Copper prices are up 60 percent in 24 months and zinc has gained 140 percent in two years. Gold is up too, 20 percent in two years. But one of the best performing miners on the Toronto Stock Exchange doesn’t produce any of those metals.

It is Cameco and it produces uranium.

(Click to enlarge)

Cameco hasn’t gained 36 percent year-to-date by leveraging a rising uranium price. In fact, on first glance the uranium spot price chart still looks pretty darn bad.

(Click to enlarge)

But savvy investors look past the price chart and see a sector poised to break out.

Uranium producers have drastically cut production. Big funds are being established to hold physical U3O8, removing more supply. And Cameco is buying large volumes in the spot market to fulfill its contracts. Against all of that, demand keeps rising.

Utilities have been buying spot supplies for several years now to take advantage of low prices. But in the last six months, the spot market has been turned upside-down – and those supplies have basically vanished.

In very short order, the spot market will dry up completely and utilities will have to face the music and sign new long-term supply contracts… in the shadow of a looming deficit.

Many investors have been waiting for those contracts as a clear sign that uranium is back. But when uranium moves, it moves fast. By the time contracts are announced, the sector could already have made massive moves.

That’s why the spot market shift is so important. The disappearance of spot supplies is the force that will make utilities sign contracts. Acting now means being ahead of the crowd.

And the crowd will pile in, because uranium bull markets are a favorite of legendary investors. The last uranium supply squeeze pushed the spot price from US$20 per lb. to US$138 per lb. in just two years. Uranium stocks multiplied that rise: leading producers gained tenfold while top explorers and developers doubled that.

The last hot uranium market was short lived. Supplies had been ramping up, from Kazakhstan to Saskatchewan, and so supply overwhelmed demand in short order. Then the Fukushima Daiichi nuclear disaster acted as the nail in the coffin.

Oversupply plus extremely negative sentiment decimated the market for six years:

- 500 uranium stocks worth $125 billion dwindled down to 40 stocks worth perhaps $6 billion.

-Spot prices slid from $138 per lb. to $20 per lb. rendering 75 percent of global production uneconomic.

-Projects that once supported companies with market capitalizations in the tens or even hundreds of millions of dollars were available for hardly anything, or even for staking.

And so IsoEnergy staked. And bought. And built a portfolio of uranium projects that would have collectively carried a billion dollars of valuation in the last uranium market.

Not only does IsoEnergy have those projects, it has the best possible team to advance them. This group has discovered more pounds of basement-hosted uranium in the Athabasca Basin than anyone else and now they are applying their knowledge to a huge portfolio of projects.

The odds of success are high. The market is primed to carry a new discovery to ridiculous heights. And yet investors haven’t quite realized that the uranium game is on.

Setting Up The Spot Market Shock

The spot market has been overflowing with supply for years. The world was already producing too much uranium in 2011 – and then the Fukushima disaster prompted Japan to shut down all its reactors releasing unneeded Japanese uranium flowed into a spot market already filled to the brim.

It didn’t help that Kazatomprom, the state-owned uranium company of Kazakhstan, had been ramping up production as fast as possible as it worked to grab market share, impact on prices be damned.

All told, there was uranium everywhere and the spot price responded, sliding consistently from 2012 until 2017… when producers collectively decided to do something about it.

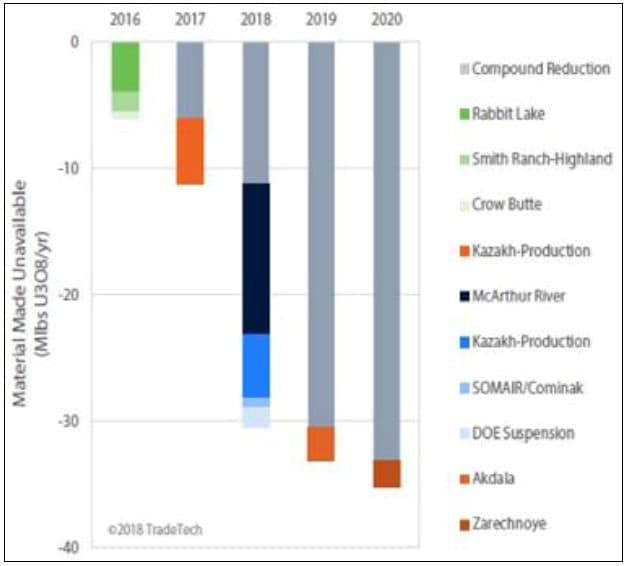

The first to act was Kazatomprom, which cut output by 10 percent in early 2017. Other producers followed suit: Cameco suspended McArthur River, the world’s largest uranium mine, in November; Paladin cancelled a planned expansion and then just shuttered the aged Langer Heinrich mine; Kazatomprom announced two additional production cuts bigger than the first.

(Click to enlarge)

Collectively, producers have erased or are in the process of erasing more than 30 million lbs. of annual production since 2016.

That’s huge against a market that consumes 155 million lbs. a year. In fact, just Cameco shutting down McArthur River is the equivalent of Saudi Arabia halting oil production entirely. Both produce 13 percent of global supply.

The market did take note when Cameco shuttered McArthur, but a small gain in the spot price soon subsided. Why should prices stay up if there’s so much supply?

It would be a fair question, except those supplies have now disappeared.

The reason represents the biggest news in the uranium space for a decade – and it is news that the market hasn’t noticed yet: Cameco is buying 10 million lbs. of U3O8 in the spot market this year.

Cameco’s buying will increase spot market demand by 50 percent. If that isn’t enough to dry up supplies, nothing is.

Cameco will churn out some 17 million lbs. of U3O8 this year, but it is contracted to supply 37 million lbs. The company can pull some from inventory on the order of 10 million lbs., but that still leaves a gap of 10 million lbs. The spot market is only 20 million lbs. total.

And it plans to buy all of those pounds in the spot market, specifically to dry up supplies. Without spot supplies, utilities will have to sign contracts again.

Cameco’s intent is clear – it is doing its best to cure the ailing market, and when you are the world’s second-largest uranium producer your best is very powerful.

If the market survives that, things only get more intense in 2019. By then, Cameco would have drawn its inventories as low as it wants to go, so it would have to fill its entire production gap with spot purchases – on the order of 20 million lbs.

That’s the entirety of the spot market today. The whole thing.

Spot volumes are quoted as roughly 40 million lbs. a year but many pounds get bought and sold several times, so the rule of thumb is that 50 percent of the buying is final.

Cameco buying 10 million lbs. of uranium this year will boost spot demand by 50 percent. There is nothing more bullish than that.

To add fuel to the fire, several large new funds are being established to hold physical uranium.

Their rationale is twofold. First, such funds give investors the chance to own direct exposure to a rising uranium price. Second, by holding physical uranium these funds will remove even more supply from the spot market, helping to bring forward the very bull market on which they are based.

The biggest such fund is Yellow Cake, which just raised $200-million. Yellow Cake has already secured a deal to buy 25 percent of Kazatomprom’s production, which will lock away another 5 percent of global annual production.

From production cuts to funds secreting away supplies to Cameco buying up half the spot market – spot uranium is about to disappear.

Demand

There are nuclear reactors under construction all over the world. China leads the pack with 19 followed by India, Russia, and a few other Asian and Middle Eastern countries that are collectively building 27 reactors. Japan has restarted 7 reactors since 2015 and is working to restart 17 more, though it will need 30 back in operation to achieve its goal of powering 20 percent of domestic needs from nuclear by 2030.

(Click to enlarge)

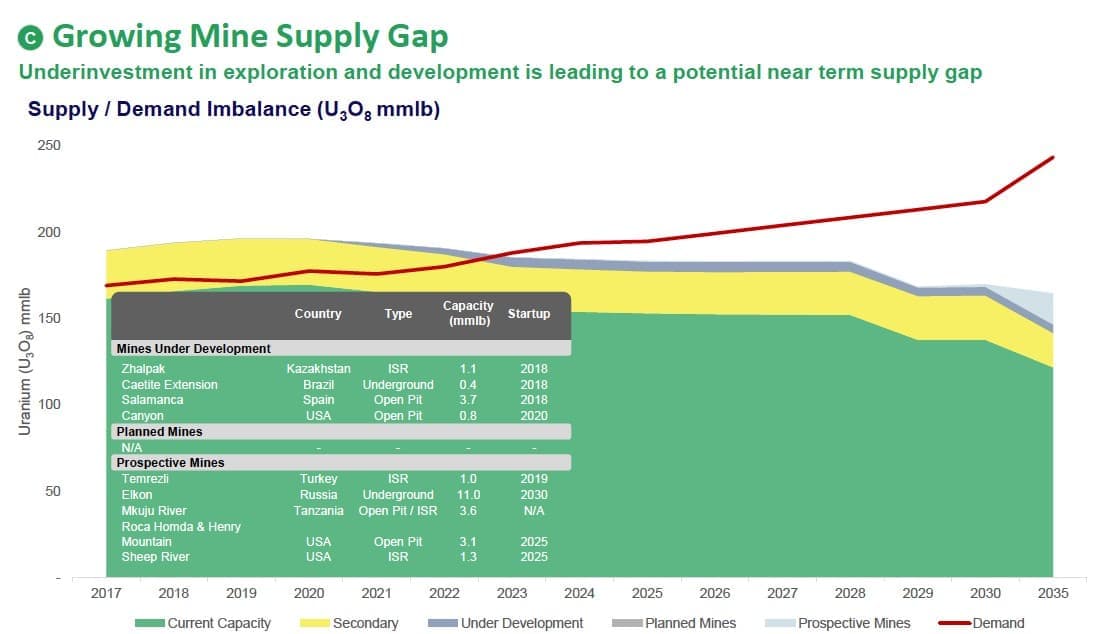

All told, nuclear generation capacity is set to hit 384 gigawatts by 2022 and 438 gigawatts in 2030, up from 359 gigawatts today.

To power those watts, uranium consumption will reach 188 million lbs. in 2022 and 222 million lbs. in 2030, up from just 154 million lbs. last year.

The market is looking at a deficit of 80 million lbs. a year by 2030 – half of current production.

(Click to enlarge)

The requirements are set; the reactors are under construction. There’s just one problem: it’s almost impossible to build a uranium mine at today’s prices.

So prices have to rise.

Contracting Coming

Between 2005 and 2010 utilities signed long-term contracts for over 200 million lbs. of uranium a year. In the last three years contracting has fallen by more than 60 percent to average just 77 million lbs. a year.

The result: by 2022, which is not far off, utilities will need 38 million lbs. more uranium than they have ordered. By 2026 uncovered requirements soar to 116 million lbs.

As soon as it becomes clear that the spot market is running out, utilities will rush to ink new contracts.

And those contracts will not come at current spot prices. There’s no point in a producer agreeing to sell uranium at prices that guarantee it will run at a loss. And analysts estimate that producers need, on average, a uranium price of US$55 per lb. – more than double today’s spot price.

Contract prices will be significantly stronger than current spot. Adding to the bullish vibe, producers will probably even demand that contract pricing is somehow linked to the spot price, so they retain exposure to a market expected to shoot skyward.

IsoEnergy

ADVERTISEMENT

If a uranium bull market is imminent, investors need to know where to place their bets. Some avenues are obvious: Cameco is up 36 percent this year already because it’s the go-to uranium play.

But the biggest wins come from stocks that haven’t gained yet but that have been working quietly for years to position themselves perfectly for this uranium bull run.

IsoEnergy has been doing just that.

The company was born out of NexGen Energy. NexGen is focused on the Arrow deposit - widely known as the best uranium discovery of several decades.

With all eyes on Arrow, NexGen created ISO to house the rest of its exploration portfolio.

But that was just the beginning.

Since debuting in 2016 ISO has added 8 projects to its portfolio. Some it staked but many it bought from Cameco and Orano, uranium majors that have selected ISO as their preferred junior exploration partner for these projects.

ISO’s portfolio is large. Apart from Mountain Lake in Nunavut, Canada, where the company has an 8.2M lb. uranium resource, the projects are early stage, most offering geophysical targets and perhaps a few drill holes. They have all the tell-tale signs that this experienced team wants to see in their search for the next great Athabasca uranium discovery.

(Click to enlarge)

Take Thorburn Lake for example. This property has it all: shallow sandstone cover, all the right geophysical targets, three significant uranium deposits within 7 km, sniffs of uranium in previous drilling, and key targets that remain untested. Oh, and the haul road for the Cigar Lake uranium mine runs through the property.

Then there’s Radio, which sits just 2 km east of the Roughrider deposit. Roughrider was the target in the last big deal in the uranium space, when in 2012 Rio Tinto paid C$654 million to buy Hathor Exploration. The sandstones are shallow, the sedimentary corridor and structure associated with Roughrider runs right through the project, there are numerous other uranium deposits and showings within just a few kilometres, and the McClean Lake uranium mill is just down the road.

Or Larocque East, which covers the northeast extension of the Larocque Lake conductor system. That system offers up some incredibly high-grade showings, like 29.9 percent U3O8 over 7 metres at Larocque Lake, just 6 km from ISO’s ground. Within ISO’s property, the team has identified 22 km of graphitic conductors – those are important because basement uranium often occurs along graphite horizons. And the targets to test, in the basement alongside these conductors, are relatively shallow, sitting under 140 to 290 metres of sandstone, and have never been tested before.

Then there are really early stage projects where the team is testing out newer ideas. Whitewater is an example – this project covers a 26-km swath of the Grease River shear zone, which is known to host uranium at the nearby Fond du Lac deposit. No one has really looked at Whitewater before, though, because it is 5 km outside of the basin – and until very recently, everyone assumed uranium ended at the edge of the Athabasca.

But recent work is showing that rocks outside the basin can indeed carry uranium – and with the advantage that they are at surface, not covered by a thick layer of unstable sandstone. ISO staked Whitewater in 2018 and has already identified 25 uranium occurrences on the property.

That’s just a taste of ISO’s portfolio.

The take home is this: for ISO’s team, the uranium bear market of the last few years has been an opportunity to build up their dream portfolio. With 14 projects now in the company, each highly prospective for their own list of reasons, ISO has stacked the deck in its favor. The more prospective projects you have, the greater your odds of a big win.

It’s also worth noting that the portfolio itself will attract attention in a uranium bull market – the Athabasca Basin offers uranium at 10 times the average global grade, so investors flock to Saskatchewan players when uranium heats up. Imagine that this portfolio of projects, spread out among dozens of companies, was probably worth over a billion dollars in the last uranium bull market.

Almost half of ISO’s projects came from NexGen Energy, Cameco or Orano, who have selected ISO as their preferred junior exploration partner. The selection is because of the team.

Between CEO Craig Parry, VP Exploration Steve Blower, Senior Geologist Andy Carmichael, and key Board members like NexGen’s CEO Leigh Curyer and Mega Uranium’s Richard Patricio, the IsoEnergy team has discovered about 400 million pounds of basement-hosted Athabasca Basin alone.

Basement is better, by the way, because the basement rocks are strong and easy to mine. The sandstones of the basin itself, by contrast, are unstable and so mining is very challenging and costly. But basement uranium is a newer concept in the Athabasca; most of the big deposits discovered prior to 2010 were in the sandstones. As such, expertise in basement Athabasca uranium is still rather rare.

This is why NexGen, Cameco and Orano are choosing to partner with or sell projects to ISO – these majors are choosing the most proven team of Athabasca Basin basement uranium discoverers around.

For investors: IsoEnergy also offers the other quality you want in an explorer - a tight share structure.

The company has only 55 million shares outstanding, which is a low count in itself, but making it even better is the fact that NexGen, Cameco, Orano and management own almost 70 percent of the count. That means there are fewer than 20 million shares trading – that’s the kind of tight structure that turns a discovery into a share price phenomenon.

And ISO has cash. It has $3.8 million in the bank right now and has raised $14 million since it debuted – this company has access to cash if needed, which is a rare quality in a market as beaten up as uranium.

Access to cash and knowledge gained from multiple Athabasca Basin basement discoveries has given Iso an incredible advantage over the last two years as it turned a modest portfolio into a very large and prospective landholding – all at rock bottom prices.

By Peter Bell

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. This article is written by a third party and does not express our views. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.

https://twitter.com/quakes99/status/1017863495004532736

Thanks, John!

Thank you for the great article!

Wonder why very few people know and talk about isoenergy??

Thank you for the article.

Why no one talks about isoenergy?