Breaking News:

How the U.S. Presidential Election Could Influence Precious Metals Prices

Precious metals prices are expected…

U.S. Refiners Q2 Results Expected to Dull on Dampening Demand

U.S. oil refiners are expected…

American Shale Drillers Set To Boost Production In July

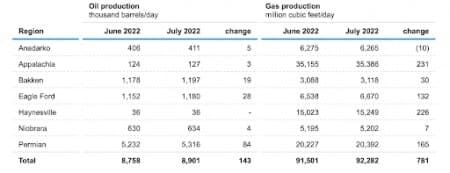

U.S. Shale production in the seven most prolific shale basins is set to increase 143,000 bpd in July to 8.91 million bpd, according to the Energy Information Administration’s latest Drilling Productivity Report published on Monday.

It would be the largest monthly production increase since March 2020, according to EIA data.

The largest jump is expected to come from the Permian basin, increasing by 84,000 bpd from an estimated 5.232 million bpd in June 2022 to 5.316 million bpd next month. The EIA has forecast that the second largest gainer will be the Eagle Ford, which it expects will see an increase of 28,000 bpd, to 1.180 million bpd in July.

Source: EIA DPR

On the natural gas front, the EIA estimates an increase in productivity from June to July, with an uptick of 781 million cubic feet per day. The biggest gains are set to be in Appalachia, which will see an increase of 231 million cubic feet per day, followed by Haynesville, which should be up 226 million cubic feet per day in July.

The EIA also estimated in the Drilling Productivity Report that Drilled but Uncompleted (DUC) wells had slipped from 4,295 in April to 4,249 in May—the lowest it’s been since the EIA started collecting data. The DUC count has been steadily declining since July 2020 when the DUC count was more than double what it is today.

American shale producers are under high-profile scrutiny this quarter, as gasoline prices soar and inflation hits a four-decade high. Washington is looking for big production increase numbers as gasoline prices threaten to reach $6 per gallon.

In the EIA’s previous DPR, the agency had estimated that total production from the seven major U.S. shale basins would rise by 142,000 in June to reach 8.761 million bpd—3,000 bpd above where June figures actually landed.

By Charles Kennedy for Oilprice.com

More Top Reads From Oilprice.com:

- Natural Gas Prices Tank Again As Freeport LNG Remains Shut For Almost A Month

- Noway's Offshore Oil Workers Threaten To Strike

- More Iranian Crude May Be Coming To World Markets

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

let's keep going,,,,

renewables are on the rise most airlines are leaning towards SAF

Venezuela, best kept secret is their heavy crude can only be refined in the US right now and they're wanting to join in on the boom

Electric vehicles are booming, new battery technologies and charging station availability are taking gas vehicles off the road

Hydrogen is taking off

Small nuclear reactors are in play, nuclear energy as a whole is enjoying a renaissance, even states like Calfornia aren't closing sites, if anything they're talking about overhaul, new technologies that don't produce much waste if any

So yes inflation is bad, the economy will slow for a few months, but overall get ready for a superboom economy by the end of 2022 if not a bit earlier