Solar developers and investors may have to brace for solar panel costs to start rising after a 30-percent plunge last year.

The period of ultra-cheap solar panels is over, according to the president of one of China’s largest solar panel manufacturers.

The party is definitely over, Eric Luo, president of China’s GCL System Integration Technology, told Reuters this week, commenting on the super-cheap solar components on the global market.

According to the Chinese manager, solar panel prices have already stabilized and are expected to rise by 10-15 percent within two years.

Despite the expected higher costs for solar installations, the global solar industry will continue to add generation capacity this year, and China, the U.S., and India will drive the market, analysts say.

It was China that triggered the massive drop in solar panel prices last year.

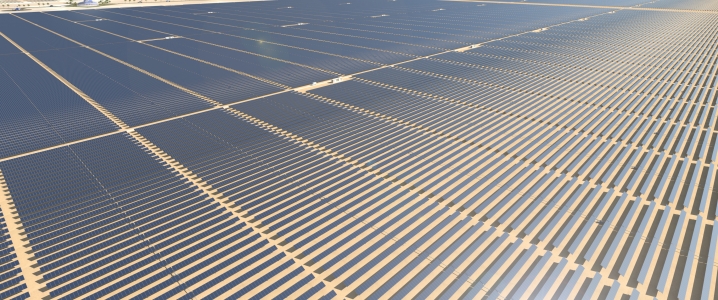

China surprised everyone in June 2018 by announcing that it would not issue approvals for any new solar power installations in 2018 and would also cut subsidies. The major shift in Chinese solar policies led to local manufacturers flooding the global solar panel market, creating a glut and pushing prices down.

As a result of this, solar panel prices plunged by 30 percent last year. While this jeopardized smaller Chinese manufacturers, the ultra-cheap solar panels created a windfall for solar developers and investors in solar photovoltaic (PV) installations around the world.

The market, however, has started to adapt to these disruptions and prices of China-made solar panels are expected to rebound by 10-15 percent over the next year or two, because the Chinese solar manufacturing market is heading to consolidation as small producers suffered the most from China’s solar policies, Luo told Reuters.

Related: Can Mexico Stop Its Oil Production Decline?

The solar market globally is set to gradually adapt in 2019 to the industry disruptions last year, which also included the U.S. slapping tariffs on imports of solar panel products. Together with continued declines in solar and wind costs, 2019 could be a brighter year for the U.S. solar and renewable energy markets, analysts and industry professionals say.

“2018 was certainly a difficult year for many solar manufacturers, and for developers in China. However, we estimate that global PV installations increased from 99GW in 2017 to approximately 109GW in 2018, as other countries took advantage of the technology’s fiercely improved competitiveness,” Jenny Chase, head of solar analysis at BloombergNEF, said last week.

BloombergNEF expects global PV installations this year to rise by 17 percent from 2018, with three key markets driving demand—China, the U.S., and India. Those three markets are expected to account for 52 percent of global installations in 2019, Bloomberg NEF’s Pietro Radoia said on Friday. In China, despite the restrictions on new-build solar capacity, developers are still busy and planning to build subsidy-free projects, Radoia noted.

China also plans to only approve new solar and wind power capacity if it matches the country’s coal benchmark on price.

In the U.S., the tariffs on imported solar cells and modules created uncertainty in the market in early 2018, resulting in quarterly additions of utility-scale solar dropping in Q3 2018 below 1 GW for the first time since 2015, according to Wood Mackenzie Power & Renewables and the Solar Energy Industries Association (SEIA).

Related: Saudi Arabia’s Dangerous Geopolitical Game

“We did, however, see utility PV procurement outpace installations fourfold in Q3, showing that despite the tariffs causing project delays, there is substantial growth ahead for the U.S. utility PV sector,” said Colin Smith, Senior Analyst at Wood Mackenzie.

In its monthly Short-Term Energy Outlook (STEO) last week, the EIA forecast that the U.S. will add nearly 5 GW of utility-scale solar PV capacity in 2019 and another 6 GW in 2020. In 2019-2020, the EIA also sees almost 9 GW of small-scale solar PV capacity installed, mostly in the residential sector. The share of renewables excluding hydropower of U.S. electricity generation was 10 percent in 2018 and is forecast to rise to 11 percent this year and to 13 percent next year.

In the long run, the renewables share, including hydropower, is set to increase from 18 percent in 2018 to 31 percent in 2050, driven largely by growth in wind and solar generation, the EIA’s Annual Energy Outlook 2019 with projections through 2050 showed this week.

“Renewables grow to become a larger share of U.S. electric generation than nuclear and coal in less than a decade,” the EIA reckons.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- Chaos Erupts In Venezuela As Trump Backs New President

- BP Remains Bullish On Oil Demand Growth

- Saudi Arabia: We’ll Pump The World’s Very Last Barrel Of Oil

Batteries are the largest part of a domestic system cost, and aren't going to fall much because there's so much demand, often competing with national grid "peak" balancing schemes, (South Korea particularly), with electric vehicles also competing for battery factory capacity).