Breaking News:

Physical Oil Market Hints at Potential Upswing

Oil prices could break to…

Geomagnetic Storms Could Devastate Washington DC's Power Supply

New research shows Washington DC…

Crude Shows Surprise Build But Product Inventories Slip Further

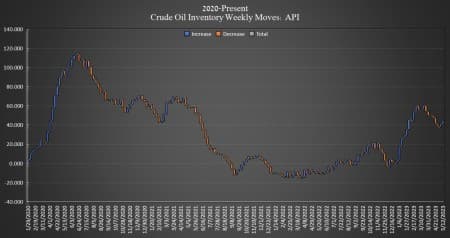

Crude oil inventories in the United rose this week by 3.69 million barrels, the American Petroleum Institute (API) data showed on Tuesday, with analysts expecting a 1.3 million barrel draw.

The total number of barrels of crude oil gained so far this year is still nearly 42 million barrels.

This week, SPR inventory dropped for the seventh week in a row as another 2.4 million barrels of congressionally mandated crude oil was sold during the week ending May 12. There are now 359.6 million barrels—the lowest amount of crude oil in the SPR since September 1983. There are additional sales of crude oil from the SPR planned yet this month.

U.S. crude oil production saw no changes for the week ending May 5, staying at 12.3 million bpd. U.S. production is now 800,000 bpd lower than the peak production seen in March 2020, but 500,000 bpd higher than this time last year.

The price of WTI and Brent were both trading down on Tuesday in the run-up to the data release.

By 3:07 p.m. EST, WTI was trading down $0.43 (-0.60%) on the day at $70.68 per barrel, and down roughly $3 per barrel week over week. Brent crude was trading down $0.49 (-0.65%) on the day at $74.74 —down roughly $2.50 per barrel from this time last week.

WTI was trading at $70.58 shortly after the data release.

Gasoline inventories fell by 2.46 million barrels after rising in the week prior by 399,000 barrels. Distillate inventories fell by 886,000 barrels after decreasing by 3.945 million barrels in the week prior.

Inventories at Cushing, Oklahoma, rose by 2.87 million barrels—after falling by 1.316 million barrels last week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- IEA: Oil Bears Are Disregarding An Imminent Supply Shortage

- Equinor Reopens Gas Field In A Boost For Exports To Europe

- $70 Oil Creates Opportunity In Canadian Oil Stocks

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B