Whilst much of the Caspian is struggling to come out of COVID-induced hibernation, Azerbaijan and Turkmenistan settling one of the region’s longest-standing maritime disputes has finally brought a spark to one of the world’s oldest producing regions. The Sardar/Kyapaz block, discovered in 1986 by Soviet geologists at a total depth of 5km and contested for most of the subsequent period, straddles their maritime border, abutting the Azeri field of the ACG complex. By signing a memorandum of understanding on the disputed block and by simultaneously renaming it to “Dostluk” (Friendship), Baku and Ashgabat are signaling that past grievances should be left behind for the purpose of greater good and greater (shared) profits. The move to jointly develop the Dostluk field did not come as a complete surprise, following President Gurbanguly Berdymukhamedov’s visit to Baku in March 2020, though it was never confirmed that the field was on the tapis during the talks. Dostluk has had several names throughout its existence, initially identified in 1959-1960 in the same string of appraisal events as Azerbaijan’s flagship group of fields, ACG. Initially the assumption was that Dostluk will be named after the Communist October Revolution, however, an even less illuminating name caught on, Promezhutochnaya (Russian for “intermediary”). Needless to say, by 1991 the field boasted at least 80 MMbbls in recoverable reserves therefore in the post-Soviet period the relations between Baku and Ashgabat were not always as rosy as they seem to be today.

Exactly 20 years ago Turkmenistan has closed its embassy in Baku after the failure of the first round of demarcation talks. This was still back in the heyday of Turkmenbashi quarreling with Heydar Aliyev, i.e. two Soviet-era leaders that carried their respective countries from the rubbles of the Soviet Union to more nationalistic, more locally driven policies. The talks did not collapse for nothing – by that point both parties have already allotted the much-disputed Sardar/Kyapaz block and failed spectacularly to have their choices affirmed by the international community. First in 1997 Azerbaijan awarded the Kyapaz block to the Russian tandem of LUKOIL and Rosneft but was forced to retract, a year later Turkmenistan tried the same with US-based Mobil, to no avail.

Related: Global Natural Gas Demand Set To Rebound After Pandemic Shock

For most of the 2000s and 2010s the issue of Sardar/Kyapaz was off the agenda, however, its resolution became a fully plausible option after the five littoral states signed the Convention on the Legal Status of the Caspian Sea in August 2018. Its adoption provided the legal background against which Caspian states could seek non-conventional solutions for decades-old problems – in this case, clarifying whose right is overbearing. Geographically “Dostluk” is closer to the Turkmen seashore, on the other hand Azerbaijan’s Absheron Peninsula extends so far out into the Caspian that with the usage of the right demarcation angle Baku could rightly claim it to be under its control.

Objectively speaking, Dostluk will hardly be the Caspian’s largest oilfield. Its reserves are assessed at 100 million tons of crude and some 30 BCm of gas and the block is generally assumed to be the geological continuation of the Azeri-Chirag-Guneshli structure. Once Dostluk is further appraised, this could either mean that Azerbaijani drillers were right in prioritizing ACG and keeping Dostluk for later or that the decades-long dispute was well justified. All in all, Dostluk’s main benefit will most probably in creating early Azeri-Turkmen synergies might pave the way for further cooperation. Primarily this would imply using the cross-Caspian route for Turkmen gas, one of those evergreen concepts of European energy policy that seek to find alternative gas conduits that could diversify the EU’s imports from heavy dependence on Russia and Norway.

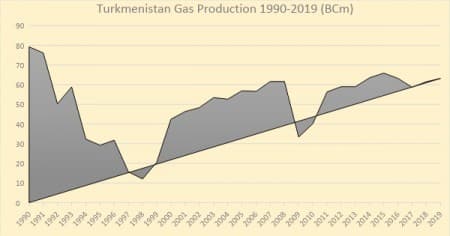

For Turkmenistan this might be quite the development, considering its increasing gas production and ample reserves. Turkmenistan is not publishing any official data on its crude and gas production, rendering it almost impossible to pinpoint its production in an exact manner. However, thanks to ENI’s latest statistical survey it might be assumed that in the past 3 years crude output has oscillated around the 220kbpd mark. Most of Turkmenistan’s crude production ends up being blended into streams of Russian Urals and Azeri BTC, meaning that if there is any Caspian subsea pipeline to be laid it will most probably focus on gas and not crude. Turkmenistan boasts the supergiant Galkynysh field (gas in place around 27 TCm, recoverable reserves assumed at 14 TCm), outstripped any other Caspian asset within Azerbaijan’s or Russia’s territorial waters.

Graph 1. Turkmenistan Gas Production in 1990-2019 (billion cubic meters).

Source: BP Statistical Survey 2020.

The Galkynysh gas field is now undergoing Phase 2 preparations which, once over, should add another 30 BCm per year of processing capacity, effectively doubling the current tally. Virtually all of Phase 1 exports usually ends up in China and there remain substantial doubts that despite its alluded interest, China would be willing to accommodate additional production from Phase 2 capacities. The main reason of Chinese reticence lies in the relatively high price of Galkynysh gas – looking at the 2020 statistics issued by China’s General Customs Administration one can notice that imports from Uzbekistan or Kazakhstan, albeit smaller in volume, are generally cheaper than Turkmen gas. Needless to say, the slump in LNG prices in H1 2020 has compelled Chinese buyers to reduce pipeline imports and to focus heavily on the more profitable LNG stream.

Should Turkmenistan consider the option of feeding its gas into the existing infrastructure of TANAP and TAP, it would need to clear three main roadblocks. The first would be the most politicized one – Russia might object to having a new contender from the former Soviet Union, especially on the back of the massive pressure Nord Stream 2 has been under. Secondly, any revived variant of the Nabucco pipeline would need a committed owner – Turkmenistan’s financial travails with TAPI attest to its lackluster financial stature. Thirdly and perhaps most importantly, the gas’ pricing would be quite a challenge, considering that TAP and TANAP tariffs would eat up all of profit under current circumstances, i.e. gas prices would need to be much higher than 200 USD per MCm to warrant the pipeline’s construction.

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

- Why China Can’t Replicate America’s Shale Boom

- The World’s Biggest Oil Firms Face Rating Downgrades

- 5 Oil And Gas Predictions For 2021

I think we should spend more time thinking about a smooth transition to a fossil fuel free future. With all the electric vehicles coming on our roads by 2025, the gas station infrastructure will weaken to the point that diehards with gasoline engine cars will suffer from range anxiety.