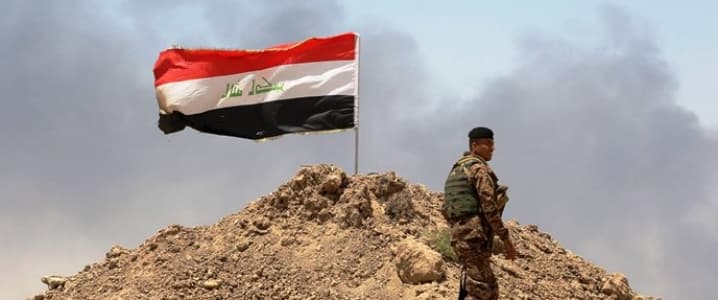

The expected military operation of Iraqi forces against the Kurdish peshmergas in Kirkuk has begun.

Sources indicate that the Iraqi military, supported by Shia militias and Iranian forces, are battling in and around Kirkuk to retake the city and its vast oil reserves. Initial media reports that Kurdish fighters withdrew from the city without a fight are now being countered by reports on the ground of direct military contact. Iraqi military reports still indicate that they have retaken the Kirkuk oil fields and entered parts of Kirkuk.

The official Iraqi military move is a reaction to the Kurdish independence September 25 referendum, where an overwhelming majority (more than 72 percent) of the Kurdish voters cast their ballots in favor of independence. Most Western countries oppose the Kurdish referendum, and have reacted negatively to the outcome. The Kurdish move, supported by most Iraqi Kurds, is feared to start a regional drive for a greater Kurdistan, at least if Baghdad, Tehran and Ankara are to be believed.

The current success of the Iraqi military in Kirkuk is still unclear, as some parts of the city—held by the Kurdish PUK party—left without fighting, yet fierce fighting rages on in other city areas. Outside Kirkuk, sources report that Iraqi military and Shia militias have taken control of a power plant and refinery adjacent to the oil fields. Baghdad’s forces also seem to have secured control of a military airport west of the city.

The current military gains could be short-lived however, as they are largely based on a split inside of the Kurdish command. The governing KDP (Kurdistan Democratic Party) is continuing the battle. The KDP’s leader and regional leader of the KRG, Masoud Barzani, is behind the referendum, which includes the Kirkuk Province and its oil fields. Not all Kurdish parties seem to be behind a move to include Kirkuk into a possible Kurdish independent state. Historical infighting has caused the Iraqi-Kurdish question a lot of pain. The real question now: How far is Baghdad, supported by Iranian backed Shia militias and the IRGC (soon to be designated as a terrorist organization by Washington) willing and able to confront the Kurdish homeland?

For Washington, the current military confrontation is a big headache. The military conflict now pits one American-trained military force against another. The Iraqi army and the Kurdish peshmergas are supported and trained by U.S. forces in their fight against IS/Daesh. U.S. weapons and systems have been provided to both sides. According to the U.S. army, no assistance or coordination has been given to the Shiite militias. However, reports and pictures from the area, in which Shi’a militias are using U.S. weapons or armored vehicles, counter this. Presently, Shi’a militias are openly taking part in the fight against the peshmergas.

This fact could become a major issue in the outcome of the current conflict. After U.S. president Trump decertified the JCPOA agreement with Iran and asked for sanctions on the Islamic Revolutionary Guard Corp (IRGC), Washington is now being dragged into a conflict between two parties it currently supports, Baghdad and Erbil. Since Baghdad is using Shia militias and Iranian forces to counter the Kurdish claims, it could force Washington to choose a side.

The Kurds have already complained that one of the big issues with Iran is its current involvement in Iraq, and now the military confrontation with the Kurds. Based on the claims by the autonomous KRG government that Iran-backed militias armed with U.S. military hardware are taking part, largely via the Iranian-backed Popular Mobilization Forces (PMU), Washington can’t afford to stand on the sidelines much longer, and U.S. hardware is being used by Iranian-backed groups. Related: Chinese EV Boom Could Crash Oil Prices

Last Friday, Trump counted Iran’s growing influence in the Middle East as one of the reasons for decertifying the 2015 nuclear deal with Iran, listing the country’s IRGC as a terror organization. He accused Iran of fueling sectarian violence in Iraq. One of the main groups targeted is the PMU, which was established by Iran in 2014. Sources report that recent days have seen an increased involvement of several Iranian IRGC leaders in the preparations around Kirkuk.

The role of the PMU, which is linked to the Badr Organization, whose members control the Interior Ministry in Baghdad, is considered a concern. Analysts have stated that PMU leaders Hadi Al-Amiri and Abu Mahdi al-Muhandis went to Kirkuk on October 15 to negotiate. These two PMU officials worked with the Iranian IRGC in the 1980s against Saddam Hussein’s regime. On October 15, Iranian Major general Qasem Soleimani was also in Kurdistan. Soleimani is the commander of the Quds Force of the IRGC, the organization responsible for the external operations of the IRGC. Some even indicate that part of the military operations in Kirkuk have been outsourced by Baghdad to Tehran. If true, that would run contrary to Washington’s strategy to support a unified and stable Iraq, without the involvement of Iran.

U.S. Senator John McCain has already warned Baghdad and others of using U.S. arms against the Kurds. McCain, who is chairman of the Senate Armed Services Committee, issued a statement of concern about Iraqi forces using American-supplied arms to attack a “valuable” U.S. partner. McCain bluntly stated that the U.S. hasn’t provided equipment to Baghdad to attack elements of one of its own regional governments, which is a longstanding and valuable partner of the United States. McCain also voiced his concerns about the Iranian involvement in the ongoing conflict in Kirkuk.

Until now, effects on the oil markets have been limited. Reports stating that Baghdad has regained control over the northern oilfields around Iraq could calm markets. However, increased fighting, including military operations against the heartland of Iraq’s Kurdish region, could inflame the country and move other regional powers to also take measures. Today, the KRG temporarily shut down around 350,000 bpd of production from two major fields, Bai Hassan and Avana, but the fields are now back onstream. Kurdish sources also indicate that the export pipeline to Turkey is still open.

Iran and Turkey still threaten further repressive actions against the KRG. Tehran warned the Kurds to back down or be confronted by a combined Iraqi-Iranian military operation, the first signs of which were seen today. Ankara already threatened to shut the KRG operated pipeline to Ceyhan, which could block most of the 600,000 bpd produced in the north of Iraq.

Turkey might take part in a move against the KRG the coming days, as Ankara is keen to quell any Kurdish independence dream. It isn’t coincidental that Iraqi premier Abadi stated that one of the main reasons for the current military operations in and around Kirkuk is the deployment of PKK (Turkish Kurdish militants) by the KDP. Ankara already accused the KRG of using the PKK militias, as well—this could be used by Turkish military forces to start their own incursion into Iraqi Kurdistan.

A Turkish-coordinated effort with Baghdad and Tehran, looking at the growing cooperation between them, shouldn’t be ruled out. For the oil markets, the effect of a joint effort from these countries would be significant. Turkish moves would block not only the 120,000 bpd of oil produced by the KRG from fields claimed by Baghdad, but around 565,000 bpd currently being exported by the KRG, roughly the same amount as OPEC member Qatar. International operators will also be impacted, with Genel Energy, Gulf Keystone Petroleum and DNO all interested in the area. Russian companies are also interested in the area, with Gazprom Neft and Rosneft leading the way.

Related: Iraq Seizes Kirkuk, Briefly Knocks 350,000 Bpd Offline

For Baghdad, the move is risky, as part of its norther oil production is being transported via the Kurdish pipeline infrastructure. Any major military operation or an outright civil war will put a full stop to these oil exports. Considering the current situation, it likely that the Erbil government won’t allow any further use of its pipelines. A possible Iraqi-Iranian-Turkish military incursion would also lead to a total breakdown of exports and possible fallout of other regions.

There’s no present solution. The KRG has dug itself in, while regional powers are getting involved. The lack of engagement by the West—especially Washington—provokes concern. Without Washington’s involvement, the conflict could explode in the West’s face. Trump’s confrontation with Iran is already being tested. There’s still room for cooperation, but the KRG isn’t willing to play the scapegoat role. Washington and the Arab countries must force Baghdad to back down. If not, Kurdistan could become an Afghanistan 2.0, as the peshmergas won’t go down without a fight.

A destabilized northern Iraq is another boon for Iran’s regional expansion, further complicating the region. With another 600,000 bpd at risk, oil markets should start to worry.

By Cyril Widdershoven for Oilprice.com

More Top Reads From Oilprice.com:

- New Tech Could Turn Seaweed Into Biofuel

- Is Hydrogen Fuel As Dumb As Musk Thinks?

- Canada Aims To Solve U.S. Nuclear Woes