Oil prices are on track for a slight weekly gain as traders grow cautiously bullish despite a strengthening U.S. dollar and speculation on another rate hike from the Fed.

Friday, July 21st, 2023

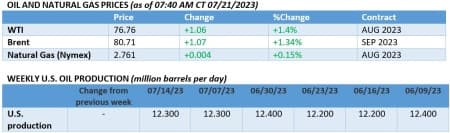

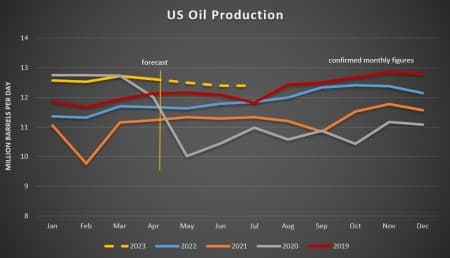

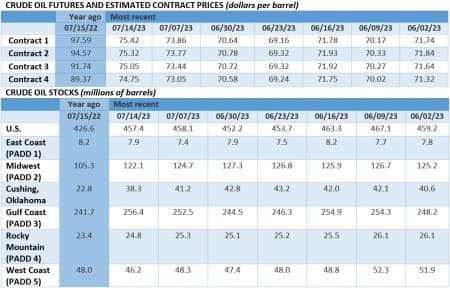

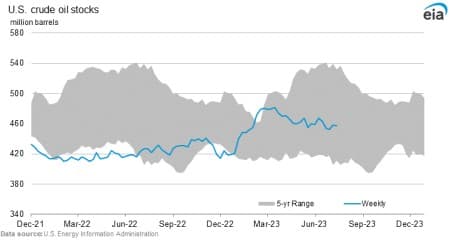

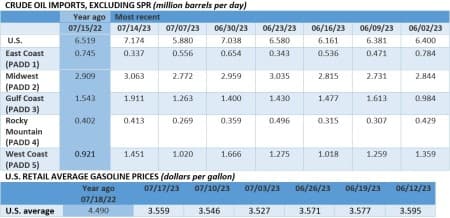

This week has seen the first replenishment of US SPR stocks in more than two weeks and another week-on-week decline in oil inventories (albeit a meager 0.7 MMbbls), prices have been trending sideways as bullish indicators were capped by a stronger US dollar and resurgent speculation about the upcoming OMC meeting of the Federal Reserve next week. With this, ICE Brent remains around $80 per barrel whilst WTI hovers slightly above $76 per barrel.

US to Ban SPR Sales to China. The US Senate overwhelmingly (85-14) voted in favor of an amendment to the annual defense bill that would ban exports of strategic petroleum reserves to China, although last year there were only 2 MMbbls sold to Chinese buyers, a fraction compared to “normal” crude sales.

Ukraine Grain Deal Collapses After Russia Pull-Out. Moscow has warned shippers that any vessel heading to Ukraine’s Black Sea ports could be considered a military target, sending the Black Sea Grain Deal down the drain amidst continuous strikes on port facilities in Odesa and Mykolaiv.

Iran Courts India Over Crude Purchases Renewal. Iranian authorities indicated they were ready to provide India with a “special priority”, seeking to renew exports to one of Tehran’s key customers before 2019 as before the sanctions kicked in Indian buyers were buying an average 500-600,000 b/d of oil.

Key Senegal Project Delayed. The launch of Woodside Energy’s (ASX:WDS) 100,000 b/d Sangomar project in offshore Senegal has been postponed to mid-2024 as the project operator needs to finish up remedial work on its FPSO which still remains at a shipyard in Singapore.

Cheniere Eyes Midstream Expansion. US LNG exporter Cheniere Energy (NYSEAMERICAN:LNG) considers building a new pipeline link to its Sabine Pass liquefaction facility in Louisiana as it seeks to tap into other pipelines in the Haynesville or Marcellus basins for its Stage 5 expansion.

Iraqi Megadeal Changes Revenue-Sharing Terms. Having, at last, signed the $27 billion deal package with the Iraqi government, French oil major TotalEnergies (NYSE:TTE) will no longer get a flat rate for every barrel of oil produced but instead will share risks and profit with the state.

Oil Service Companies Shine as Majors’ Revenues Wane. The big three oilfield service companies – Schlumberger, Baker Hughes, and Halliburton – are set to post combined Q2 profits of $2.04 billion, up 60% year-on-year as revenues from offshore drilling and Middle Eastern onshore projects are soaring.

UAE Clinches India LNG Term Deal. ADNOC, the national energy company of the UAE, announced a 14-year LNG supply deal with India’s state-owned firm IOC (NSE:IOC) to provide 1.2 million tonnes of LNG per year in a deal that is expected to be worth some $7-9 billion.

Colombian Turmoil Just Never Ends. Colombia’s energy minister Irene Velez resigned this week amid investigations that she abused her power to get the immigration office to approve her son’s travel abroad despite not having the required paperwork, a case taken up by the country’s attorney general.

ADVERTISEMENT

US Extends Iraq Waiver for Another 120 Days. The US State Department issued a 120-day national security waiver that would allow Iraq, still dependent on Iranian power and gas imports, to pay for imports via non-Iraqi banks as Baghdad descends into a summer of blistering heat.

First Gulf of Mexico Wind Auction to Start Soon. The US Interior Department announced that the first ever offshore wind power auction in the Gulf of Mexico, home to 1.8 million b/d of crude production, will take place August 29 with the aim of allocating rights for more than 300,000 acres in offshore Texas and Louisiana.

Poland Doubles Down on Coal. Poland’s Supreme Administrative Court overturned a June ruling that work at the giant Turow lignite mine field should be suspended on environmental grounds, claiming energy security as a constitutional value and brushing aside claims of underground water loss.

Majority of LME Aluminium Stockpiles Remain Russian. Russian-origin aluminum now represents over 80% of stocks held in warehouses of the London Metal Exchange, raising the risks for buyers that have self-sanctioned from Russian goods as they are now vying for a smaller volume of available supply.

UAE Bids for Germany’s Chemical Giant. UAE national oil company ADNOC has upped the ante on its $12 billion takeover offer for German chemical giant Covestro (ETR:1COV), evaluating it at almost 8x EV/EBITDA and marking a follow-up to its consolidation effort with Austria’s OMV to merge assets.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Shale Challenges OPEC With Record Production In 2023

- Carbon Prices Set To Fall As Europe Speeds Up Energy Transition

- U.S. and Qatar At The Forefront Of Global LNG Supply Growth