanchez said, "committing ourselves to diversify energy sources as fast as possible" is necessary. He said "small businesses and citizens can't bear" soaring gas and electricity costs.

European politicians are awakening to the fact that high energy costs could "re-awakening the nightmare of populism" on the European continent, Greek Prime Minister Kyriakos Mitsotakis warned.

That's why the European Union is likely to pass some kind of energy relief package for businesses and households in the near term.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Big Oil Is No Longer “Unbankable”

- The World Could See A Record-Breaking Oil Supply Shock

- Huge Russian-Run Iraqi Oilfield May See Near-1 Million Bpd Output Boost

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

The truth of the matter is that the EU has been enveloped in an energy crisis months before the Ukraine conflict erupted because of its hasty policies of accelerating energy transition at the expense of fossil fuels, mismanaging its energy market and abandoning long term gas supply contracts in favour of the spot market that may today has supplies of gas and tomorrow none.

Geopolitically, the EU is responsible for what has befallen it for letting the United States trample on it and involve it in schemes to bring Ukraine to membership of the EU and eventually NATO.

Through history, Europe was the source and the battlefields of wars and the eventual loser in all. It is now paying for its past mistakes.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London