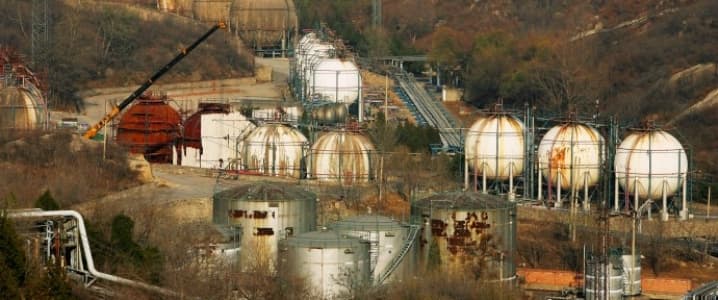

China is tightening government control over the collection of the oil consumption tax in order to eliminate the loopholes that independent refiners—known as teapots—have been exploiting to beef up their profitability.

The stricter oil tax collection move is closely watched by oil analysts because it could hurt teapots’ profit margins and ultimately affect Chinese crude oil imports and oil product exports, S&P Global Platts’ Oceana Zhou wrote in an analysis on Thursday.

As of March 1, China is using a new tax reporting system that tightens transaction monitoring, and it is trying to make the tax collection more effective by eliminating the role of the provincial governments in the tax collection.

Independent refiners have so far enjoyed the protection of their respective local governments that have been collecting the tax revenues from the teapots, but all tax revenue has gone to the central government. Provinces where independent refiners are based have not fully collected the oil consumption taxes and have given tax breaks to the teapots, to ensure local employment and continuous income.

“And unlike their state-owned peers, which pay tax revenues to the central government, local teapots’ fiscal contributions stay within their locality. As such, teapots have received strong support in the form of tax breaks and cheap access to land. Local authorities have even offered teapots refunds on the consumption tax—on blending components for gasoline—or have not been collecting it from the teapots at all,” Michal Meidan of Energy Aspects wrote in a paper for the Oxford Institute for Energy Studies last year.

Now, together with an updated tax reporting system, China’s central government is said to be considering sharing the tax revenue with the provincial governments, Platts’ Zhou says. This would encourage the local governments to collect the oil consumption tax in full and in line with regulations in order to boost their tax revenues.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- The Aviation Industry Is Backing Biofuels

- Something Unexpected Just Happened In LNG Markets

- EIA’s Shocking U.S. Oil Production Predictions