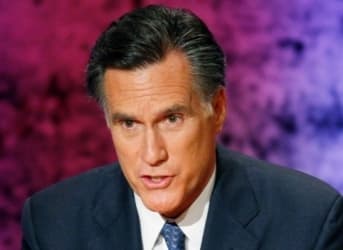

After his wins on Tuesday, Mitt Romney is clearly the Republican standard bearer in the 2012 election, and he is already flailing about attempting to find some mud to throw at President Obama in hopes some of it will stick. He has trotted out a tired talking point attempting to blame Obama for high gasoline prices, saying that the president’s environmentalism has gotten in the way of US drilling. The charge is full of factual and logical holes.

But the attack of Romney on Obama is undermined by the positions taken by Romney1. In 2006, Romney opposed temporarily suspending gasoline taxes because of a spike in the price of petroleum, asserting, “high gasoline prices are probably here to stay.” Then in his 2010 book, “No Apology,” he actually saw rising gasoline prices as a good thing: “Higher energy prices would encourage energy efficiency across the full array of American businesses and citizens … It would provide industries of all kinds with a predictable outlook for energy costs, allowing them to confidently invest in growth.”

Romney had it right the first time. Oil prices are a matter of supply and demand, and Romney only wants to talk about supply. The US imports 8.7 million barrels of petroleum per day (the world produces roughly 87 million barrels a day). If you wanted to put down its price, you could begin by slashing imports by not wasting so much gasoline. If we moved more things by train instead of by trucks; if we gave more tax breaks for buying hybrids and electric vehicles; if we did more to encourage wind and solar energy and integrated it with electric vehicles; if we lowered the speed limits; if we held Detroit’s feet to the fire and required much higher gasoline efficiency much sooner, if we set policies that encouraged people to live in cities near their work– if we did all that we’d put down the price of petroleum. We only have 4% of the world’s population and we use about a fifth of the world’s petroleum, and that is one of the problems.

Of course, the upward pressure on prices is coming mainly from increased use of petroleum by China and India, where large numbers of people have forsaken bicycles and discovered the joys of urban gridlock. Prices jumped the other day on good news about China growing a little faster this year than had earlier been forecast. When China grows, the price of petroleum goes up. So to get firm downward pressure on pricing you’d need China and India and Europe to stop wasting so much gasoline, too.

We can’t affect the supply part of the equation. The United States just doesn’t have many petroleum reserves by world standards, and drilling in nature reserves and off pristine beaches is not going to produce enough fuel to lower world prices. We’ve already increased our production of petroleum and liquid fuels by about a million barrels a day since Obama has been president, and Obama isn’t doing anything to stand in the way of that kind of thing.

And, there are currently some international issues affecting supply:

1. the boycotts on Iran (which Romney supports, in fact he wants more! The more you boycott Iran’s oil, the more you put up the price of petroleum; hint: you’ve reduced supply). Talk of war also raises gasoline prices because the futures markets get nervous.

2. Declining production from old fields. China’s domestic production is down 200,000 barrels a day this spring because an old field is being worked out. China’s good economy is also roaring along, so that Chinese demand was up about 18% in February.

3. Political instability and quarrels. The Kurds in northern Iraq say they will stop pumping oil until the central Iraqi government gives them the share of profits it had promised. Syria used to produce 400,000 barrels a day and is now not doing much because of the upheaval there. South Sudan has shut down production as part of its quarrel with Sudan, through which it pipes its oil, over how much Khartoum skims off.

Romney doesn’t have a magic wand to address these issues, and most of his policies would make things worse (he’d pursue heightened tensions with Iran, would oppose green energy and more efficient use of fuel, etc.)

So why is Romney flipflopping and lying about the president and gasoline prices?

Petroleum companies, oil services companies, and pipeline companies, which can collectively be called Big Oil, spend millions on lobbying politicians in Washington. Some 90% of their contributions go to Republicans. As the likely incoming leader of the Republican Party, Mitt Romney is eager to attract more Big Oil campaign money (the industry liked Rick Perry slightly better) and to support a major constituency of his party.

That constituency is a coddled one.

The Center for American Progress points out, US taxpayers give the 5 biggest oil companies $4 billion a year in tax breaks, even though they made nearly $140 billion in profits last year:

“High oil and gasoline prices in 2011 enabled the big five companies to rake in $137 billion in profits last year. These enormous earnings contributed to the $1 trillion in profits they earned from 2001 through 2011. Despite a profit figure with 12 zeroes—count them: $1,000,000,000,000—these oil giants are major players in the lobbying efforts to retain $4 billion in annual tax breaks for oil and gas companies that they clearly do not need. In the scheme of all things Big Oil, these tax breaks are small, particularly in relation to their profits and in light of the fact that in 2011 these companies also had a combined $58 billion in cash reserves, nearly 30 times more than they received in special tax breaks.”

So Romney wants a political narrative that casts the oil companies as heroic victims. Why, they could supply us with cheap gasoline if only mean Obama didn’t interfere so much with their attempts to drill in Santa Monica beach and in nature reserves.

But they can’t, and Obama isn’t. And besides, Romney already praised the high prices as a good impetus for greater private sector efficiency. Is that cold comfort to the middle class vacationers this summer paying an arm and a leg at the pump? Yup, but Romney is going to provide the middle classes with so much cold comfort this summer that they won’t need air conditioning.

By. Professor Juan Cole

Juan runs the popular geopolitics blog Informed Comment where he provides an independent and informed perspective on Middle Eastern and American politics.