It was a record setting week in the energy complex with crude oil posting one of its biggest declines since the price collapse in 2014 and natural gas posting back-to-back double-digit percentage moves. U.S. crude oil also completed a record 12 consecutive lower closes. In the natural as market, a short-squeeze spiked the market higher, producing the biggest one-day rally in 14 years and the highest closing price since 2014. This was followed by the sharpest one-day decline since February 2003.

Crude Oil

We know the market is oversupplied. This is because of rising production in the United States, Saudi Arabia and Russia and weakening global demand. U.S. producers aren’t likely to lighten up. Russia likes the cash flow and says it is comfortable with $70 crude oil. The Saudi’s seem to be the most receptive to production cuts.

According to reports, prices are being underpinned by expectations OPEC would start withholding supply soon. They seem to be operating under the fear of a price collapse similar to the crash of 2014.

According to Reuters, OPEC’s de-facto leader Saudi Arabia wants the cartel and its allies to cut output by about 1.4 million barrels per day (bpd), around 1.5 percent of global supply.

Technical Analysis

Both WTI…

It was a record setting week in the energy complex with crude oil posting one of its biggest declines since the price collapse in 2014 and natural gas posting back-to-back double-digit percentage moves. U.S. crude oil also completed a record 12 consecutive lower closes. In the natural as market, a short-squeeze spiked the market higher, producing the biggest one-day rally in 14 years and the highest closing price since 2014. This was followed by the sharpest one-day decline since February 2003.

Crude Oil

U.S. West Texas Intermediate and international-benchmark Brent crude oil futures have been moving higher since Tuesday’s plunge, but are still in a position to close lower for a sixth consecutive week. The price action suggests a support base is being formed. I haven’t seen any evidence of strong counter-trend buying so I’ll have to chalk up the three day move to light short-covering.

The price action suggests that traders should start preparing for heightened volatility. This means we’re going to enter a headline driven market, if we haven’t entered one already.

We know the market is oversupplied. This is because of rising production in the United States, Saudi Arabia and Russia and weakening global demand. U.S. producers aren’t likely to lighten up. Russia likes the cash flow and says it is comfortable with $70 crude oil. The Saudi’s seem to be the most receptive to production cuts.

According to reports, prices are being underpinned by expectations OPEC would start withholding supply soon. They seem to be operating under the fear of a price collapse similar to the crash of 2014.

According to Reuters, OPEC’s de-facto leader Saudi Arabia wants the cartel and its allies to cut output by about 1.4 million barrels per day (bpd), around 1.5 percent of global supply.

Technical Analysis

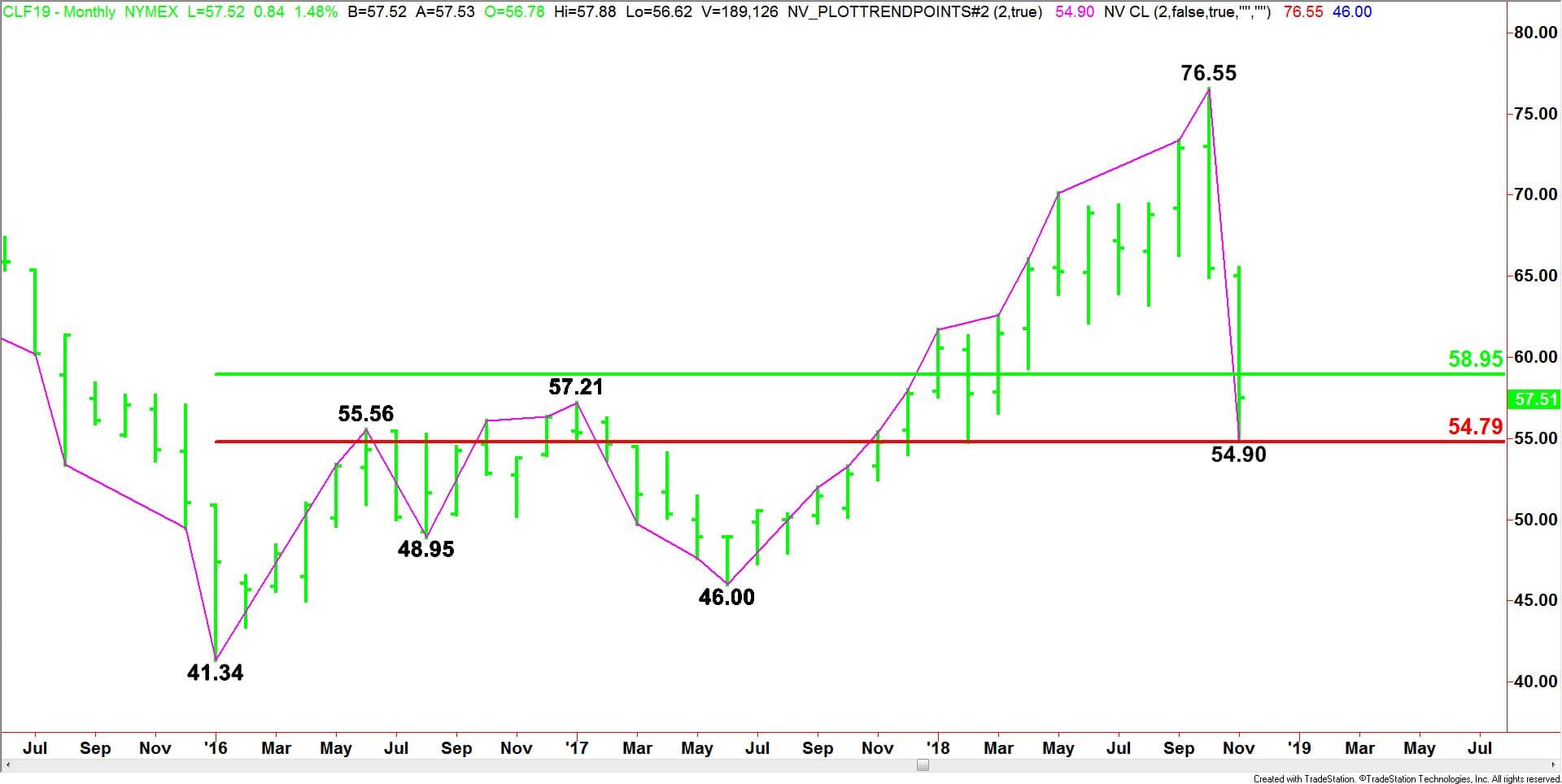

Both WTI and Brent crude oil have hit potential support zones on the monthly chart. Additionally, some technical traders have declared the markets oversold. These two factors combined with speculation that OPEC and its allies are considering production cuts are helping to hold the markets in a range.

(Click to enlarge)

The support zone for WTI is $58.95 to $54.79. This represents 50% to 61.8% of the $41.34 to $76.55, three-year range. The direction of the next move in crude oil is likely to be determined by trader reaction to this zone.

For January WTI crude oil, look for a bullish tone to develop on a sustained move over $58.95 and for the bearish tone to resume on a move through $54.79. Holding inside the zone will suggest traders have found a balance point on the charts.

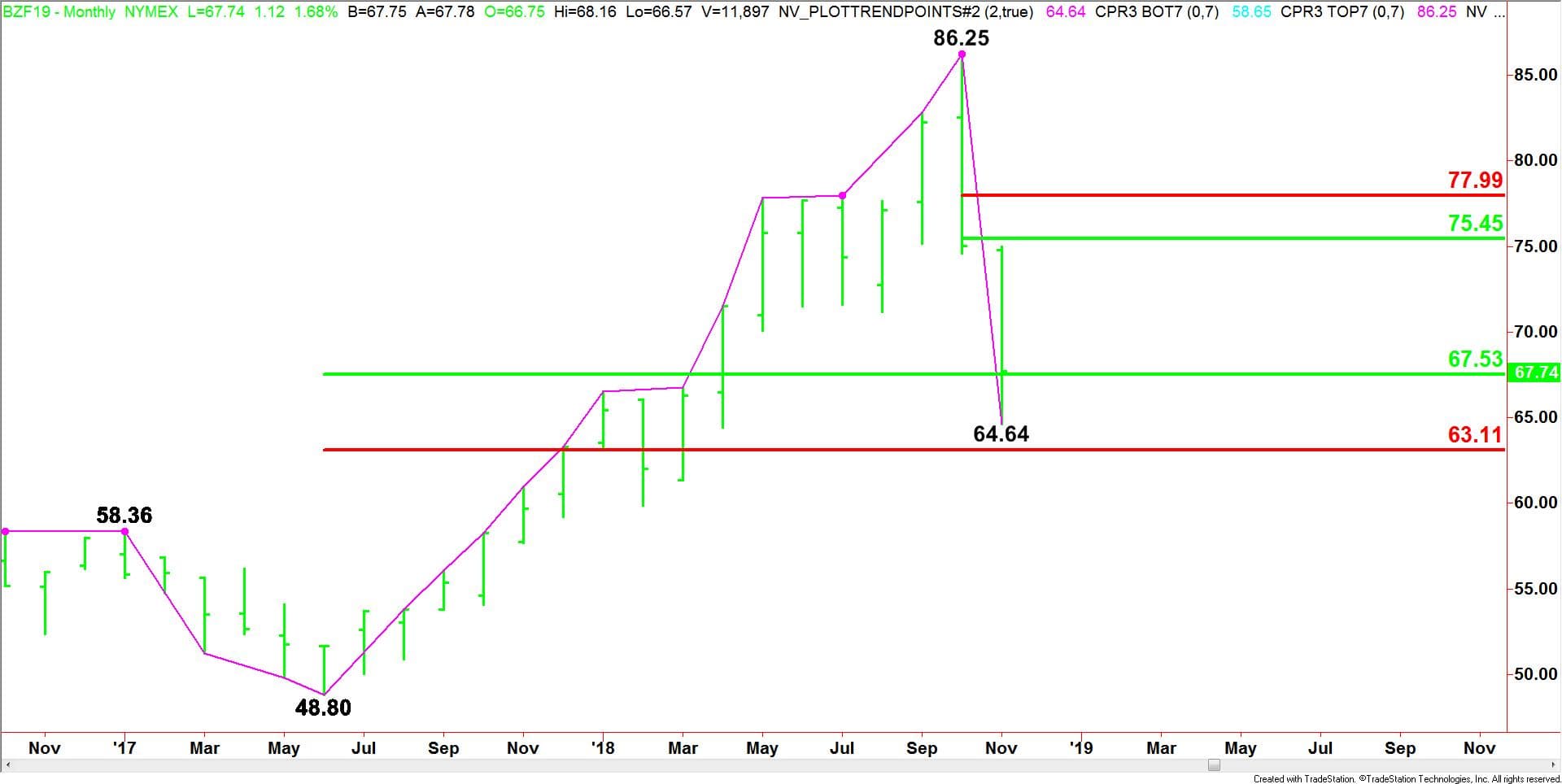

(Click to enlarge)

For January Brent crude oil, look for an upside bias to develop on a sustained move over $67.53 and for the downside bias to continue on a sustained move under $63.11. The market could become rangebound inside this zone as traders await the next piece of important news.

Natural Gas

Natural gas is trading nearly flat early Friday after Thursday’s blood bath completely reversed the previous day’s spike to a multi-year high. The inability to follow-though to the downside suggests the market may have found value. The tight range suggest that both buyers and sellers may have learned valuable lessons about chasing prices in either direction during a weather market.

Because of the heightened volatility, the daily chart will offer the best trading opportunities.

(Click to enlarge)

The daily chart indicates the main trend is up. The current range is $3.199, the October 29 bottom, to the November 14 main top at $4.964. The market is currently testing its 50% to 61.8% retracement zone at $4.082 to $3.873. Trader reaction to this zone is likely to determine the next major move in the market.

To recap this week’s events, the market started firm as forecasts continued to call for cold weather until at least November 25. The market was also underpinned by historically low stockpiles. A short-squeeze spiked the market higher, producing the biggest one-day rally in 14 years and the highest closing price since 2014. This was followed by the sharpest one-day decline since February 2003.

Outside factors also contributed to the wild price action. There is speculation that the hedge funds that had been long crude oil and short natural gas for the winter were forced to liquidate their positions to meet margin calls and end-of-the-year redemptions.

U.S. Energy Information Administration (EIA) Weekly Storage Report

According to the EIA, U.S. natural gas stockpiles rose by 39 billion cubic feet in the week-ending November 9, exceeding the 34 billion cubic feet rise analysts and traders had forecast. Furthermore, the increase was more than double the injection for this time of year.

Nonetheless, total storage remains about 16% less than normal for this time of year. This news should continue to underpin prices until it goes away. If the winter is cold enough or if below average temperatures continue into the spring, we may even begin the summer heating season with a deficit.

Weekly Outlook

The price action this week brings to mind several factors. You can have the perfect storm of fundamentals, but you still have to have position management to make money.

Traders are probably going to look at this week’s high as an anomaly and consider the $4.00 as resistance. The charts are zeroing in on $4.082 to $3.873 as the key area to watch.

We could see another upside bias develop over $4.082 and a downside bias to emerge under $3.873.

The large build during the week-ending November 9 indicates that the market is well-supplied so any major change in the weather to the warm side could lead to a steep drop in prices. This week, investors will be focusing on the weather forecasts for the last week in November and the first week in December. So far they have been fairly inconsistent, but conditions may be clarified over the week-end.