Mexico oil production is in decline though, at the moment, not as steep as it was expected to be (at least by me – IEA predictions are closer).

Data is through June and comes from Pemex and National Hydrocarbons Information Center (CNIH)(both sites are pretty good).

For June C&C was 1870 kbpd, down 25 kbpd from May and 170 kbpd y-o-y. Yearly decline rates for each region are shown in the chart below. Production peaked in 2004/2005 at just over 3500 kbpd, so overall decline is approaching 50 percent.

(Click to enlarge)

Most of the decline has been in light oil and condensate, with heavy oil holding fairly level.

(Click to enlarge)

KU-MALOOB-ZAAP

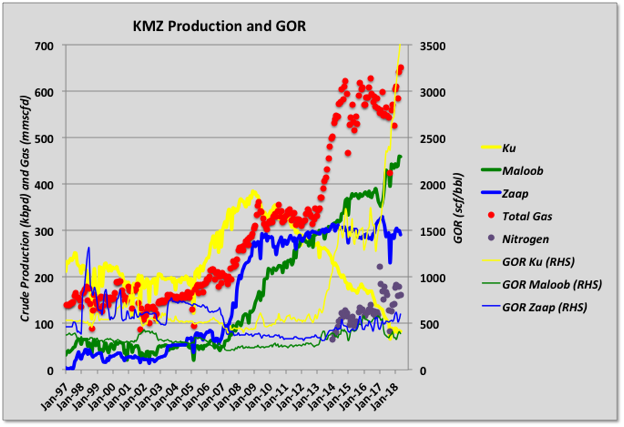

The largest producer is the Ku-Maloob-Zaap complex (KMZ), which has been kept on a plateau, contrary to predictions of a decline starting about now from a Pemex presentation in 2012. The production has been maintained mainly by increasing flow from the Maloob field, and it looks like this has resulted in increased nitrogen production. Ku and Zaap production has been maintained, but the Ku field is getting close to exhaustion now. Ku is a medium oil at API 22°, while Maloob and Zaap produce heavy oil at API 12°. The two types of oil are processed separately so it’s not clear that decline in Ku can be fully replaced by the heavier oil fields, which I think also require more nitrogen for voidage replacement. Nitrogen injection to maintain production there was started in 2014, which was also when overall production came off a temporary plateau and started the current steady decline period. It would be interesting to know how the total available nitrogen is apportioned to the fields; presumably the total available is fixed and therefore so too is the net voidage replacement capacity and hence the total amount of heavy oil that can be produced. The nitrogen gas produced is (again presumably) reinjected so local compression capacity would also be a limit, for example there is still a high amount of nitrogen produced in Cantarell for relatively low oil production and eventually the same fate must befall KMZ.

There’s a six day shutdown planned for one FPSO operating on KMZ, which will knock 95 kbpd off, affecting July and August numbers.

(Click to enlarge)

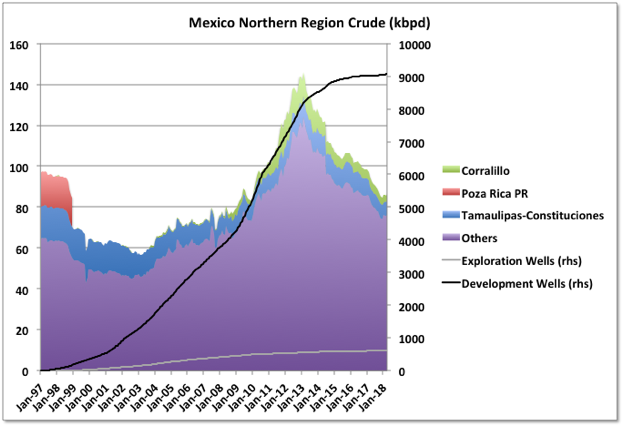

REGIONAL DETAILS

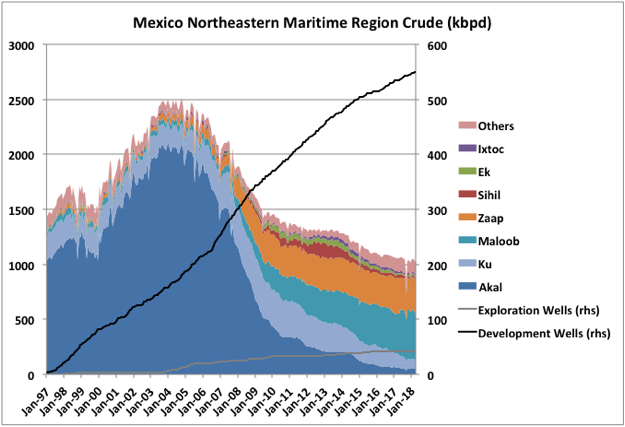

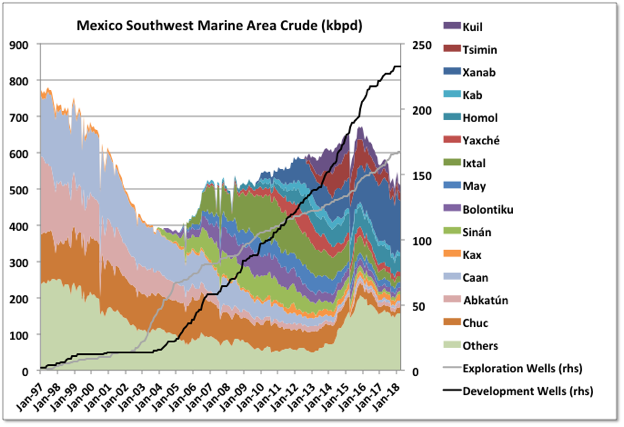

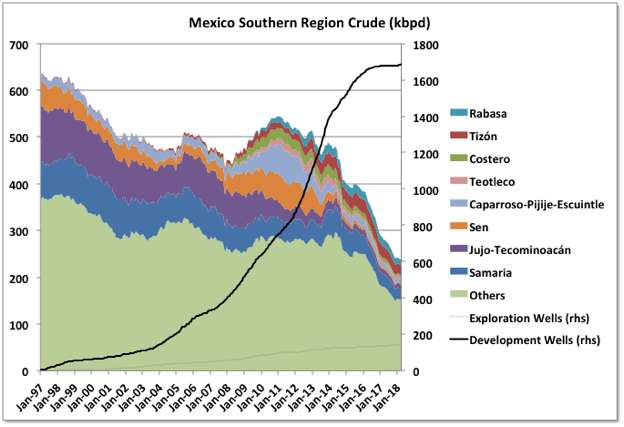

There are four producing regions in Mexico, two onshore and two offshore. The offshore regions are where most of the new drilling and developments are occurring. The onshore basins are mature, show clear creaming curves for drilling, and with few new wells have declines that are steady and almost linear at the moment. Even the two marine areas show evidence that they are in late life stages with declining flow in almost all the fields and creaming of the well numbers. The charts show production stacked but the cumulative completed wildcat and development wells are shown as normal trends. Related: The “Weakest” EIA Report In Years

(Click to enlarge)

Note Akal is by far the largest contributor to Cantarell, other fields are almost negligible by comparison.

(Click to enlarge)

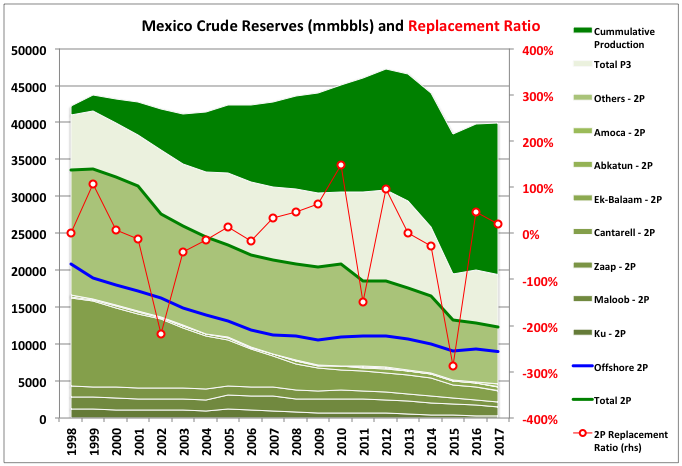

MEXICO RESERVES

OIL

Remaining Mexico reserves have been falling continuously in all categories for several years. The chart shows estimates for oil reserves with 2P (i.e. ‘proven plus probable’, which is usually the best estimate for what is likely to be ultimately produced), with some of the larger fields highlighted, together with total P3 (‘possible’, which tends to decline to zero as a province plays out) and cumulative production since 1999, when data first became available. The offshore proportion of the 2P reserves is also highlighted. KMZ and Cantarell are still the fields with largest reserves, although Cantarell production is well below what might be expected given that its remaining reserves are nominally still enough to class it as a supergiant (and therefore possibly limited by nitrogen capacity – see above). Ek-Balam has been announced as a redevelopment and Abkatun was a large field, produced mostly in the 80s and 90s and now largely depleted.

The biggest reserve additions this year were for the Amoca, Mizton and Tecoalli shallow fields, which Eni is developing as a fast track project with early production planned for next year and ramping to 100 kbpd in 2021. These fields show 2P total reserves at 413 mmboe, and 3P at 706 mmboe, with most of the ‘possible’ additions being natural gas rather than liquids.

The current overall R/P ratio is a respectable 17 years, representing a rise after fairly consistent slight falls in recent years.

(Click to enlarge)

There has been some excitement over the potential for significant deep-water discoveries, but so far there has not been much to show. What discoveries there have been presently only constitute P3 resources, as none of the fields have any firm development plans, and were revised down to a relatively minor 500 mmbbls from 780 mmbbls last year. There may also be some shale oil potential onshore but few exploratory wells have been drilled and I think no reserves have been booked so far.

Only three years since 1999 have had reserve replacement ratios greater than 100%. Many years’ numbers have actually been negative, some of them significantly so, and the estimated ultimate recovery has been revised slightly downwards overall. Related: Canada’s Pipeline Crisis Is A Boon For Russia

Note I’ve labeled the years against the end date for which the reserves and production apply, which is how most countries report them, but Mexico labels them by the reporting year (i.e. one year later).

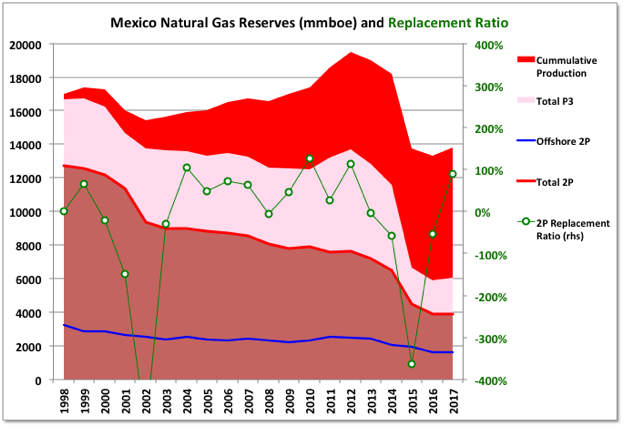

NATURAL GAS

Natural gas reserves have been declining faster than oil, both for ultimate recovery and those remaining, but flattened out this year because of some onshore discoveries. There might be more discovery potential for gas than oil, with extensions of some of the Texas shale gas plays onshore and the deep water sites maybe turning out to be more gas prone.

(Click to enlarge)

MEXICO PETROLEUM IMPORTS AND EXPORTS

As the oil price has increased Mexico has returned to a neutral trade balance for petroleum related goods. The Mexican refining industry is running well below capacity; I think this is mainly because it cannot handle the heavier slate of domestic crude that has resulted as the light grades have been depleted faster, but also from general underinvestment on ageing plants. There have been attempts to open up the Mexico industry to foreign investment, but with limited success and some notably disappointing lease sales, and that effort may now reverse again with a recent change of government. The new Mexican president has said that he intends to end the import of foreign fuel within three years, that is not going to happen by a long way, and reverse the decline in oil production, that is not going to happen at all without several large and easily developed deep water discoveries and even then not in less than five to ten years – in fact some time during his second and third years the decrease from KMZ is likely to get very noticeable

(Click to enlarge)

By George Kaplan via Peakoilbarrel.com

More Top Reads From Oilprice.com:

- Nord Stream 2 Clears Another Hurdle

- All-Time Low Spare Capacity Could Send Oil To $150

- The Productivity Problem In The Permian