On Wednesday, when looking at the imminent principal payment on $842 million in debt issued by Venezuela's state-run oil company PDVSA , we warned that the state - which had previously activated a 30-day grace period on over $586 million in interest payment due over the past month - may be bankrupt shortly for one specific reason: unlike the rest of the country's debt, the PDVSA bonds have no grace period in the bond indenture for an event of default. It is also why some suggested that Venezuela was shoring up dollars by not repaying other debt, to have funds available for this particular issue.

In retrospect, that appears to be the case because on Friday, PDVSA said that unlike the various other "technical glitches" that had accompanied Venezuela's previous interest payment, it has transferred funds to make a principal payment on debt due Friday amid jitters among investors that the energy producer could default as soon as today."

According to Bloomberg, the Caracas-based firm said it paid $842 million on bonds that fully mature in 2020. The statement didn’t mention the $108 million interest payment that was also due Friday, but has a 30-day grace period. Petroleos de Venezuela SA owes an additional $1.2 billion by Nov. 2 for notes that mature that day.

That said, we still have to get confirmation from the transfer agent that payment was indeed made, and didn't get lost in yet another "technical glitch."

Some generic big picture observations from Bloomberg:

A default for PDVSA would have been disastrous at a time when access to credit has already been severely curtailed, refineries are running at less than half of their capacity and oil output has tanked to less than 2 million barrels a day. Venezuelan President Nicolas Maduro has insisted that his government will continue to honor its international obligations even as imports shrivel to save cash for debt payments causing shortages of goods to worsen in a nation already suffering a deep recession and hyperinflation. Related: Kurdistan Proposes Immediate Ceasefire With Iraq

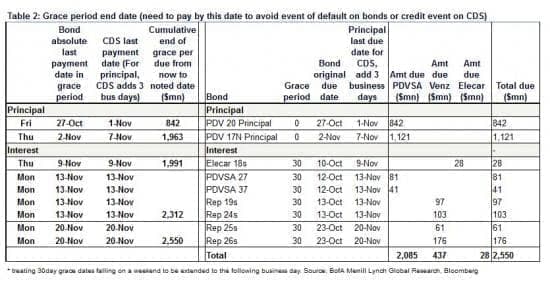

Well, that's one down... and many more to go. As the tables below show, Venezuela is entering a phase where it has a lot of interest payments and a lot of principal maturities.

Grace Period expirations:

(Click to enlarge)

Maturity Schedule

(Click to enlarge)

Debt summary breakdown

(Click to enlarge)

As such, it is not a question of if, but when the financially sanctioned state - which is finding that obtaining dollars is becoming more and more difficult - will default.

By Zerohedge

More Top Reads From Oilprice.com:

- Are Petrocurrencies Heading For Extinction?

- Saudi Rhetoric Sends Oil Prices To Two-Year High

- Why Millennials Can’t Bank On Clean Energy Jobs