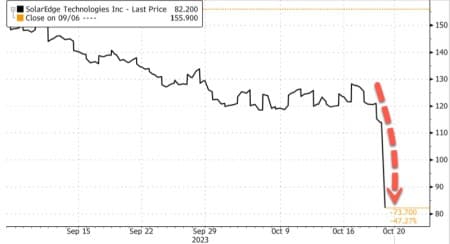

The renewable energy meltdown continues as solar power company stocks tumbled on Friday morning after solar equipment maker SolarEdge Technologies warned of sliding European demand.

"During the second part of the third quarter of 2023, we experienced substantial unexpected cancellations and pushouts of existing backlog from our European distributors," said SolarEdge CEO Zvi Lando in a statement.

Lando said, "We attribute these cancellations and pushouts to higher-than-expected inventory in the channels and slower-than-expected installation rates. In particular, installation rates for the third quarter were much slower at the end of the summer and in September where traditionally there is a rise in installation rates."

SolarEdge also announced preliminary third-quarter results, with third-quarter revenues ranging from $720 million to $730 million, compared to the previous expectation of $880 million to $920 million.

Shares of SolarEdge crashed as much as 28% in premarket trading in New York. Also, Competitor Enphase Energy plunged 17%, Sunrun -9%, and SunPower -8%.

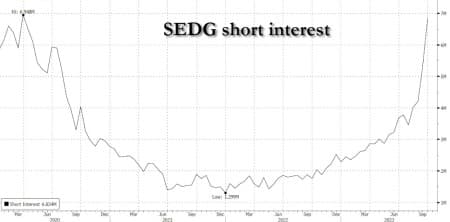

Large short in SolarEdge.

Here's what Wall Street analysts are saying about SolarEdge's dismal outlook (list courtesy via Bloomberg):

Goldman Sachs (cut to neutral from buy; PT to $131 from $254)

- Downgrade reflects SolarEdge's negative pre-announcement on "significantly weaker installation rates"

- "After a second straight disappointing quarter of results/guidance, we find it hard to defend the stock"

Deutsche Bank analyst Corinne Blanchard

- Cut the recommendation on SolarEdge to hold

- Trimming numbers for most solar companies, as expects further downside with sluggish demand in the US and European residential market

- Also downgrades Sunrun and Sunnova recommendations to hold

BMO analyst Ameet Thakkar (outperform, PT $216)

- Expected for a negative update this quarter but SolarEdge's comments suggest 4Q forecast "will be materially lower than this"

- The stock should be "under significant pressure"

Truist Securities analyst Jordan Levy (buy, PT $180)

- SolarEdge's 3Q outlook cut reflects challenges beyond the US market

- The company cut its guidance as European residential solar markets weakened during the quarter

Solar demand has also slid in the US due to high-interest rates and less favorable state renewable policies.

We've been keeping an eye on the financial crisis brewing in the offshore wind industry.

The ultra-efficient and reliable form of clean energy production is an essential component of all of the world's possible decarbonization pathways, but soaring inflation costs have undercut the sector's growth and left major projects dead in the water just when their output is most needed. A major policy shift is in order, but the public and private sector are at loggerheads as to who should have to pay for the increasingly expensive development plans.

The entire energy transition to renewables is cracking and never was sustainable. And queue more spending from the White House to prop up the failing industry.

By Zerohedge.com

Indian grocery store near me