Breaking News:

Geomagnetic Storms Could Devastate Washington DC's Power Supply

New research shows Washington DC…

Centrica's Profits Decline Amid Return to Market Normalcy

Centrica, the owner of British…

API Reports Large Inventory Build As Oil Falls Back Below $100

The American Petroleum Institute (API) reported a large build this week for crude oil of 4.762 million barrels, while analysts predicted a draw of 1.933 million barrels.

The build comes as the Department of Energy released 6.9 million barrels from the Strategic Petroleum Reserves in Week Ending July 8, to 485.1 million barrels.

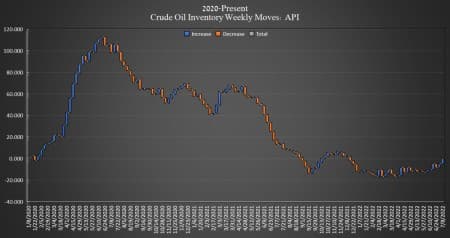

U.S. crude inventories have shed some 63 million barrels since the start of 2021 but the net losses have been negligible since the start of 2020, according to API data.

In the week prior, the API reported a build in crude oil inventories of 3.825 million barrels after analysts had predicted a draw of 1.1 million barrels.

WTI continued to slide on Wednesday on recession fears, and fears of a China demand slump on the presence of the new Covid variant there. WTI was trading down 8.23% on the day at 2:50 p.m. ET in the runup to the release at $95.52—a roughly $2.50 slide on the week. Brent crude was trading down 7.48% on the day at $99.09—a nearly $2 drop on the week.

U.S. crude oil production data for the week ending July 1 stayed at 12.1 million bpd, according to the latest EIA data.

The API also reported a build in gasoline inventories this week of 2.927 million barrels for the week ending July 8, compared to the previous week's 1.814-million-barrel draw.

Distillate stocks followed with a build of its own of 3.262 million barrels for the week, compared to last week's 635,000-barrel decrease.

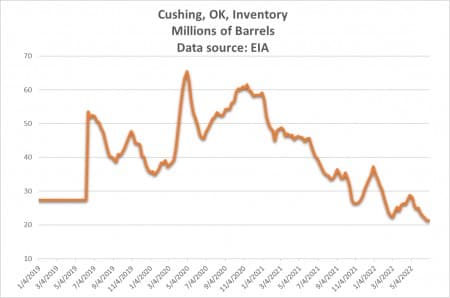

Cushing finished out the inventory gains with an increase of 298,000 barrels this week, compared to law week's draw. Official EIA Cushing inventories for week ending July 1 was 21.330 million, up slightly from 21.261 in the prior week.

At 4:37 pm, ET, WTI was trading down at $95.47 (-8.28%), with Brent trading down at $99.09 (-7.48%).

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- French Industry Switches To Oil From Gas Amid Uncertainty Over Russian Supply

- IEA Director: Price Cap On Russian Oil Should Extend To Fuels

- BlackRock Is Bracing For “Persistent Inflation”

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B