Waterborne crude exports from Corpus Christi, TX, reached a record high of 11.379mn bbls, or 1.626mn bpd, in week ending September 27, buoyed by increased flows into the port from new pipelines coming online, according to our North American Waterborne report. The high exports from Corpus Christi partially drained crude inventories that grew 2.7mn bbls between mid-August and late September, following the start-up of Plains All American's 585,000 bpd Permian-to-Ingleside, TX, Cactus II pipeline and EPIC'S 400,000 bpd Permian-to-Corpus Christi EPIC NGL pipeline, currently in interim crude service, according to our Texas Gulf Coast Storage report.

Corpus Christi Exports Contributed To Total U.S. Record

Our data showed waterborne exports from Corpus Christi ports, including the offshore Corpus Christi Lightering Area, surged 5.394mn bbls, or 771,000 bpd, week-on-week to the new record high in the week ending September 27. Volumes surpassed the previous record high of 7.392mn bbls, or 1.056mn bpd, set two weeks before and marked the third record high in four weeks. The second-highest export total from Corpus Christi, at 10.25mn bbls, or 1.464mn bpd, followed shortly after in the week ending October 4.

The 2019 year-to-date export average from Corpus Christi prior to September was 502,000 bpd. By comparison, volumes averaged 395,000 bpd overall in 2018.

Record-high exports from Corpus Christi contributed to the highest exports ever from the U.S. overall in the week ending September 27, as they jumped to 29.612mn bbls, or 4.23mn bpd. Export volumes passed the previous high mark of 28.659mn bbls, or 4.094mn bpd, set in week ending July 5, our data shows.

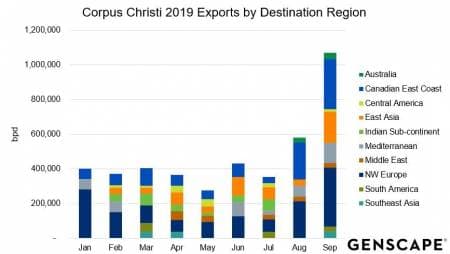

Figure 1: Crude exports from Corpus Christi reached new levels in September. Source: Genscape

The recently higher exports from Corpus Christi led to a record monthly high in September at 1.07mn bpd, up 491,000 bpd from August. The largest portion of the shipments in September headed to Northwest Europe at 343,000 bpd, a 129,000 bpd month-on-month increase, while 181,000 bpd left for East Asia, a month after posting only 37,000 bpd.

The second-highest amount in September from Corpus Christi departed for Eastern Canada at 291,000 bpd, an increase of 76,000 bpd from the month before. Meanwhile, refineries in the Mediterranean received about 116,000 bpd of crude from the U.S. on the month, up 52,000 bpd from August. Related: EIA Sharply Cuts Oil Price Forecast

Moda Midstream’s Ingleside terminal had the most export loadings of any Corpus Christi terminal at 346,000 bpd in September, up 28,000 bpd from August. However, the biggest month-on-month increase came from NuStar’s terminal, which posted 127,000 bpd more in September than August at 200,000 bpd, after averaging 52,000 bpd on the year until September.

Flint Hills exported 125,000 bpd in September from its Ingleside facility, a monthly increase of 99,000 bpd to 125,000 bpd. Buckeye’s Texas Hub posted 75,000 bpd more than August at 210,000 bpd.

New Pipelines Connected Stranded Permian Barrels To The Coast

Record exports in recent weeks were supported by higher inbound flows via new pipeline capacity. Plains’ Cactus II pipeline and EPIC’s NGL pipeline, which is temporarily in crude service, commenced operations in August. Both lines deliver barrels to the Corpus Christi area from West Texas, alleviating a bottleneck in the Permian Basin and fueling substantial growth in exports from the coast.

We began monitoring Cactus II pipeline flows in September as part of the Gulf Coast Pipeline service. Volumes on the line averaged 361,000 bpd in September and reached an average of 472,000 bpd for the week ending October 4. We are currently assessing monitoring feasibility of the EPIC NGL pipeline, as well as nearly-completed pipeline projects which will bring more crude into the region from West Texas.

Phillips 66’s 900,000 bpd Gray Oak pipeline, which will also transport crude from West Texas to the Corpus Christi area, is expected online in Q4 2019, according to an August Phillips 66 investor presentation. Gray Oak and other expected capacity increases could further facilitate higher export volumes from the Texas Gulf Coast as additional Permian supply gains access to waterborne transit.

Figure 2: New pipelines from West Texas supplied export growth in recent months. Source: Genscape

Corpus Christi Inventories Reflected Shifting Supply/Demand Dynamics

Crude inventories in Corpus Christi plummeted 1.2mn bbls to 13.2mn bbls for week ending October 4, as high export volumes provided a substantial outlet for barrels, according to our Texas Gulf Coast Storage report . Previously, stocks rose 2.7mn bbls between weeks ending August 9 and September 27, reaching the highest level in two years as new inbound pipeline capacity boosted supply. Related: Is The U.S. Gas Boom Already Over?

More than 24mn bbls of crude storage capacity was under construction at monitored Texas Gulf Coast locations as of the week ending October 4, the highest level of construction since we began monitoring the area in 2014. The majority of construction was in Corpus Christi, accounting for nearly 19mn bbls of tankage under construction, including hydrotesting. By comparison, more than 27mn bbls of crude storage capacity was operational in Corpus Christi in early October, including tanks in maintenance. When all tanks under construction come online, operational capacity will increase by 70 percent, according to our Texas Gulf Coast Storage Report. Many storage projects are associated with new pipelines that commenced operations recently or are expected to come online by the end of 2019.

Figure 3: South Texas Gateway Terminal construction in Ingleside. Source: Genscape imagery from September 26

Conclusion

Record Corpus Christi exports in September appear to be just the beginning of large-scale growth from the South Texas hub. Several construction projects are underway that will bolster storage, pipeline, and export dock capacity. Broader infrastructure will facilitate higher supply from West Texas and strengthen Corpus Christi’s role in international markets. Crude exports from the port are set to continue reaching new heights in the months and years to come. We will continue monitoring waterborne, pipeline, and storage activity to provide real-time updates as the Corpus Christi supply chain continues to develop.

By Genscape

More Top Reads From Oilprice.com:

- Trump’s Big Biofuel Package Has No Teeth

- The World’s Largest Oil Company Fights To Save Gasoline Engines

- Russia Aims To Ditch The Dollar For Oil & Gas Sales