Sales of electricity in the US have barely increased despite nine straight years of economic growth. It almost looks as if the conservation ethos for American consumers has finally taken hold. That restraint also applies to large commercial and industrial customers as well. And foreign consumers seemed even less interested in plugging in. A discouraging drip, drip of bad news for the electricity industry.

Well, something happened. For the six months ended June, electric sales to ultimate customers in the US actually rose 3.5 percent. In other industries that's not a high growth number but for electric utilities with virtually 100 percent market penetration it constitutes unusually high levels of sales growth. Electric industry participants in recent years have gotten used to zero percent as a normal "growth" rate.

What changed? Sales to residential customers rose a spectacular 7.8 percent, commercial sales rose a solid 2.0 percent and the US industrial sector, assumed growth engine of the economy, purchased 0.1 percent less power.

The first half of the year featured unusually cold weather and a warmer than usual June. Residential customer load is more sensitive to weather. Individuals and families often adjust their A/C on and off all summer depending on the weather. Heating and cooling accounts of 22 percent of residential electric sales. Large commercial and industrial facilities run their HVAC systems constantly, all year round. Heating and cooling, furthermore, account for only 15 percent of commercial and 7 percent of industrial electric sales. For them the incremental change in electricity usage is typically modest. So while residential electric loads are more weather sensitive, commercial and industrial electric load tends to be more economically sensitive.

Temperature departures from the heating and cooling norm make a big difference for residential kWh sales. Thus, it looks as if the recent sales surge is weather induced. Consumer attitudes towards electricity usage were not likely altered. But electric utility customers did respond to temperature extremes in their respective locales in the way we would expect. Related: Diesel Demand Is Set To Soar

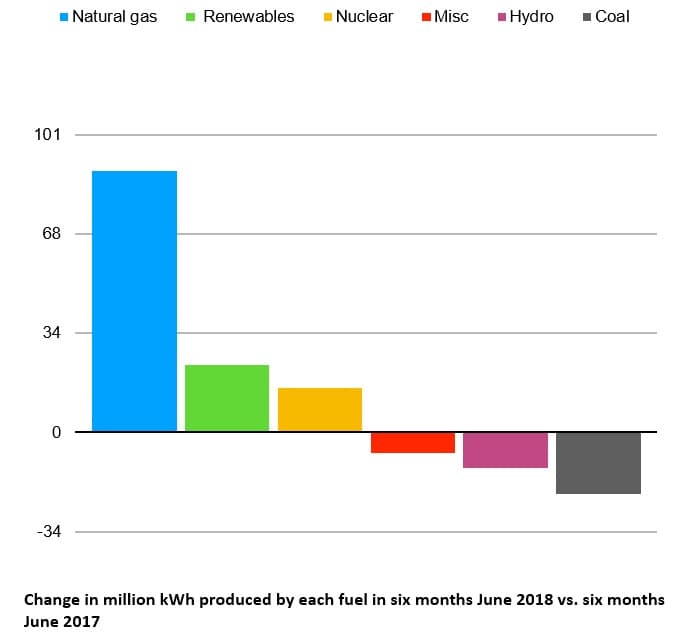

How did the electric industry produce that extra electricity sold in the first six months of 2018. ? Here is how the production by fuel changed: the industry burned more natural gas, used more renewables and burned less coal. That is not an auspicious omen for the Trump administration’s plans to revive coal. It seems that the electricity industry is acclimating itself to a low or no coal future, despite the stated intentions of the Trump administration (See figure that follows.)

The six months results probably do not portend an upturn in electricity sales due to a change in consumer attitudes with respect to the efficient usage of electricity. But these strong sales results may say something about escalating future power generation requirements due in part to climate variation itself. Related: The Biggest Risk In Today’s Oil Markets

Climate change is a topic the once coal dependent electric utility industry has preferred to ignore. But now the industry overall benefits economically with the more rapid demise of coal and increased reliance on natural gas. It seems like an ideal time for industry rebranding. It is not unreasonable to think the local electric utility could one day appeal to consumers as the carbon-free, home climate comfort provider operating on both sides of the meter.

No one today, for good reason, thinks of electric utilities as a growth industry. And while climate extremes both hot and cold may propel near term kWh hour sales growth-- the electrification of our transportation system --that's the game changer.

By Leonard Hyman and William Tilles for Oilprice.com

More Top Reads From Oilprice.com:

- Saudi Oil Inventories Continue To Plummet

- U.S. Shale Oil Production Beats Estimates Again

- Oil Prices Jump On Saudi Arabia’s $80 Claim