A salar-size gap has opened up between bulls and bears in the lithium market.

In March Morgan Stanley sent shares of lithium companies tumbling after the investment bank forecast overproduction of the battery raw material and plunging prices.

Some in the industry characterized the New York bank’s assessment as little more than a hit job to help a client pick up assets cheaply. Miners pointed to the complex nature of lithium mining leading to production ramp-up problems and processing bottlenecks.

The industry could also point to the fact, that there was a 20-year hiatus in new mines in the lithium triangle of South America before the much delayed Orocobre brine operation entered commercial production two years ago.

However, the bears got some help on Thursday after SQM, the world number three lithium miner, said it will more than triple production in fewer than three years.

De Solminihac’s soothing comments about how the company plans to manage all that additional supply would do little to assuage bears

A relatively modest investment of $525 million would lift the Chilean company’s output in the Atacama salt flats from 48,000 tonnes to 180,000 tonnes by early 2021. $75m will be spent this year to lift output to 70,000. Total global supply last year was an estimated 215,000 tonnes.

Related: OPEC Could “Relax” Production Cuts

"We believe that with demand growing close to 20 percent this year and next year, the market will be able to absorb this additional supply," said CEO Patricio de Solminihac in a statement accompanying the company's first quarter results. "Our strategy is to have the installed capacity to react to market demand."

"2018 sales volumes in the business line should reach approximately 55,000 MT (metric tonnes) as we ramp up the current production. These additional sales volumes should be seen during the second half of 2018," according to SQM.

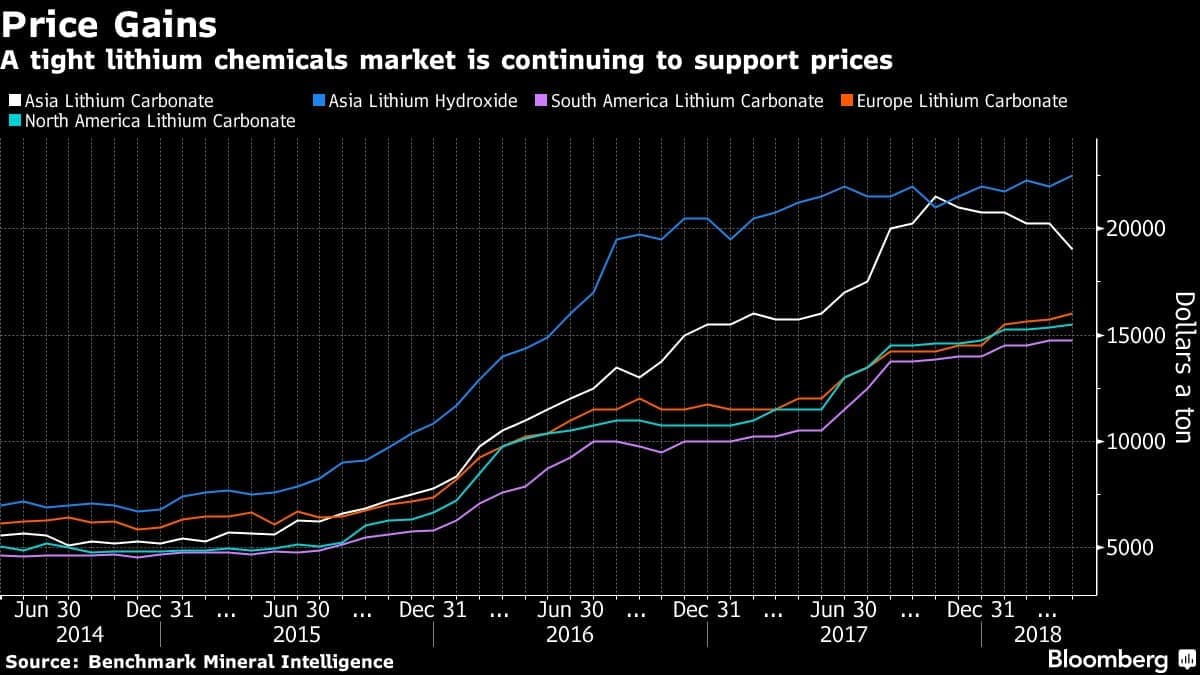

Lithium prices have withstood all the bearish forecasts up to now and there is widespread consensus on growing demand for lithium.

But SQM is not alone in its ability to up output at low cost quickly and Mr. De Solminihac’s soothing comments about how the company plans to manage all that additional supply would do little to assuage bears.

(Click to enlarge)

By Mining.com

More Top Reads From Oilprice.com:

- Dubai To Become Global Leader In Solar Energy

- Iran Tensions Send Oil Spiking Again

- EVs Could Erase 7 Million Bpd In Demand