Reddit investors have discovered silver, with everything from silver miners, silver ETFs and the actual price of the physical metal itself soaring on Thursday.

Spot silver soared as much as 6.8%, the biggest jump since August. IShares Silver Trust, the biggest exchange-traded instrument backed by the metal, rose as much as 7.2%, the biggest intraday gain since August.

“The GameStop/AMC/Reddit mania is spilling over to silver and gold is getting a lift. The economic data this morning have become a moot point,” Bob Haberkorn, senior market strategist at RJO Futures said by phone. “This isn’t predicated on any global events, it’s just people on a message board putting all their guns towards the precious metals markets.”

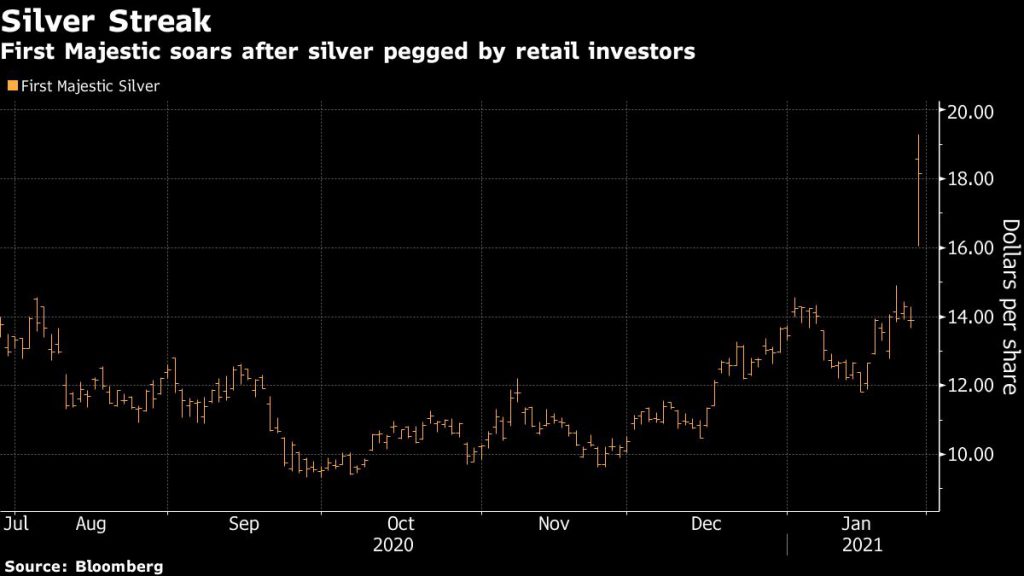

First Majestic Silver Corp., which was cited as a short-squeeze target, soared as much as 39% in New York on Thursday amid a frenzy of retail trading fueled by Internet chat rooms.

Options markets were bid up in the frenzy, with brokers seeing wide bid/ask spreads on the ETF and Comex contracts.

Investors are looking at buying silver options for far-out months, according to Haberkorn. “You see some incredible price increases in options that normally wouldn’t be worth anything at this point,” he said.

By Mining.com

More Top Reads From Oilprice.com:

Really?

Anyhow certainly odd trading in the mining sector going on forever now.