It’s been well over a year now since London-listed Tullow Oil struck it big in Kenya, making the country’s first massive oil discovery that set the stage for Kenya to become East Africa’s energy giant. But we’re still waiting to advance to the commercial development phase, and the market is growing impatient.

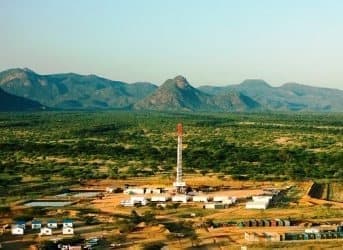

Since then, Tullow—which has 50% interest in 12 blocks in Kenya--has had its ups and downs, most recently getting a bit of a time-buying boost with the announcement of a discovery in another oil well at Etuko-1 in the prolific Turkana County, Northern Kenya—also home of the Ngamic and Twiga South plays that put Kenya on the fossil fuels map.

Last week, Tullow announced the find at Etuko-1, saying it expected a flow rate potential of 5,000 barrels a day based on Ngamia-1 and Twiga South-1. Tullow estimates that its combined wells, with Etuko-1, hold 250 million barrels of oil in place—at a minimum.

Related article: For Better or Worse, Big Oil has Big U.S. Future

Tullow has also recently doubled its oil projections in Ngamia (to 200 meters of net pay) and Twiga South (to 75 meters of net pay).

"The flow testing programme at Ngamia 1 in the Lokichar Basin has now been successfully completed with a cumulative constrained flow rate totaling 3,200 barrels per day of 25 to 35 degree API sweet waxy oil with no indication of pressure depletion," Aidan Heavey, the Tullow CEO, said in a statement.

"We have significantly upgraded our resource estimates for the South Lokichar Basin following the highly successful flow testing of Ngamia and Twiga South. Additionally in Kenya, Tullow has made a new discovery at Etuko 1," he said.

So, how much longer will shareholders wait for commercial viability? For now, Tullow is buying time here and there with updates on its progress, but traders are fickle and analysts are uncertain at best.

On 15 July, Morgan Stanley reaffirmed its “overweight” rating for Tullow, putting a $26.13 price target on the stock and pointing to a potential upside of 57.13% from the current price. Simultaneously, analysts at Societe Generale downgraded shares of Tullow from a “buy” rating to a “hold” rating, with an $18.12 price target on the stock. Citigroup Inc. has reaffirmed a “neutral” rating on Tullow, with a $17.16 price target on the stock. Finally UBS AG raised its price target on Tulllow shares from $16.92 to $17.37 the previous week, but has since maintained a “neutral” rating.

Related article: GE to ‘Power Africa’, Without the Risk

Right now the consensus is “hold”, but opinions vary wildly.

Even more impatient is the Kenyan government, which is toying with oil and gas legislation before commercial viability has been proven. Kenya has already licenses out 44 of its total of 46 blocks—23 of them to international companies.

In June, Kenyan energy officials said they would be changing the licensing process because of the high interest.

"To set the ball rolling, the country is moving away from the previous open door policy of licensing the blocks on basis of first come first served in favor of bid rounds," the energy secretary said at a conference.

This comes as the government prepares to carve out seven more oil blocks for exploration, to raise the total to 53. But the next auction will come with tougher terms. But we could also expect to see smaller blocks up for auction, but this will come along with tighter terms for speeding up exploration and moving towards commercial production.

By. Charles Kennedy of Oilprice.com