Breaking News:

What Does Von der Leyen’s Re-Election Mean for Europe’s Future?

Ursula von der Leyen, a…

Stock Market’s Short-Term Focus Threatens Energy Transition Goals

The problem that most companies…

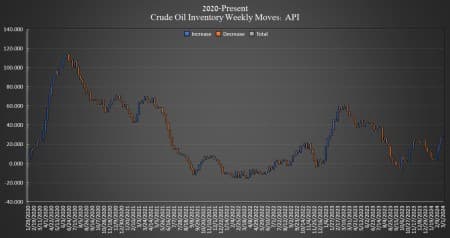

WTI Holds Steady After Smaller Than Expected Crude Build

Crude oil inventories in the United States rose this week, by 423,000 barrels for the week ending March 1, according to The American Petroleum Institute (API), after analysts had predicted a 2.6 million barrel build. The API reported an 8.428-million-barrel rise in crude inventories in the week prior.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 0.7 million barrels as of March 1. Inventories are now at 361 million barrels—the highest level since May 2023.

Oil prices were down ahead of the API data release despite news from OPEC+ that the group had agreed to extend their voluntary production cuts into the next quarter.

At 4:01 pm ET, Brent crude was trading down 0.93% on the day at $82.03, down more than $1 per barrel compared to this time last week. The U.S. benchmark WTI was trading down on the day by 0.72% at $78.17, down nearly $0.50 per barrel compared to last Tuesday.

Gasoline inventories fell this week by 2.8 million barrels, on top of the 3.272 million barrel inventory drop in the week prior. As of last week, gasoline inventories were about 2% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories also fell this week, by 1.8 million barrels, on top of last week’s 523,000 barrel drop. Distillates were already 8% below the five-year average for the week ending February 23, the latest EIA data shows.

Cushing inventories rose again this week, by 500,000 barrels after rising by 1.825 million barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- This Could Be A Gamechanger For Natural Gas In Europe

- Breakthrough Biotech Paves Way for Green Fuel Production Boom

- U.S. Seeks Semiconductor Supremacy with New Funding Initiatives

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B