Breaking News:

Oil Moves Higher on Crude, Fuel Inventory Draw

Crude oil prices ticked higher…

Solar Surplus: California's Renewable Energy Dilemma

California's excess solar power production,…

Crude Oil Inventory Build Takes Oil Markets By Surprise

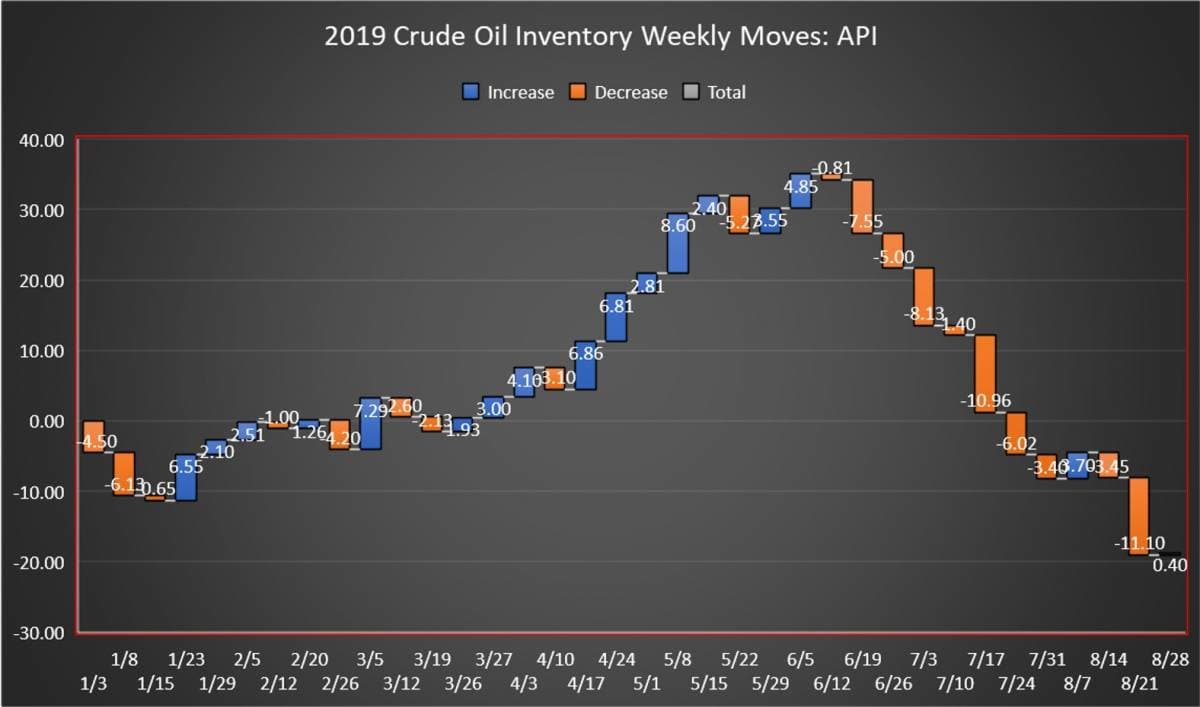

The American Petroleum Institute (API) has estimated a surprise crude oil inventory build of 401,000 barrels for the week ending Aug 29, compared to analyst expectations of a 3.50-million barrel draw.

The inventory build this week takes away from last week’s draw in crude oil inventories of 11.1 million barrels, according to API data. The EIA estimated that week that there was an inventory draw of 10.0 million barrels.

After today’s inventory move, the net draw for the year is 18.68 million barrels for the 36-week reporting period so far, using API data.

Oil prices were trading sharply up on Wednesday prior to the data release after favorable economic data from China came in, boosting what has been until now sour spirits regarding the stunted demand growth outlook.

At 2:21pm EDT, WTI was trading up $2.41 (+4.47%) at $56.35, or about $1.50 up from last Tuesday. Brent was trading up $2.46 (+4.22%) at $60.72 $59.01—about $1.70 up from last week’s levels.

The API this week reported a 877,000-barrel draw in gasoline inventories for week ending Aug 29. Analysts predicted a draw in gasoline inventories of 1.60 million barrels for the week.

Distillate inventories fell by 1.2 million barrels for the week, while inventories at Cushing fell by 238,000 barrels.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending August 23 rose to 12.5 million bpd, a brand new production high.

At 4:42pm EDT, WTI was trading at $56.41, while Brent was trading at $60.82.

The U.S. Energy Information Administration report on crude oil inventories is due to be released on Thursday at 11:00a.m. EDT, a one-day delay due to the Labor Day holiday in the United States.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Exxon Drops Out Of Top 10 In S&P 500

- Oil Jumps 4% On Positive Chinese Economic Data

- Global Economic Slowdown Hits China’s Natural Gas Demand

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

is it going to a buy or sell?

-

Needs to be an investigation into these reports: they've been yanking us back and forth all summer, mostly complete 180 to what's really going on.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B