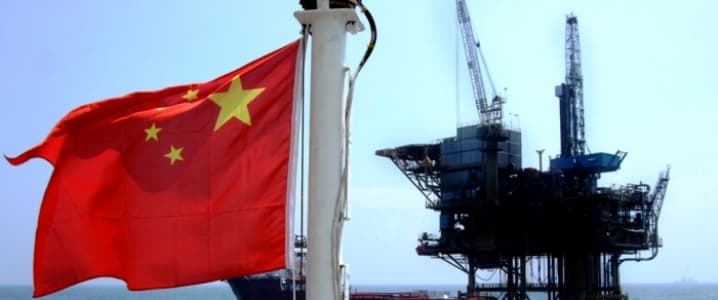

China has said it will allow private companies to invest in the country’s oil and gas storage sector, the government said in a document laying out changes it plans to make to the energy sector.

In a document approved Sunday, the State Council said it plans to increase government investment in the country’s oil storage facilities while also allowing non-state firms to operate storage. It did not give further details.

China’s new energy plan that acts on earlier promises to reform the country’s oil and gas industry was approved by the Central Committee of the Communist Party of China (CPC) and the State Council on Sunday, according to China’s Global Times.

Beijing has been trying to reform its oil and gas industry for some time as the country looks for ways to improve the efficiency of its monopolized sector amid lower oil prices. The CPC has introduced a number of measures including so-called mixed ownership of state firms and permitting smaller “teapot” refiners to import crude oil in the past.

“This is the first time that China said it would encourage private capital in oil and gas storage facilities,” Lin Boqiang, a specialist in energy at Xiamen University, told Reuters.

China has been working to expand its crude storage capacity over the past two years to capitalize on lower oil prices. Related: The Battle For Natural Gas Dominance In Russia

China looks to import more U.S. natural gas

As China continues to look at how best to meet the growing demand of its citizens and open its oil and gas industry, natural gas continues to be a major focus for the country as well.

Supplies of natural gas from the U.S. accounted for almost 7 percent of China’s LNG imports in March, customs data show, but all of it was supplied through intermediaries or spot deals, which China hopes to augment with larger, direct, import volumes, reports Bloomberg.

A trade deal announced May 11 between President Donald Trump and his Chinese counterpart Xi Jinping encouraged China’s investment and purchase of American natural gas.

“The trade deal paves the way for Chinese support into U.S. LNG in both existing and potential future projects,” said Kerry Anne Shanks, an analyst at Wood Mackenzie. That includes immediate LNG sales or signing long-term contracts to underpin financing of new plants.

China National Petroleum Corp. (CNPC) Chairman Wang Yilin said earlier this month that the country’s biggest oil and gas company wants to import more U.S. supplies and will consider participating in projects. Sinopec’s trading unit, Unipec, is considering the U.S., among other producers, for possible long-term LNG contracts for supply starting around 2022, Chen said Wednesday at the CWC China LNG & Gas International Summit & Exhibition.

“U.S. gas will be the cheapest of all because they have abundant supply,” and the Trump-Xi trade agreement is encouraging LNG shipments between the two countries, Zhu Xingshan, a senior director in the planning department of CNPC, said in Beijing last week. “Thus we should increase imports of U.S. LNG.”

By Oil and Gas 360

More Top Reads From Oilprice.com:

- Canada And Brazil Could Jeopardize Oil Market Balance

- Russia And The Saudis: An Oil Marriage Of Convenience

- Venezuela: The Brutal Consequences Of Oil Addiction