Breaking News:

Bad News From China Could Be The Harbinger For Lower Oil Prices

Despite some industrial sector gains,…

U.S. Electricity Prices Surge Amid Grid Strains and Rising Demand

The expected higher expenditures, as…

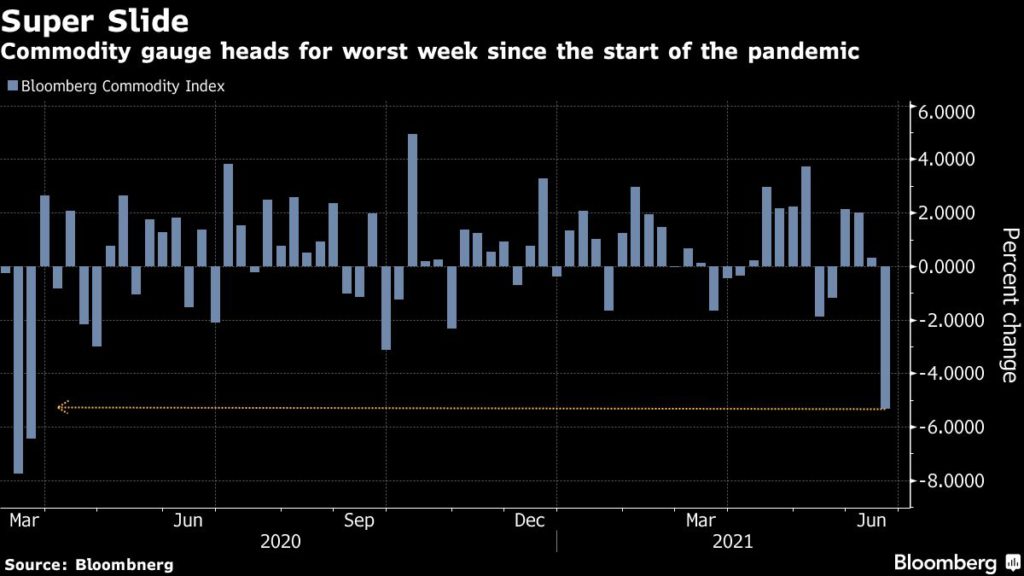

Commodities To See Worst Week Since Start Of Pandemic

Copper prices are headed for their worst week in a year, gold crashed through $1,800 an ounce and palladium gave up almost $300 an ounce in a single day after the US Federal Reserve also signaled that higher interest rates may happen sooner than expected.

This pushed the dollar to its highest in two months, making commodities priced in the greenback more expensive and less appealing to holders of other currencies.

Metals were further damaged by Chinese plans to release copper, aluminum, and zinc from its national reserves as it struggles to rein in factory gate inflation at more than a decade high, although iron ore prices continued to defy gravity jumping to $220 a tonne on Thursday.

The combination with even steeper declines in soft commodities, set up the Bloomberg Commodity Index for its worst week since the start of the pandemic.

With the exception of gold, metals remain well above where they started the year (tin is up more than 50% and aluminum has gained 20%), and some analysts say the rally is unlikely to fade significantly reports Bloomberg.

“We believe we are in the early innings of a decade long strong cycle in commodities, similar to the cycle that took place from the late 90’s through 2008,” said Jason Bloom, global market strategist for Invesco, which oversees $1.4 trillion assets for clients:

“The supply constraints are relatively insulated from the language of the Fed in a given meeting. China can push around prices in the short-term by releasing reserves, but they don’t control markets.”

By Mining.com

More Top Reads From Oilprice.com:

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

President Biden just said "money is cheap!" meaning the US Dollar to him anyways is super over-valued ... a speculators dream comment if ever there was one and indeed an odd formulation of creating ahem *real economic growth* ahem if there ever was one.

Anyhow good lucking claiming the Federal Government can simply financialize an economy again and again and again and again and call that "in fact economic growth that pays for anything!" (let alone cough cough *pays for everything!* cough cough.)

Simply put US Treasury Bond interest rates are the marker for actual economic growth in *ANY* economy and not just the US economy...although certainly in the latter there is that.

Long $ibm International Business Machines

Strong buy