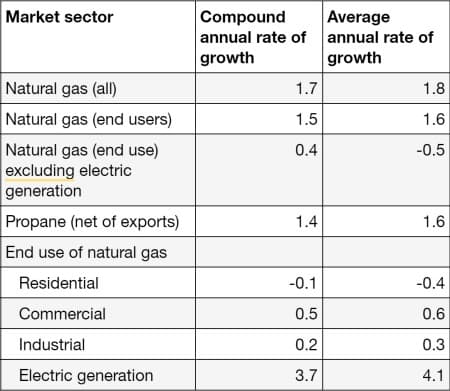

The natural gas industry’s domestic sales pattern over the past two decades makes one wonder whether the industry has much of a future. Okay, sales volume has gone up, at a slow pace, but most of that growth is due to increasing sales to wholesale electric power generators. The rest of the market has shown barely any growth. Table 1 shows annual rates of growth for major customer classifications as well as an estimate of the growth in propane usage. The table calculates growth using both compound annual and average annual growth rates. Either way, the numbers are dreadful. But not out of line with other energy growth rates, generally above the rate of population growth and below the rate of real economic growth.

TABLE 1. ANNUAL % RATES OF GROWTH (2002-2022)

Source: Energy Information Administration

What does the future look like? Warmer winter weather means lower sales. So do more efficient appliances. And so do more efficient competitive products that use electricity like heat pumps. The Energy Information Administration projects that growth in overall demand will hover just below zero, although slightly higher for industrial use and lower for electric generation. Could be worse.

Related: India Looks to Triple Underground Coal Mining Production

What does the stock market think of that grim outlook? Presumably, investors have priced gas utility stocks as potential losers, selling at low ratios of price to earnings and paying ultra-high dividends, because they want immediate returns before the growth fizzles and the companies disappear. But not so. These stocks sell in line with what one might expect for reasonably safe, slow-growth utilities, not companies in terminal decline. What did the company's senior management tell investors to convince them to take an optimistic view? The companies have a simple strategy. They invest in rate base, having convinced regulators that—like a perpetual motion machine—they must continuously spend money on plant expansion and on refurbishing of the network and strengthening connections to pipelines. A larger rate base requires higher earnings to cover costs, including cost of capital. The old regulated utility game is fairly straightforward. Expand rate base (i.e. assets) in order to grow earnings. As an aside, this is the same policy adopted by electric companies a few years ago, when they could anticipate little growth but they spent money on capital expansion anyway and got away with it. The difference, however, is that electric companies can now look forward to acceleration in demand, but gas companies cannot.

Our question, then, is how long can gas utility managers continue with this strategy of making consumers pay more for a commodity when they keep using less of it? Especially when the sale of the product produces carbon dioxide which governments are attempting to limit. That does not sound like a sustainable business model to rational people, so why invest more money in such an industry?

Okay, but consider this. Gas industry executives claim in response that their customers typically save $1000 per year over the alternatives. That’s not much of a sales pitch at a time when both residential and major business customers will pay more to get low carbon or no carbon alternatives, whether to be virtuous or to satisfy corporate “green” initiatives. What sensible marketer promises a low price for an inferior product? Now, technical developments offer the possibility of a cleaner (non carbon emitting) product. Renewable natural gas (from agricultural and municipal waste) could provide about 15% of end user needs. Hydrogen injected into the network might displace. another 15%. And gas derived from municipal wastewater treatment could displace another 15% of natural gas consumption. But here is the message for the gas distributors. The municipal wastewater plants will likely sell directly to generators of electricity, not inject the gas into the networks. The 30% reduction in total natural gas usage (through use of renewable gas and hydrogen) translates to a 40-50% replacement of natural gas within the networks of the distributors, the companies we are talking about, some of which, by the way, are making significant investments in renewable gas producers, opening up another avenue of growth for their stockholders. It means that gas companies could sell carbon-free gas to a large part of their customer base. That gives the companies time to figure out how to replace the rest of its gas supply, if possible. The smart companies are already telling shareholders that their networks can carry anything.

So, to answer our opening question, the domestic gas industry does have a future, we think, at least over the medium term, despite stagnant sales, as long as it takes advantage of an opportunity to transform itself from a purveyor of carbon dioxide emitting products into a smart marketer of something else that’s cleaner and greener.

By Leonard Hyman and William Tilles for Oilprice.com

More Top Reads From Oilprice.com:

- ESG Moment of Truth Turns Tables for Big Oil

- Trillion Dollar Bailout: What Xi Really Wants From Biden

- OPEC+ Nearing Compromise in Spat with African Oil Producers Over Quotas

Moreover, without gas, even a partial energy transition wouldn’t succeed.

And whether the weather is cold or warm, global gas demand will continue to rise.

Therefore, the future of the gas industry like the oil industry is assured well into the future.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert

We don’t disagree. And that natural gas still has a future was the point of our article. However it is the nature of future fuel on fuel competiton that is unclear. Gas is very unevenly distributed around the world. Coal is much more plentiful in the earth’s crust. If politicians who believe climate change is a hoax attain power, then we are likely to see a resurgence of coal not gas fired power plant construction.

As for oil, the competition from battery electric vehicles is only beginning. Probably the greatest factor supporting continuation of the status quo with respect to ICE vehicles is the failure thus far to build out a viable cgsrging infrastructure for BEVs.