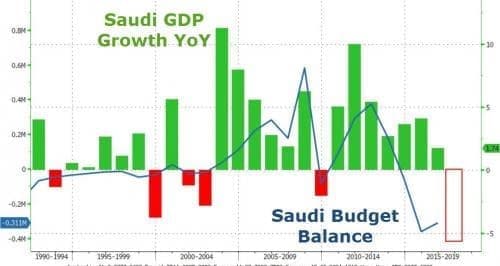

Back when oil was at $100 and above, the Saudi economy was firing on all cylinders, and nobody even dreamed that the crown jewel of Saudi Arabia - Aramco - would be on the IPO block in just a few years. However, with oil stuck firmly in the $50 range, things for the Saudi economy are going from bad to worse, and today Riyadh - when it wasn't busy preventing Yemeni ballistic missiles from hitting the royal palace - said its economy contracted for the first time in eight years as a result of austerity measures and the stagnant price of oil, as the Kingdom announced record spending to stimulate growth.

(Click to enlarge)

OPEC's biggest oil producer said 2017 GDP shrank 0.5 percent due to a drop in crude production, as part of the 2016 Vienna production cut agreement, but mostly due to lower oil prices. The last time the Saudi economy contracted was in 2009, when GDP fell 2.1 percent after the global financial crisis sent oil prices crashing. Riyadh also posted a higher-than-expected budget deficit in 2017 and forecast another shortfall next year for the fifth year in a row due to the drop-in oil revenues: the finance ministry said it estimates a budget deficit of $52 billion for 2018.

More surprising was the Saudis announcement of a radically expansionary budget for 2018, projecting the highest spending ever despite low oil prices in a bid to stimulate the sluggish economic, saying it expects the GDP to grow by 2.7 percent. While we wish Riyadh good luck with that, we now know why confiscating the wealth of ultra-wealthy Saudi royals was a key component of the country's economic plan...

Related: Oil Market On Edge Following Outages

Specifically, spending is at 978 billion riyals ($260.8 billion), up 10 percent on 2017 estimates, the Saudi finance ministry said: "The 2018 expansionary budget includes a number of new development projects," Crown Prince Mohammed bin Salman, who oversees the economic affairs, said in a statement quoted by the official Saudi Press Agency. It was unclear if the projects include the prince purchasing another ultra-expensive French chateau or just a few more Leonardo paintings purchased by proxy.

"About 50 percent of the new budget will be financed from non-oil sources," said the powerful Crown prince, who clearly envisions even more royal arrests and asset "confiscations."

The Saudi economic contraction comes as the world's top oil exporter tries to cope with persistent budget deficits that began in 2014 when oil prices plummeted. In the past four years, Riyadh posted a total of $258 billion of budget deficits, withdrew $240 billion from its reserves and borrowed around $100 billion from domestic and international markets.

So far it has not been enough to restore economic growth.

The new budget was announced during a cabinet meeting chaired by King Salman who said the country would "continue to decrease its dependence on oil to reach just 50 percent" of total revenues.

The finance ministry also said the budget deficit for 2017 came in at $61.3 billion, or 9.2 percent of GDP, and higher than the expected $53 billion. It could be worse: the shortfall is still 25 percent lower than the $82 billion posted in the previous year.

King Salman told the cabinet that Saudi Arabia expects to continue posting a deficit through to 2023.

Some more details from the released budget courtesy of Bloomberg:

- Revenues in 2018 were estimated to be 783 billion riyals ($208.8 billion), up 13 percent on the previous year's projections.

- Actual revenues for the current fiscal year rose by a healthy 34 percent compared with 2016 to $185.6 billion due a sharp increase in both oil and non-oil revenues.

- Actual non-oil revenues collected in 2017 reached 256 billion riyals ($68.3 billion), a 38 percent rise on the previous year, reflecting the impact of hiking prices and imposing fees.

- Total spending includes 83 billion riyals from the sovereign wealth fund and 50 billion riyals from national development funds, in addition to the 978 billion riyals allocated in the 2018 budget

- Capital spending will increase by more than 13 percent

- The economy is expected to grow 2.7 percent next year after contracting 0.5 percent in 2017

- Inflation is expected to reach 5.7 percent from a negative rate at the end of 2017

- The government expects to spend 32 billion riyals in 2018 on a cash-transfer program designed to protect middle- and lower-income Saudi families from the planned increase in fuel and electricity prices

- Non-oil revenue in 2018 is expected to rise to 291 billion riyals versus 256 billion riyals this year

- Achieving the fiscal balance goal was delayed to 2023 from an initial target of 2019

In recent years, Riyadh had resorted to a string of austerity measures to contain spending and imposed a variety of subsidy cuts and rises in prices of services, which however failed to boost consumption and if anything, led to further contraction.

In this context, Prince Mohammed, the architect of the Vision 2030 program of reforms for a post-oil era, has announced a host of mega projects, including a futuristic megacity with robots and driverless cars, which require about $500 billion in investments. It is unclear where he will get the money from unless oil somehow miraculous recovers to $100.

Actually, a war with Iran that drag in some other Gulf states may be precisely what the Crown Prince ordered to send Brent back into the triple digits and restore the Saudi economic shine.

Related: Saudi Arabia’s Big Oil Gamble

Until the war, however, the cornerstone of the kingdom's economic reforms is the IPO of 5 percent of national oil giant Aramco, planned for next year.

As AFP reminds us, Prince Mohammed last year unveiled his "Vision 2030" program of economic and social reforms for a post-oil era with the aim to reduce the country's dependence on oil. The heir to the Saudi throne has been behind stunning decisions to allow women to drive and to lift a 35-year-old ban on cinemas.

Last month, he launched a wide-ranging crackdown on dozens of elites, ostensibly to tackle corruption but in reality, to beef up government funds. Paradoxically, since 2015, the ultra-conservative and oil-rich Gulf state has also introduced a series of price hikes on fuel and electricity. It has also imposed fees on expats and is preparing to introduce value-added tax in the new year.

By Zerohedge

More Top Reads From Oilprice.com:

- Is Premium Gasoline A Waste Of Money?

- China’s Natural Gas Consumption Soars

- EV Range Set To Triple With New Lithium Battery Breakthrough

Long-term, there is no alternative to diversification without a minute's delay and transparency on the spending of the kingdom's huge oil wealth. Moreover, Saudi Arabia should stop spending money on currying favour with the United States. America is not part of the solution for Saudi Arabia.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London