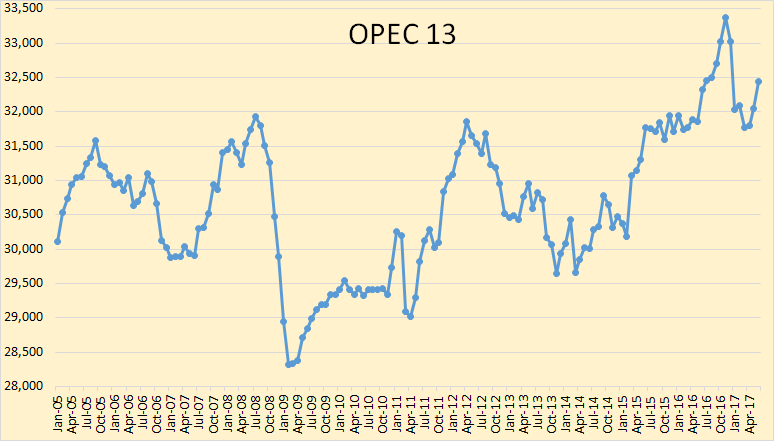

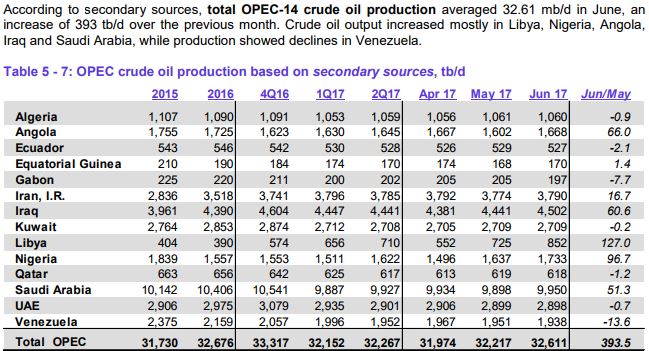

All data below is based on the latest OPEC Monthly Oil Market Report.

All data is through June 2017 and is in thousand barrels per day.

(Click to enlarge)

The above chart does not include the 14th member of OPEC that was just added, Equatorial Guinea. I do not have historical data for Equatorial Guinea so I may not add them at all. It doesn’t really matter since they are only a very minor producer. Also, they are in steep decline, dropping at about 10% per year.

(Click to enlarge)

March OPEC production was revised upward by 23,000 bpd while April production was revised upward by 72,000 bpd.

(Click to enlarge)

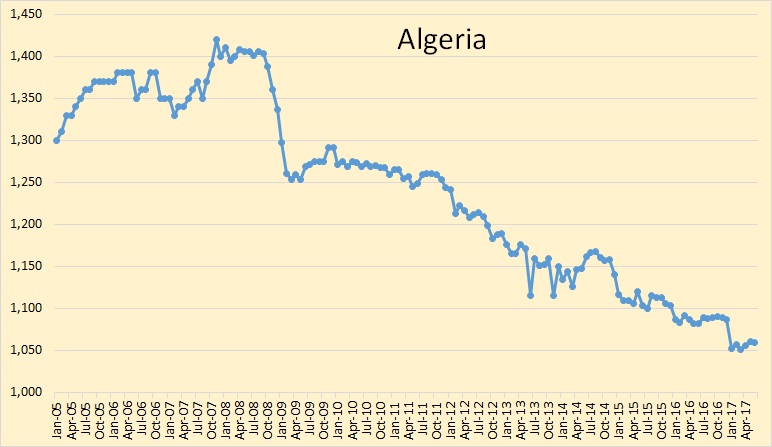

Not much is happening in Algeria. They peaked almost 10 years ago and have been in slow decline ever since.

(Click to enlarge)

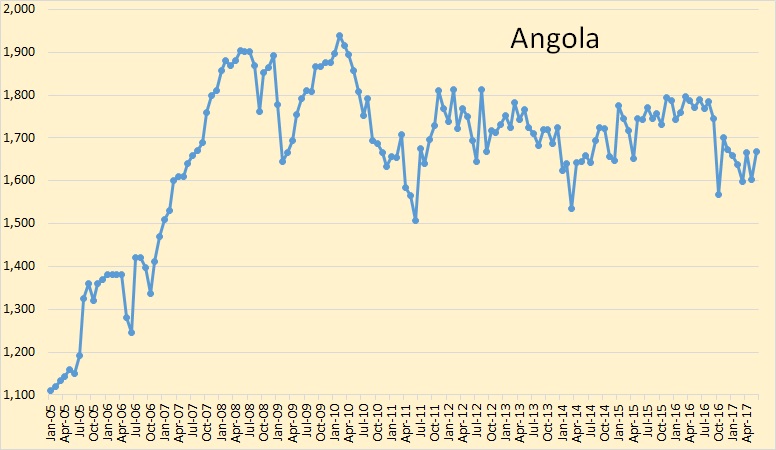

Angola peaked in 2010 but have been holding pretty steady since.

(Click to enlarge)

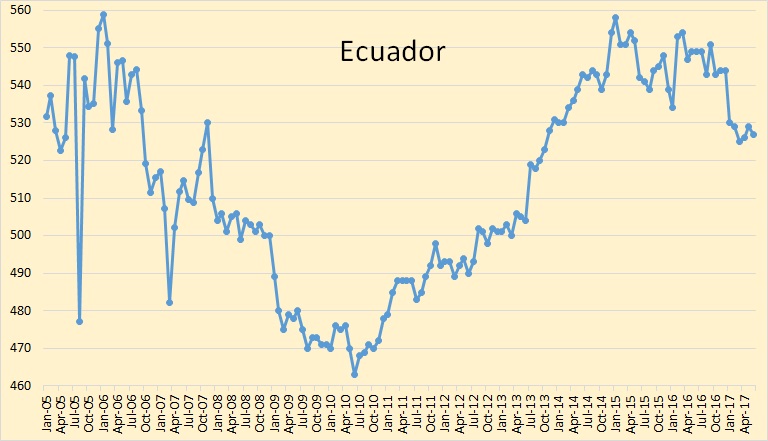

Ecuador peaked in 2015. They will be in a slow decline from now on.

(Click to enlarge)

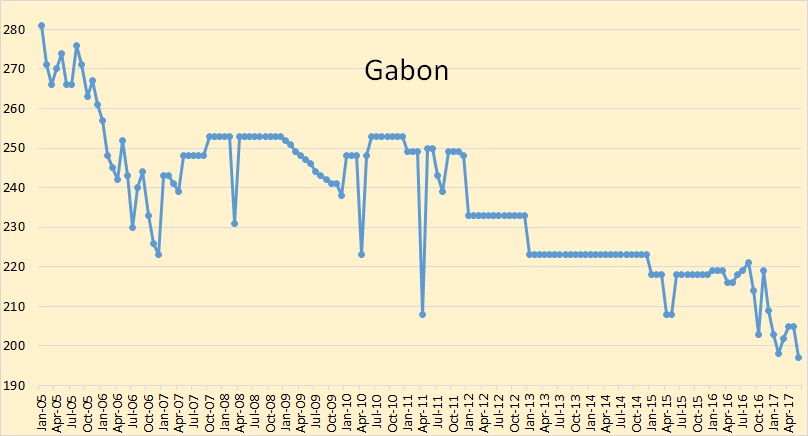

Any change in Gabon crude oil production is too small to make much difference.

(Click to enlarge)

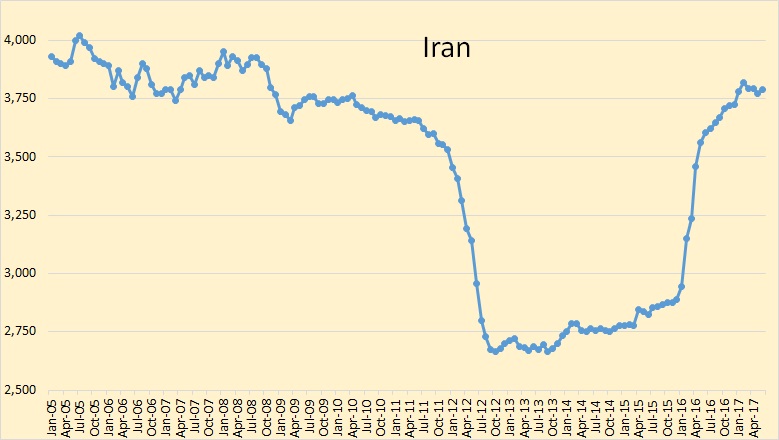

Iran’s recovery from sanctions has apparently peaked. I expect a slow decline from here.

(Click to enlarge)

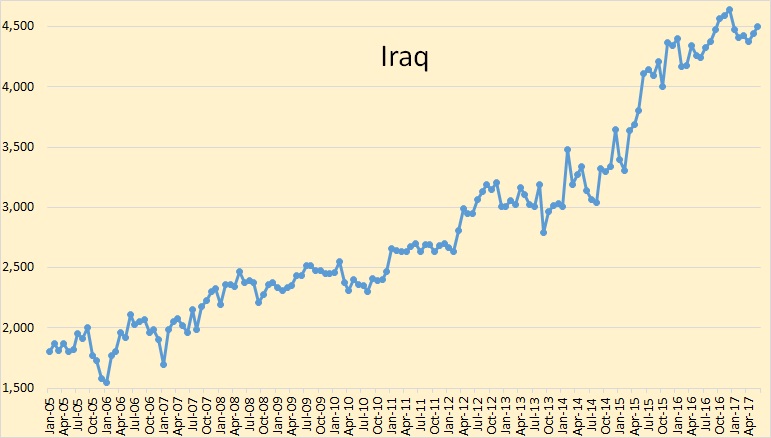

Iraq is holding steady since their December peak. Related: Halliburton Sees Oil Price Spike By 2020

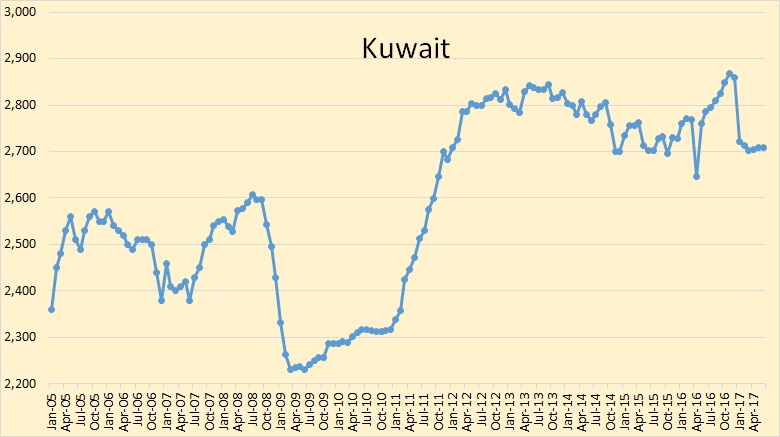

(Click to enlarge)

Kuwait is down 154,000 bpd from their November peak. That is about 5.4%.

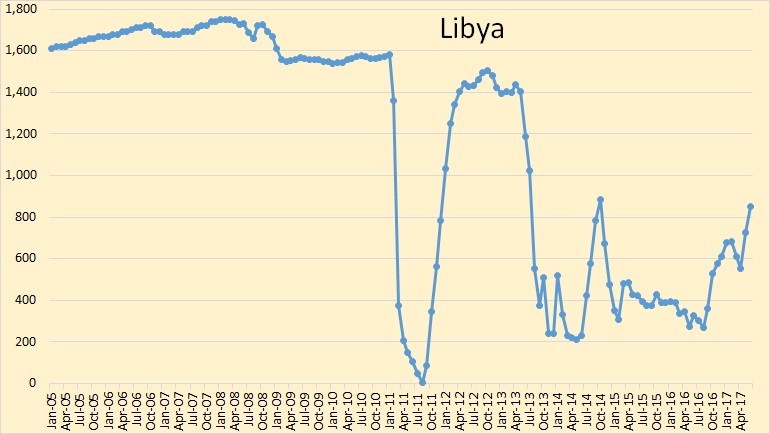

(Click to enlarge)

Libya was up 173,000 barrels per day in May and up another 127,000 in June but they still have a long way to go before they get back to their maximum possible production level, which is around 1.4 million bpd.

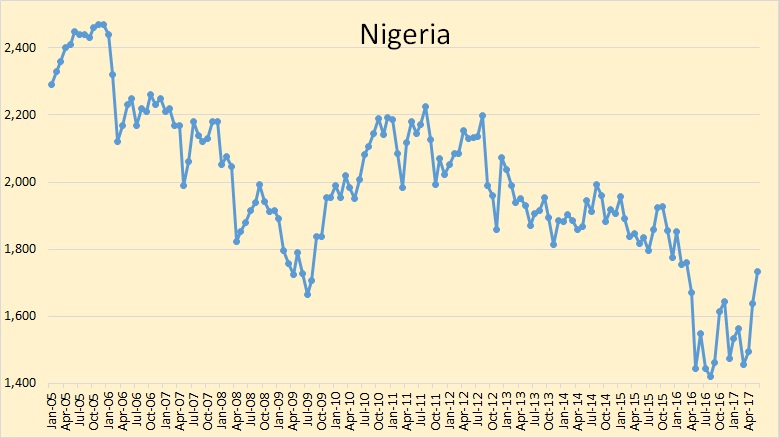

(Click to enlarge)

Nigeria was up 141,000 bpd in May and up another 96,000 bpd in June. It’s hard to tell what’s happening in Nigeria.

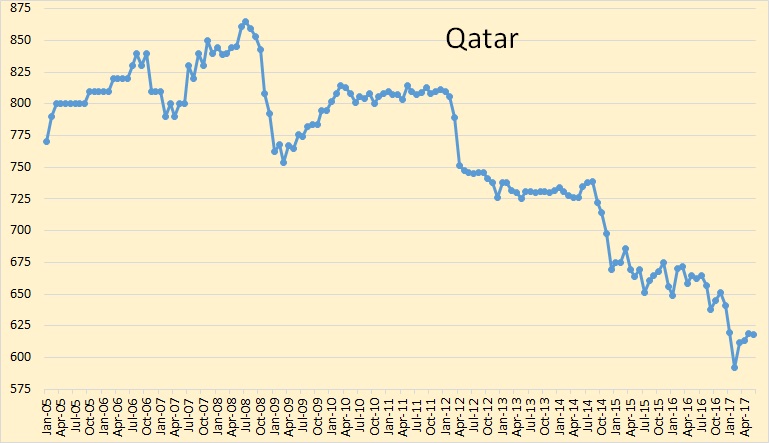

(Click to enlarge)

Qatar has been in decline since 2008. Her decline will continue albeit at a very slow pace.

(Click to enlarge)

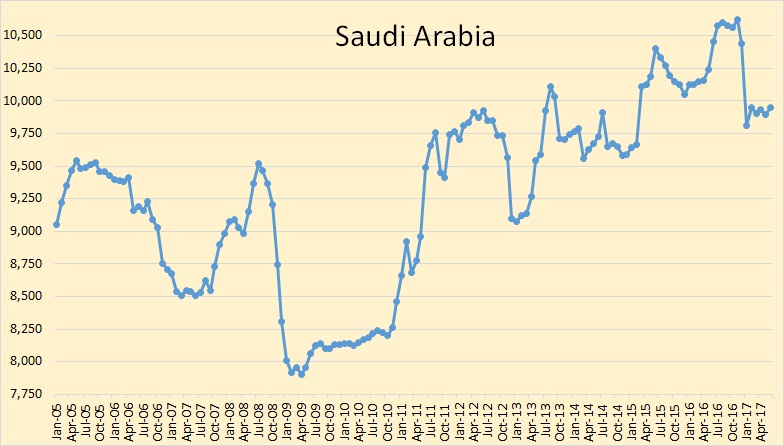

Saudi Arabia cut in January, then stopped cutting. Their production was up 51,000 bpd in January. I think this is where we will be for some time unless there is a real shake up in OPEC.

(Click to enlarge)

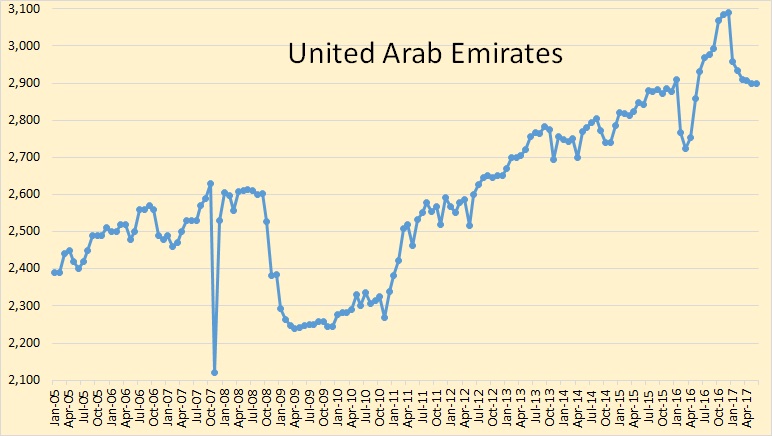

The UAE is down almost 192,000 bpd since December. This is the largest percentage cut in OPEC. I don’t think it is all voluntary.

(Click to enlarge)

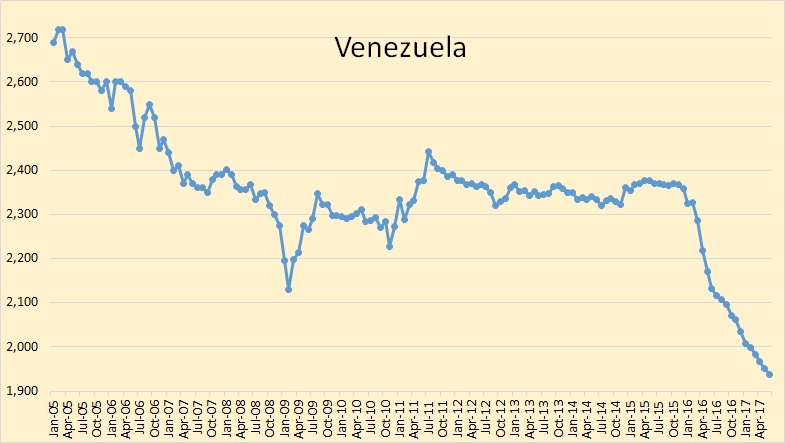

Venezuela’s problems will continue. They are now below two million barrels per day. They are at 1,938,000 bpd. They are down 430,000 bpd since November of 2015.

(Click to enlarge)

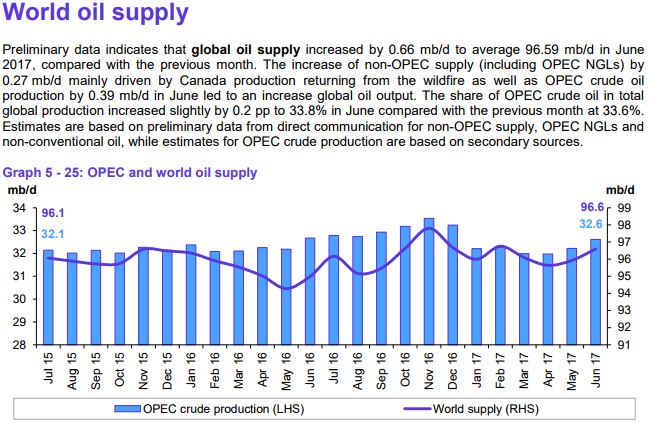

World oil supply, total liquids, was up 660,000 bpd in June. This is huge. Oil prices will continue to drop if this continues.

(Click to enlarge)

I thought I would add a chart of Russia’s production since they are now the world’s largest producer.

By Ron Patterson via Peak Oil Barrel

More Top Reads From Oilprice.com:

- The Shale Gas Revolution Is A Media Myth

- US Shale Gas Booming Despite Global Glut

- Are Hedge Funds Falling Into An Oil Market Bear Trap?