If you listen to the arguments for and against the Keystone Pipeline, you’re likely to come away thinking that either this pipeline is America’s greatest blessing or the world's greatest curse.

Dedicated advocates have zealously flooded the media with arguments in favor of their cause while belittling the position of their opponents. The result is a heated controversy that threatens to fixate American politics in another of its many endless political conflicts.

One major problem with hotly polarized issues like Keystone is that these arguments tend to obscure some very important business issues regarding the pipeline. The most glaring example is whether it’s a wise business decision for TransCanada (TCP) to float a major multi-billion project in a dramatically slowing energy industry.

Currently, nearly every energy company seems to be battening down the hatches against the flood of supplies in a slow growth environment. BP CEO publicly stated on Bloomberg that his focus for the next three years (or so) is to re-base the company around a $50 oil market. That’s hardly a vote of confidence in the future. Related: Keystone XL Pipeline: Why The Big Fuss?

Practically all the oil majors are cutting capital expenditures, including RDS, ConocoPhillips, Chevron, with expectations that ExxonMobil will soon join the crowd. Nearly the entire energy field is laying aside new big projects with the goal of conserving resources to keep ongoing projects on line, while many smaller companies are even cutting back on those.

Energy insiders seriously question why, in the current environment, anyone would bother to build from scratch a huge, complex and uncertain, multi-billion project in the high dollar cost environment of the U.S., where there are bound to be lengthy delays and large risks of litigation.

One example is Harold Hamm, the renowned boss of Continental Resources, who blasted the Keystone with his curt dismissal, “Who needs it?” This comes in spite the fact that a major selling point is that the pipeline would also serve to move Bakken oil, helping companies like Continental that are hurting for lack of transport avenues. Instead of waiting for the TCP to build the Keystone, Continental went ahead and built its own pipeline.

The largest U.S. pipeline operators, like Kinder Morgan (KMI), are instead taking advantage of falling oil prices to purchase bargain basement assets, as shown by KMI's recent purchase of the aforementioned Continental pipeline.

Enbridge, another giant Canadian pipeline company, took a different tack in its 50/50 partnership with U.S. Enterprise Product Partners. The company acquired the existing Seaway pipeline, reversed its flow southward to the Gulf refineries to transport oil from the crushing glut in Cushing, OK. The plan received government approval and was fully operational, all within 6 months, while the Keystone project has lingered in limbo since proposed in 2006

At the same time, falling energy prices, that are currently causing economic havoc in Canada, will likely make financial backers much more cautious about taking a gamble on what could be a high risk, very costly, standalone venture.

History of TCP Ventures:

This is not the first major TransCanada deal to hit a wall. Ten years ago, TCP signed a highly vaunted agreement with the State of Alaska, proposed by then Governor Sarah Palin at a time when the price of energy was sky-rocketing. The deal was to transport Alaskan stranded natural gas via pipeline from Prudhoe Bay to Alberta, where it would link up with already existing pipelines to the U.S.

What happened then? The price of oil and gas collapsed ('08) and with it the entire idea for the pipeline, a similar situation presently threatening the Keystone plan.

Other important TCP projects are currently stalled. An intense political fight has gone on over the last two years over TCP's plans to build a LNG production facility in British Columbia for export to Asia. Another plan that is floundering is a proposed oil pipeline from Alberta to New Brunswick on the East Coast, for exports to Europe.

Now TCP is floating a plan to instead build a 4,700 pipeline through Alaska for export to Asia, that many experts find doubtful and likely unfeasible.

There are also concerns that Canada's slowing economy and crashing currency may be challenging highly questionable business assumptions, i.e, that building a pipeline in the midst of a global oil glut will increase consumer demand and prices for its product. Since no companies will sign contracts to take delivery until the building of the pipeline is well on its way, the assumption about a growing market remains at best a guess.

Politics:

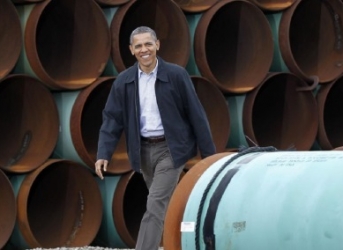

Added to that obstacle is the President’s promise to veto Congressional action to authorize the building of the Keystone pipeline.

Buttressing the President’s position is the Environmental Protection Agency’s (EPA) recently announced decision that the pipeline would increase demand for Canada’s heavy crude and worsen climate change.

From a political perspective, the Keystone offers an easy target. The real dollar-for-dollar benefits to the U.S. are nowhere to be seen; touted economic benefits of the project are way overblown. Yes, the pipeline construction might see a blip in employment for a year or so, but nowhere near the 34,000 jobs projected. The U.S. State Dept. estimates says that project will need only 5,000-6,000 workers, and that for only the two year construction phase.

After construction, the project will only require a relatively small maintenance crew. For comparison, there is the Alyeska Pipeline Service Company, the company that provides ongoing maintenance for the Trans-Alaska Pipeline (TAP) that runs some 800 miles from Prudhoe Bay to Valdez.

At slightly more than half the length of the proposed Keystone, Alyeska currently employs 800 workers to monitor and service the pipeline. Any collateral economic activity generated by the TAP's presence is hard to find.

The President’s opposition to the Keystone pipeline is well understood, but it’s important to recall that it was the U.S. State Department, with Hillary Clinton at the helm, that originally recommended the project’s approval. It's unlikely that this would have gone on without the President's approval.

It was only after State of Nebraska halted the project over pollution risks, which galvanized environmental protest movements, including many Democratic supporters, that the U.S. government began to back away from that decision, as if the Administration had never had anything to do with the pipeline's promotion.

But it’s unlikely that a Presidential veto will do anything to end the political stalemate with his Congressional opponents who have proven to be nothing if not relentless. Consider the 56 times that Congressional Representatives have voted to end Obamacare.

With the new Republican control of Congress, the President is likely to face an avalanche of Congressional bills in favor of Keystone, with many of these attached to spending bills the President favors.

Given that 60% of the public is in favor of the pipeline, including union supporters, along with numbers of Congressional Democrats, the President could be forced to consider that the political price of halting the pipeline might seriously undermine the Administration’s agenda for the final years of his term.

Another important political consideration is that Canada is one of America's oldest and most reliable allies in a very uncertain and much troubled world, a fact that any President would find hard to ignore.

A Modest Proposal:

Say, for a moment, that the President took a page from Bill Clinton’s playbook, about how to steal opponent's ideas and improve upon them.

In this scenario, the President could re-open negotiations with TransCanada towards increasing America’s stake in the project. The President could argue that if TransCanada wanted to improve its prospects in U.S., as well as increasing the benefits to the U.S., TC might consider taking on a U.S. pipeline operator as a partner.

Many countries require a domestic partner for foreign companies planning to undertake major projects across their territories. The practice is common in Canada, where many foreign companies have joint ventures with Canadian companies.

In the US, where hundreds of thousands of miles of pipeline have been built, it could be a major advantage for Keystone to partner with U.S. pipeline companies, with many a good deal larger, and far more politically astute to regulations and legal issues.

A U.S. partner would assure that the Keystone is integrated into the network of pipelines already serving the US. It could also serve to improve the image of TransCanada that has been badly damaged by the controversy over the Keystone. Related: Should President Obama Veto Keystone XL?

Financing problems could easily be overcome with TCP taking on a U.S. partner, given that many U.S. pipeline operators are flush with cash and currently hunting acquisitions. In that vein, TransCanada might also use the example of some of the U.S. partners in acquiring existing pipelines as part of their international network.

Also, both Enbridge and Kinder have shown the advantages of acquiring existing pipelines at bargain prices as part of their international networks, accessing existing approved right-of-ways to build upon, along with existing cash flows from operating businesses to pay down debt. Contrast this with the payoff for the Keystone that is years away.

Another potential benefit is that many U.S. pipelines companies hold pipeline assets in subsidiaries that are structured as master limited partnerships (MLP). These provide investment capital for expansion while also providing high dividends.

By using the MLP model as part of the pipeline plan, US investors, and mutual and retirement funds could take part of the action, spreading the benefits to the wider population, and increasing project support, while the Keystone partners receive capital for expansion. That will bring on the unarguable benefit of real dollars to companies and investors.

In that way, the U.S. would share far more beneficially in cost and profits, increasing the benefits to the U.S. economy in exchange for allowing the pipeline to traverse the country's heartland. Thus, instead of forced concession, which will inevitably be seen as a political defeat, the President can create a victory not only for his Administration, but also for America.

By Robert Berke for Oilprice.com

More Top Reads From Oilprice.com:

- Is Keystone Still Viable Amid Low Oil Prices?

- Alaska May Provide Solution To Tar Sands Issue

- North American Energy Integration Could Bring The Planet To Its Knees