Despite OPEC+’s surprise production cut, the global oil market will remain in surplus this year and next as demand growth could be hurt by lower-than-expected economic growth in the coming months, the U.S. Energy Information Administration (EIA) said in its latest Short-Term Energy Outlook (STEO).

The latest forecasts include declining production in OPEC and Russia, yet the EIA still expect global oil production to increase by 1.5 million barrels per day (bpd) in 2023, due to strong growth from non-OPEC countries excluding Russia. Non-OPEC+ production growth will largely be driven by North and South America, the administration said.

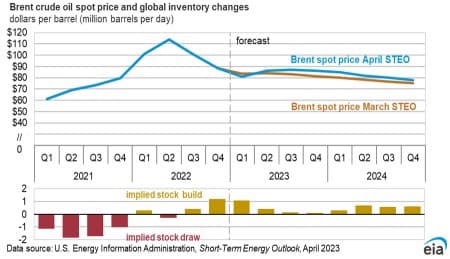

This year, global oil production is set to average 101.3 million bpd, while global oil consumption is estimated at 100.87 million bpd. The surplus on the market will start to shrink this quarter, but even in Q3 the market will be in a slight surplus, the EIA forecasts.

That’s contrary to some other projections that say the OPEC+ cuts will tighten the market so much later this year that prices could jump to $100 per barrel.

If the current OPEC+ cuts expire at the end of 2023, global oil production is set to average 103.25 million bpd in 2024, while consumption is expected at 102.72 million bpd—with supply outstripping demand next year, too, according to the EIA.

“Increasing risks in the U.S. and global banking sectors increases uncertainty about macroeconomic conditions and their potential effects on liquid fuels consumption, which increases the possibility of liquid fuels consumption being lower than our current forecast,” the EIA said.

“We expect global oil markets will be in relative balance over the coming year.”

Global oil inventories, which increased by 400,000 bpd in 2022 and by 1.1 million bpd in the first quarter of 2023, will be mostly unchanged during the second half of 2023, the EIA predicts. Inventory builds will average about 500,000 bpd beginning in 2024 if the OPEC+ cuts expire at the beginning of next year.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- Recession Fears Loom Over Oil Markets Once Again

- Inventory Draws Across The Board Push Oil Prices Higher

- Middle East Oil Prices Jump After Surprise OPEC+ Cuts

I think it's far to difficult to predict supply and demand in the current environment.

One thing for sure -- Opec wants prices at levels that allow them to reach their aspirations and NA Energy firms want to return capital to their shareholders.

Expect 75 as the floor and 95 as the summer demand level. Good for everyone.

How does the EIA explain the claim that despite OPEC+’s latest cut and Russia’s production cut estimated at 2.3 million barrels a day (mbd) the global oil market will remain in surplus this year and next? And which countries the EIA had in mind when it said that demand growth could be hurt by lower-than-expected economic growth in the coming months?

The EIA obviously had in mind countries like the United States and the EU which are projected by the IMF to grow this year by 0.8% each. However, China, the world’s largest economy based on purchasing power parity (PPP) is projected to grow by 5.25-6.5% in 2023 and this will more than offset any economic sluggishness in the US and the EU.

And which non-OPEC producers the EIA expects to add 1.5 mbd to global oil production? Let me hazard a guess of the EIA's answer: the United States, Brazil and Guyana.

However, US shale is a spent force incapable of raising its production significantly. Brazil could hardly satisfy its domestic demand and Guyana is a small fish.

Global oil demand according to OPEC+ is projected to rise by 2.3 mbd this year to 103.6 mbd against an estimated production of 98.5 mbd.

Moreover, Brent crude oil price is projected to hit $90.0 in the first half of 2023 and touch $100.0 during the year.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert