Breaking News:

Goldman Sachs: Next President Will Have Limited Tools to Raise U.S. Oil Supply

According to Goldman Sachs, the…

Oil Prices Tank on Fears China’s Rate Cuts Herald Demand Weakness

Oil prices fell significantly in…

Another Surprise Oil Inventory Build Presses Down WTI

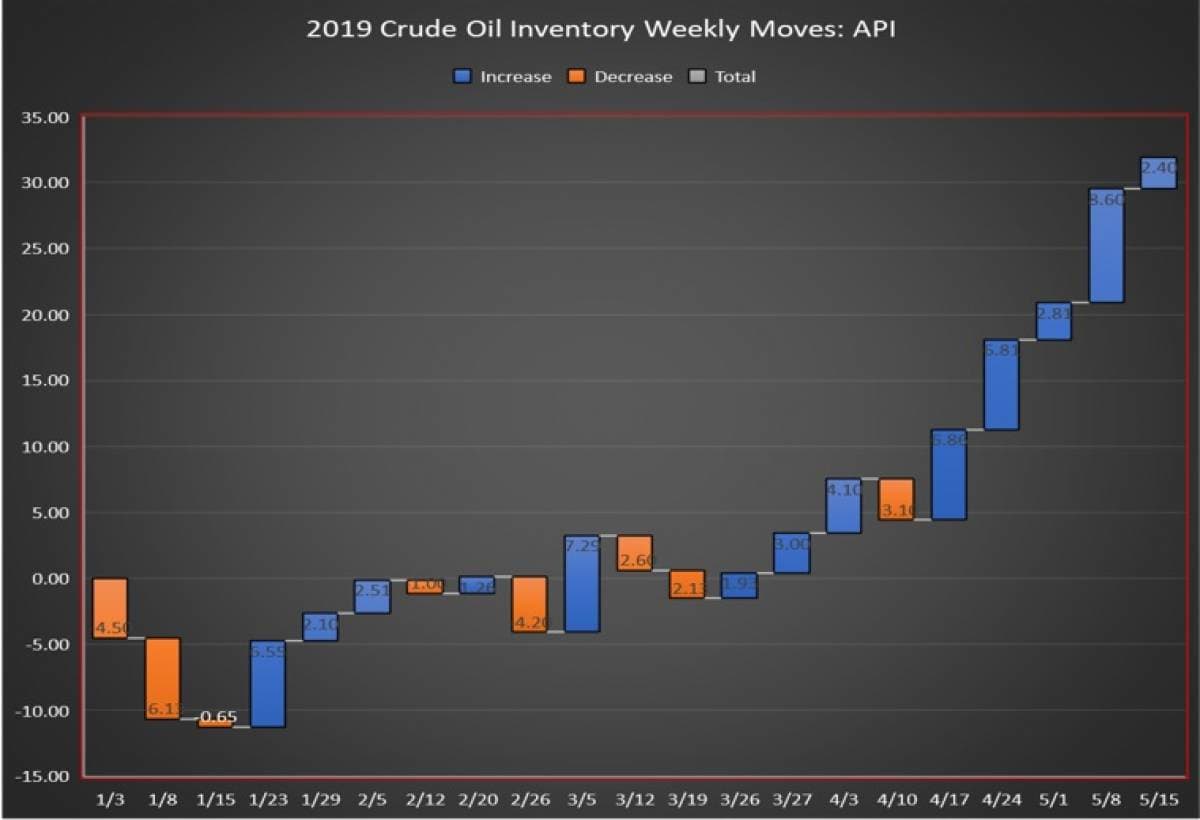

The American Petroleum Institute (API) reported another surprise build in crude oil inventory of 2.4 million barrels for the week ending May 17, coming in over analyst expectations of a 2.53-million-barrel drawdown in inventories.

Last week, the API reported a surprise build in crude oil inventories of 8.6 million barrels. A day later, the EIA estimated that US inventories had increased by 5.4 million barrels.

Including this week’s data, the net build is now 31.92 million barrels for the 21-week reporting period so far this year, using API data.

Oil prices rose early on Tuesday before sinking in the early afternoon, with the market left wondering how to accurately weigh the geopolitical stressors such as sanctions on Iran and Venezuela, attacks on Saudi- and UAE-owned oil tankers off the Strait of Hormuz, and US/China trade talks.

WTI was trading down on Tuesday before the data release at $63.03, down $0.18 (-0.28%) on the day at 12:38pm. WTI was still trading $1 up week on week. The Brent benchmark was also trading down on the day at $71.83, down $0.14 (-0.19%) at that time. The Brent benchmark was trading up just $.40 week on week.

The API this week reported a small build in gasoline inventories for week ending May 17 in the amount of 350,000 barrels. Analysts estimated a draw in gasoline inventories of 1.516-million barrels for the week.

Distillate inventories fell by 240,000 barrels for the week, while inventories at Cushing rose by 870,000 barrels.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending May 10—the latest information available—fell for the second week in a row to 12.1 million bpd from the all-time high of 12.3 million bpd two weeks prior.

The U.S. Energy Information Administration report on crude oil inventories is due to be released on Wednesday at 10:30a.m. EST.

By 4:40pm EST, WTI was trading down at $63.01 and Brent was trading up at $72.04.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- The Threat In Iraq Is Being Overblown

- One Country That Could Win Big From The U.S., China Trade War

- Why Oil Is Still Underpriced

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

World politics and economics have seemed to moved on a dime as trade and possibly real wars have come from the laughable to the edge of reality. Clearly now, the powers that be all over the place have had more information than the rest of us.

Apart from tank-tops and barges floating around full of crude and products unable to unload for lack of space in the US, China has for the past two years built up huge strategic oil reserves that could last for years - without having to import huge extra amounts for a while if necessary. The market was expecting this to be a continuing trend of increasing demand and economic growth in China and the US. But the now obvious was ignored - why were stocks really being built up?

China has been stockpiling vast amounts of crude under the radar for a while, taking advantage of secrecy around their strategic reserves and working around the edges of all the OPEC countries' rules regarding OPEC caps. They have built unbelievably huge onshore tank and underground facilities that are now full, and indeed despite lakes of stored crude there are now ships floating around China too full of crude because there is little space left - and not for lack of facilities onshore. I know because I work in the industry and have heard of very large sales of crude on the side for a while now - which did not seem to make sense, until now.

China can also very easily govern its crude oil and petroleum products usage. Apart from that, a large economic slowdown is underway. They might not need to buy that much more for a while - just enough to keep topped up. The US is now producing so much there will be no shortage there. Cushing might indeed become a lake of crude over the next few years looking at these recent stockpile records!

The US, Saudis, Russians, etc, can pretend to close down the Persian Gulf, bomb the Middle East and Iran to smithereens, set up Venezuela in perpetual stasis, stir up trouble in Nigeria and North Africa, and do whatever else to try and make crude oil prices continue to artificially surge. But, ironically, the market may have now trumped itself in its own greed and misconceptions as to why demand was really there this last little while. Simple supply and demand will put all the stories to bed.

There is now far too much crude oil and products everywhere, despite the ridiculous scare stories written by journalists whose jobs it is to scare up oil prices. Crude, as asset prices worldwide, are probably around 60-80% overpriced, and all will fall together in the correction probably just starting.