A recent report by the International Renewable Energy Agency (IRENA) has disclosed that it anticipates the cost of renewables to be on a par with fossil fuels by as early as 2020. This is excellent news for proponents of renewables, and, one would assume, very bad news for fossil fuel companies. Lower production costs mean higher returns on investment after all, so surely the choice between investing in, for example, a gas fired power station and a wind farm comes solely down to philosophical considerations? This is not necessarily the case however, as initial investment in the latter is far higher than the former. Fossil fuels then, are still a more attractive investment than renewables, as returns are realized in the shorter term. The reasons for this are myriad, but perhaps one of the most pressing issues is that of reliability. Wind power cannot be generated at whim, leading to a huge imbalance in supply and demand. Lithium-ion battery clusters have proven effective in the very short term, but without a reliable way to store renewable energy in the long term, even a dramatic drop in production costs would still mean renewables would struggle to compete with fossil fuels.

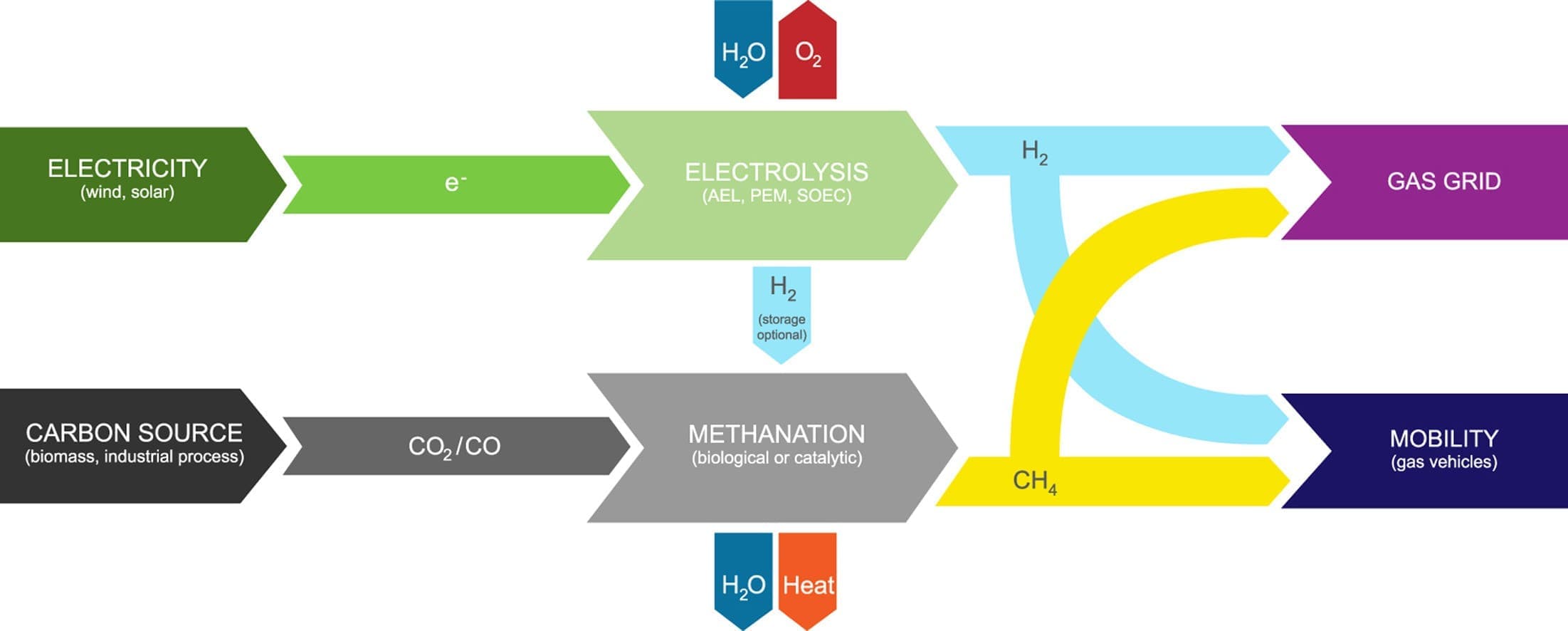

This is where power-to-gas comes in. Put in very simple terms, power-to-gas uses electrolysis to break water down into its constituent parts of oxygen and hydrogen. The hydrogen can be stored along with natural gas in pipelines, or used in fuel cell vehicles. An additional step called methanisation converts the hydrogen into renewable natural gas (RNG), which can be stored in those same pipelines to be used later in a variety of industrial and domestic applications. But just how effective is it? And how does it compare to lithium-ion batteries?

Related: Russia Could Pull The Plug On The OPEC Deal

(Click to enlarge)

(source: https://www.sciencedirect.com/science/article/pii/S0960148115301610)

Last year, research funded by SoCalGas at University of California demonstrated that power-to-gas could enable them to increase the campus’ mix of renewables in their microgrid tenfold, from a relatively minor 3.5 percent up to a hugely significant 35 percent. Such a huge jump is certainly a great argument in favour of the system’s efficacy, and it compares extremely favourable with lithium-ion, at least in terms of cost. According to Matt Gregori, technology development manager at Southern California Gas, their pipeline system has about 13 tWh of equivalent electricity storage. That level of storage using battery storage facilities would cost about $2.6 trillion.

It is indeed the ability to use existing infrastructure that makes power-to-gas so appealing. The North Sea for example, has an existing gas infrastructure. It is also home to offshore wind farms, with the green light having recently been given to construction of the world’s largest wind farm, which is scheduled to come online in 2023. The Hornsea Two project, along with its sister site Hornsea One will have the potential to generate nearly 2.6GW, enough to power in excess of two million homes. Using the preexisting gas pipeline infrastructure for power-to-gas will be a cost-effective way of ensuring that power can satisfy the demand of those homes, as and when it is needed.

Related: Another Oil-Backed Cryptocurrency Launches

Germany too, is a prime candidate for power-to-gas for a different reason - energy transportation. Since the inception of its energy transformation, widely known in Germany as the "Energiewende", there is the increased need for the transport of energy from areas with great wind potential in the north, to where it is most needed in the industrial south. Existing gas pipeline infrastructure has sufficient capacity for such transportation, meaning that power-to-gas utilisation can obviate the need for construction of expensive power lines. This in turn helps to keep costs down, and helps with Energiewende’s target of climate-neutral energy production by the mid-21st century. There are currently 14 pilot and demonstration projects in Germany in operation, with over 17 facilities under construction.

The energy market is irrevocably changing, and energy production methods that until very recently seemed uncompetitive are proving themselves to be just the opposite. Technological development is consistently finding solutions to problems that have hitherto stood in the way of adoption. Fossil fuels are undoubtedly still the mainstays of production, but for how much longer will this still be the case?

By Gary Norman for Oilprice.com

More Top Reads From Oilprice.com:

- Heavy Sweet Crude Is Heading For A Supply Crisis

- The Truth About Aramco’s $2 Trillion Valuation

- Canada Is Facing A Heavy Crude Crisis

This could also mean that we are giving up on flow batteries, which has the similar metaphor for energy stored as splitting water .. I am not sure that it would be a good bet ..

No mention was given on the round-trip energy storage efficiency and comparison with others, such as hydro pump storage, and of course, batteries.