Twice as many deepwater projects expected this year as the last two years combined

While U.S. shale has been by far the most important topic when discussing U.S. oil and gas production, Gulf of Mexico production is still a major factor. Oil production from the Gulf increased significantly in 2016, while nearly every state saw decreases in production.

According to Wood Mackenzie, the offshore industry made major changes to drilling strategies and technology in the aftermath of the Deepwater Horizon disaster. These allowed operators to cut the average cost of projects by about 20 percent, making many projects profitable at $50 per barrel or even lower.

Technological advancements are not the only factor increasing profitability, though. Producers are reducing costs with smaller projects, targeting only the best locations. Drilling “the core of the core” has become increasingly prevalent in onshore operations as well as operators look to make the most of their drilling activity.

Three big deepwater projects have been approved already this year, with another five expected by the end of the year. This would represent a significant increase in activity, as eight projects were approved in the last two years combined.

Shell, BP approve major GOM projects

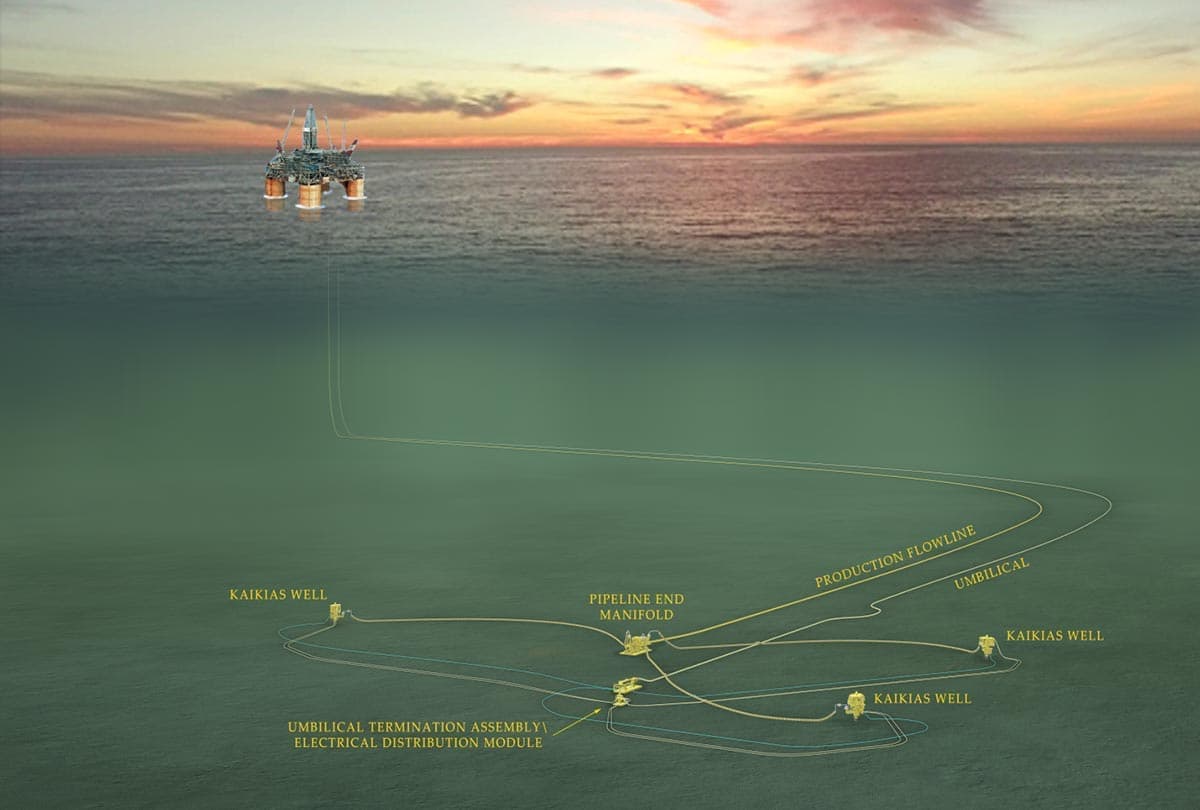

Shell gave the Kaikias project the go-ahead at the end of February, its first GOM project in more than two years, according to Bloomberg. Located about 60 miles south of the Louisiana coast, Kaikias was originally discovered in 2014. Shell estimates that the field holds about 100 MMBOE of recoverable oil. Phase one of development will start production in 2019. Related: This Asian Nation Just Announced A Radical Shift In Oil & Gas

Three wells will be drilled in this phase, with each designed to produce up to 40 MBOEPD. Shell reports that the Kaikias project has a breakeven price below $40 per barrel, after simplification reduced the cost of development by 40 percent.

(Click to enlarge)

Source: Shell

BP approved Phase 2 of development of the Mad Dog project in December, with production expected in late 2021. Originally proposed in 2013, Mad Dog Phase 2 was projected to cost over $20 billion. BP extensively simplified and standardized the proposed design, bringing the final cost to $9 billion, a decrease of nearly 60 percent. A new floating production platform will produce up to 140 BOEPD from 14 new wells.

Activity reflected in lease sales

The increase in GOM activity has also been noticed in lease sales. The most recent lease sale, on March 22, saw 163 tracts sold for $275 million. While not as high as the $850 million spent in 2014, before the price downturn, this exceeds the $156 million spent in 2016.

ADVERTISEMENT

Shell Offshore was foremost in acquiring lease blocks with the most high-bids, the most expensive single bid and the highest total amount bid. Other successful companies included Chevron and Exxon Mobil.

By Oil And Gas 360

More Top Reads From Oilprice.com:

- Malaysia’s Petronas Set To Rebound After 96% Dip In Profits In 2016

- This Non-OPEC Member Just Called For An Extension Of The OPEC Deal

- The First Sign Of Tighter Oil Markets Is Finally Here