Cut greenhouse gas emissions in New York by 40 percent by 2050. A commendable goal. But two of the four nuclear power stations in the state may close down by 2017.

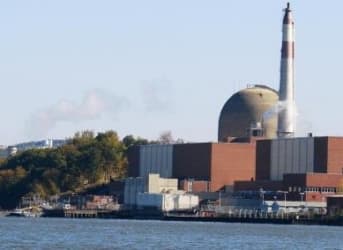

One is already on life support, collecting a surcharge from upstate customers to keep it open ostensibly because closure might cause shortages in the area. And the governor wants to close down a third plant, downstate (Indian Point) because it is too close to New York City.

None of that helps the plan to cut the greenhouse gas emissions. On top of that, the governor wants to encourage more economic activity upstate. Closing down those nuclear power stations with their hundreds of jobs and big tax payments to local governments would not endear him to upstaters, but closing down the power station in Westchester County, just north of New York City, would endear him to the locals there, who haven’t figured out how they would evacuate in case of emergency, due to crowded roads on one side and the Hudson River on the other. Related: Which Energy Companies Are Most At Risk From The Spring Redetermination?

The state’s top regulator characterized the problem this way: “We want to make certain that we don’t lose nuclear plants unnecessarily because we have a market situation that doesn’t support them in the wholesale markets…”

New York’s regulators commissioned their staff to write a white paper to look at the problem. The authors said that they looked at the best practices throughout the United States before fashioning a solution, which was an interesting comment in that the British had to deal with the same issue in their attempt to revive nuclear power, and settled on something that they had used before in various ways, the contract for differences.

That is, on a simplified basis, they set a strike price for nuclear power and force all buyers to sign a certain number of those contracts with the generator.

Here is how it works. The generator sells power to the wholesale market. When that price exceeds the strike price, it pays the excess back to the buyer. When market price falls below strike price, the buyer pays the difference to the generator. Related: Will Weak Fundamentals Force Saudis To Action

Considering all the contracts for differences out there, it looks more and more as if the UK’s competitive generation market will be crowded out by all the facilities getting preferential treatment through contracts for differences mandated by the government. New York proposes that buyers of wholesale electricity purchase zero emission credits from the nuclear plants, which the buyers will pass on to customers. Sounds similar.

As for the downstate nuclear plant, the regulatory agency has decided to exclude plants without licenses extending through 2029 and as Indian Point’s license, having expired, is awaiting relicensing from the Nuclear Regulatory Commission, it does not make the cut. How convenient.

The New York effort brings up three questions, though. The first is: don’t we ever examine what other people do and what happens when they do it? The rest of the world has tried stuff for years that we are finally thinking about. Well, that is a rhetorical question, isn’t it? Related: Is A Gas War Between The U.S. And Canada About To Start?

Second, why isn’t Indian Point’s contribution to carbon emission reductions as good as any other plant’s? If Indian Point is unsafe, why not close it and if it is deemed safe, why is the regulator denying it the same credits as other similar facilities? That question may go to court.

Third, if the market’s design cannot keep needed facilities in service, then maybe the regulator should change the market design rather than bolt on fixes that will reduce the size of the competitive market as more and more of it is reserved for generators that the market does not support.

Maybe the best way to look at New York’s nuclear protection measure is as another indicator that the current electricity market, as designed, can’t handle the fundamental issues facing it, but rather than making basic changes, the powers that be will simply encrust it with complicated modifications, barnacles so to speak, that will allow them to maintain the competitive facade but limit the competitive substance.

By Leonard S. Hyman and William I. Tilles for Oilprice.com

More Top Reads From Oilprice.com:

- $50 Oil As Soon As May?

- Oil Prices Up As Dollar Drops And Gasoline Draws

- As Net-Long Positions Near Records, Is The Oil Rally Overdone?