U.S. West Texas Intermediate Crude Oil soared on Friday as investors breathe a sigh of relief as OPEC and its partners decided to cut 1.2 million bpd.

On Thursday, Saudi Arabia took the wind out of the sail of the bullish traders when its oil minister said it would be happy with a production cut of about 1 million barrels per day. Prior to the comment from the Saudi’s, the market had been pricing in a cut in output of up to 1.4 million barrels per day.

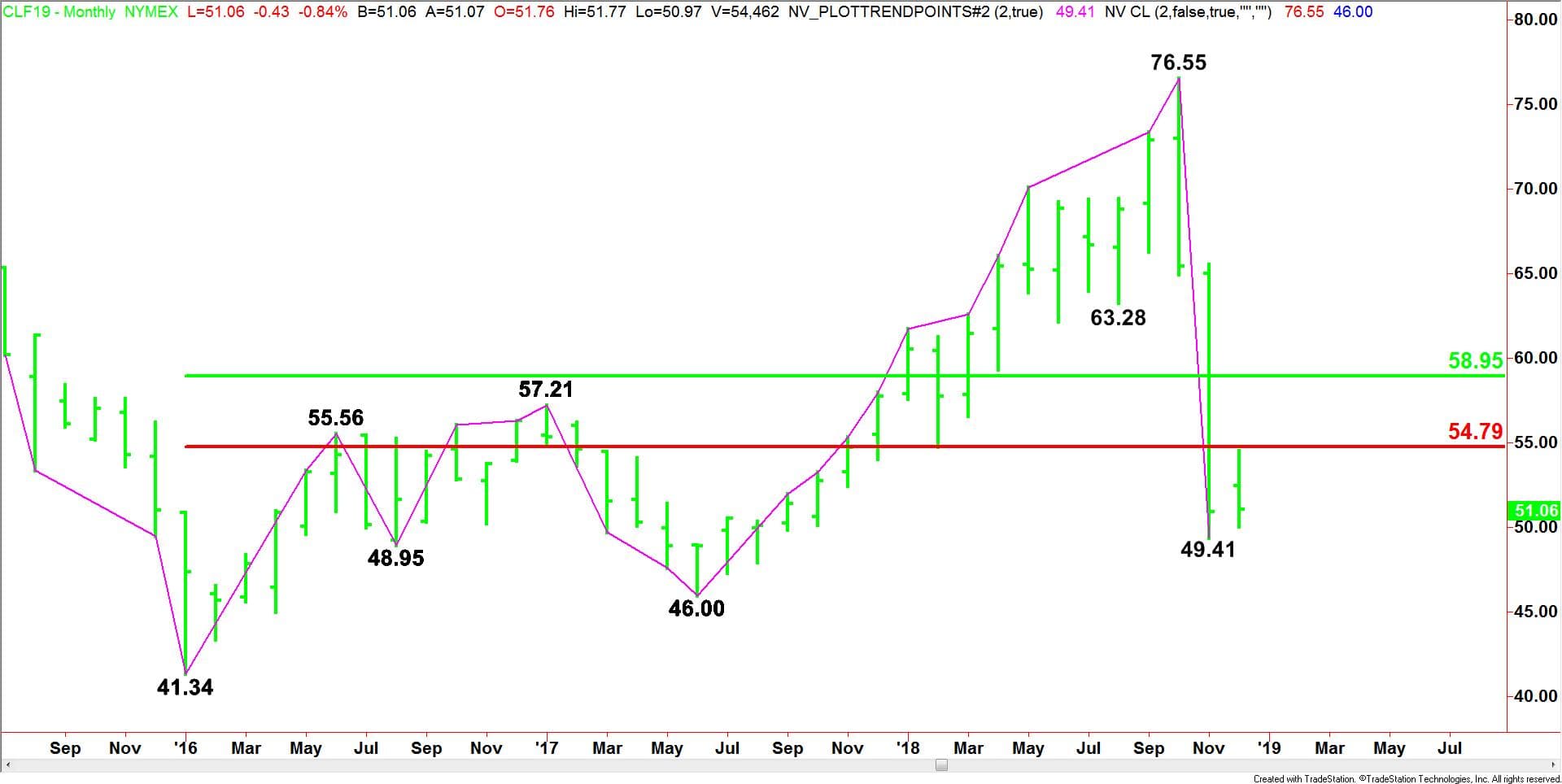

Monthly January West Texas Intermediate Crude Oil

(Click to enlarge)

One of the best ways to analyze a market is to take a top-down approach. This allows you to frame the market on the monthly and weekly chart then zero in on the daily chart for actual trade execution. It also allows you to determine the various trends that could be influencing the price action. For example, if the monthly, weekly and daily charts were all in an uptrend then the odds of a successful trade increase if you decide to trade the long side. Furthermore, it also helps let you know if you are trading with the trend or against. Trend traders tend to want to let trades run, while counter-trend traders tend to set objectives or exit zones.

Monthly Technical Analysis

The main trend is up according to the…

U.S. West Texas Intermediate Crude Oil soared on Friday as investors breathe a sigh of relief as OPEC and its partners decided to cut 1.2 million bpd.

On Thursday, Saudi Arabia took the wind out of the sail of the bullish traders when its oil minister said it would be happy with a production cut of about 1 million barrels per day. Prior to the comment from the Saudi’s, the market had been pricing in a cut in output of up to 1.4 million barrels per day.

The daily chart is set up for a breakout to the upside and we have identified what we believe is the trigger point for an acceleration to the upside. All the bullish traders need now is for OPEC and its major ally Russia to stick to their guns and cut output.

Technical Analysis

Monthly January West Texas Intermediate Crude Oil

(Click to enlarge)

One of the best ways to analyze a market is to take a top-down approach. This allows you to frame the market on the monthly and weekly chart then zero in on the daily chart for actual trade execution. It also allows you to determine the various trends that could be influencing the price action. For example, if the monthly, weekly and daily charts were all in an uptrend then the odds of a successful trade increase if you decide to trade the long side. Furthermore, it also helps let you know if you are trading with the trend or against. Trend traders tend to want to let trades run, while counter-trend traders tend to set objectives or exit zones.

Monthly Technical Analysis

The main trend is up according to the monthly swing chart. However, momentum was trending lower before the OPEC deal. The main trend will change to down on a trade through $46.00. If the selling pressure accelerates through this level then we could see a further decline into the next main bottom at $41.34.

The minor trend is down. It changed to down last month when sellers took out the minor bottom at $63.28.

The main range is $41.34 to $76.55. Its 50% to 61.8% retracement zone is $58.95 to $54.79.

Several factors are telling us that the momentum has shifted to the downside. The first is the October price action. After the market hit a high of $76.55, it closed lower for the month. This technical closing price reversal top indicated that the selling was greater than the buying at that price level. This also signaled the first shift in momentum.

The second shift in momentum occurred with the minor trend changed to down on the trade through $63.28.

Finally, trading on the weak side of the retracement zone at $58.95 to 54.79 represents the third confirmation of the change in momentum to down.

Monthly Technical Forecast

Based on the early price action in December, one can see that buyers are respecting last month’s low at $49.41 and the 61.8% retracement level at $54.79.

This chart pattern tells us that a sustained move under $49.41 will indicate the presence of sellers. If this creates enough downside momentum then we could see an extension of the selling into the next main bottom at $46.00.

Overtaking and sustaining a rally over the Fibonacci or 61.8% level at $54.79 will signal the presence of buyers. If this move can generate enough upside momentum, we could see a surge into the 50% level at $58.95.

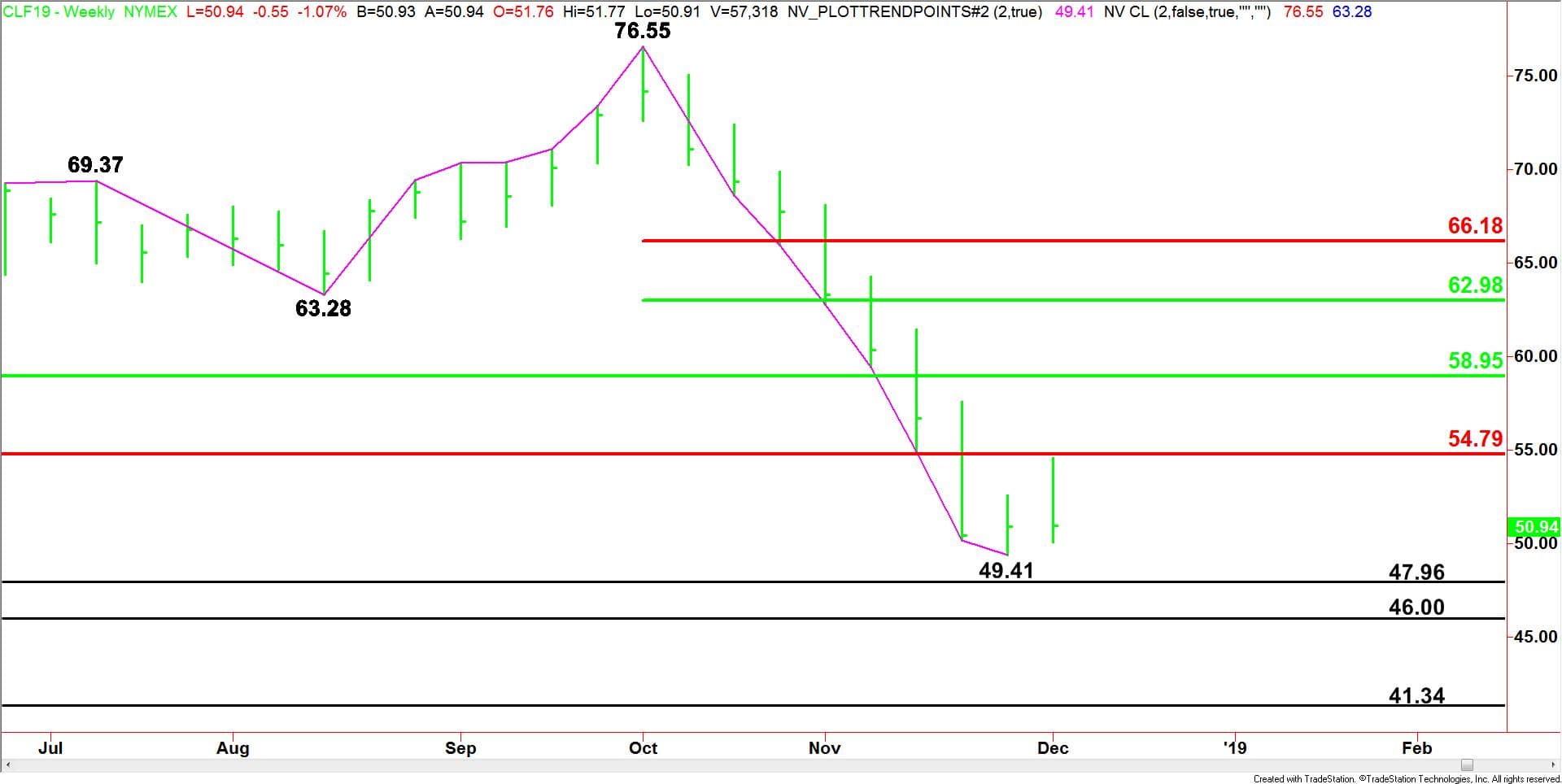

Weekly January West Texas Intermediate Crude Oil

(Click to enlarge)

The weekly chart is slightly different from the monthly chart because it incorporates weekly main bottoms that don’t show up on the monthly chart. However, they both shares all of the major tops, bottoms and retracement levels.

Weekly Technical Analysis

The main trend is down on the weekly chart. A trade through $49.41 will signal a resumption of the downtrend with potential targets coming in at $47.96, $46.00 and $41.34.

The minor trend is also down. However, this week’s price action has helped form a new minor bottom at $49.41. Although it doesn’t mean the trend is getting ready to change to up, it does represent a change in the chart pattern. Prior to the formation of the minor bottom, the market had produced eight consecutive weeks of lower highs and lower lows. The change in the chart pattern is an early indication that the buying may be greater than the selling at current price levels.

In addition to the new minor bottom, traders should note that last week, the market formed a potentially bullish closing price reversal bottom. Furthermore, this chart pattern was confirmed this week. However, the rally stalled because the buying wasn’t strong enough to overcome the 61.8% resistance at $54.79.

Once again, the Fibonacci level at $54.79 that appears on both the monthly and weekly chart proved to be strong resistance.

Weekly Technical Forecast

Based on this week’s price action, the market is going to have to take out $54.79 with conviction in order to attract enough buyers to drive out the strong short-sellers, who are still in control. Otherwise, the market could consolidate in a range, or continue the break through $49.41.

Daily January West Texas Intermediate Crude Oil

(Click to enlarge)

Daily Technical Analysis

The main trend is up according to the daily swing chart. The trend turned up on December 3 when buyers took out the swing top at $52.56. The market followed through to the upside for one day before it ran into a resistance cluster. The cluster was formed by the Fibonacci retracement level at $54.79 and a downtrending resistance angle.

The new short-term range is $49.41 to $54.55. Its 50% level or pivot is $51.98. This pivot is controlling the direction of the market.

Daily Technical Forecast

With the main trend up on the daily chart, a sustained move over the pivot at $51.98 will indicate the presence of buyers. If buyers can generate enough upside momentum then they will drive the market into the downtrending resistance angle. Overcoming this angle will indicate the buying is getting stronger. This could trigger a surge into the main top at $54.55 then the major Fibonacci level at $54.79.

The Fibonacci level at $54.79 is clearly the trigger point for an acceleration to the upside. The daily chart indicates there is plenty of room to the upside because the next resistance is the 50% level at $58.95.

On the downside, a failure at $49.41 will change the trend to down. If sellers regain control then they are likely to continue to press the market into the series of bottoms at $47.96, $46.00 and $41.34.

Conclusion

The daily chart suggests that buyers are trying to consolidate in a range, while waiting for a catalyst to drive the market higher. They are basically defending the previous week’s low at $49.41. While the buying may be strong enough to prevent another steep break, it is not strong enough to trigger a breakout to the upside.

We’ve identified the key upside breakout level as $54.79. This level appears as resistance on the monthly, weekly and daily charts. Therefore, we have to conclude that January WTI crude oil is poised to move sideways to lower until the buying is strong enough to drive the market decisively through $54.79.

The catalyst that will drive the shorts out of the market and bring in aggressive buyers could be the OPEC deal and a number of crude inventory drawdowns. If the decision by the cartel fails to impress traders then look for the downtrend to continue through $49.41.

You can go broke trying to pick a bottom. I think buying strength on a move through $54.79 offers the best opportunity to trade the long side. Furthermore, I believe you can control the risk better. With bottom-picking it’s often too difficult to place a stop-loss.

By James Hyerczyk for Oilprice.com