Breaking News:

Why China’s Commodity Imports Rise amid Struggling Economy

Chinese purchases of LNG, coal,…

U.S. Hits Record High Electricity Generation From Natural Gas

Record-breaking natural gas demand for…

Upside Momentum Continues To Grow For Gold

While gold has been on a generally positive trend for the past few years, the onset of the global pandemic has made bullion’s relevance as a hedge even more apparent and accelerated its price performance.

During the first half of 2020, the price of gold increased by 17%, followed up by an additional 10% gain for the month of July, outpacing all major assets by a significant amount.

Spot gold set a new all-time high on July 28, reaching $1,940.9/oz on the LBMA Gold Price PM (PM Price) and topping $1,981.3/oz intraday. This exceeded the previous record of $1,895.0/oz set by the PM Price on September 5, 2011, and the $1,921.2/oz intraday high the following day during Asian trading hours.

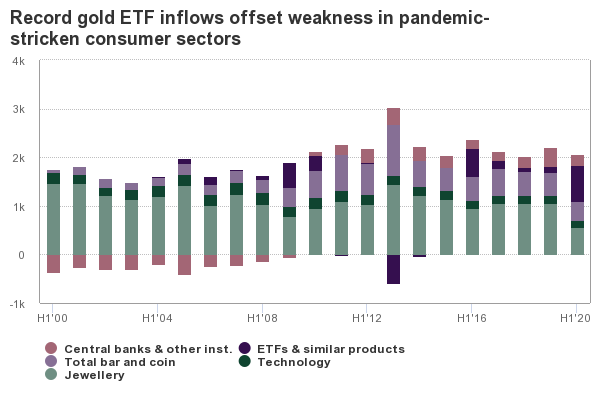

The global response to the pandemic has also fuelled record flows into gold-backed ETFs and brought total holdings to 743 tonnes for H1 2020, more than any other annual year.

According to the World Gold Council (WGC), gold’s record-breaking run has been driven by a combination of high uncertainty, very low interest rates and positive price momentum – all of which are supportive of investment demand.

The Council believes the covid-19 pandemic may bring structural shifts to asset allocation, and although the recent price move, coupled with markedly weak consumer demand (down 6% in H1 2020), may lead to higher gold price volatility in the near term, there are strong fundamental reasons supporting gold investment in the longer term.

The pandemic is far from over, the Council says, and more importantly, its impact on the global economy is yet to be determined. There are indications that some countries like China, South Korea, Germany and other European nations have started to turn a corner.

Related: The Permian Could See Record Gas Production In 2021

However, at a global level, early hopes of a fast recovery are all but gone. Instead, market participants are bracing for a bumpy ride and a longer road to recovery, the Council speculates.

In addition, central banks have aggressively cut interest rates, often in combination with quantitative easing and other non-traditional policy measures. Governments around the world have also approved massive rescue packages to support their local economies.

According to the WGC, these initiatives have raised concerns that easy money, rather than fundamentals, is fuelling the stock market rally and that all the extra money being pumped into the system may result in very high inflation or, at the very least, currency debasements.

To put things into perspective, the price of gold more than doubled from about $900/oz in early 2008 to its high more than three years later in the aftermath of the Global Financial Crisis. In contrast, it has increased by less than 30% since the beginning of the covid-19 pandemic.

Additionally, adjusted for inflation, the gold price currently is about $200 shy of the 2011 level and well below its January 21, 1980, record high equivalent of about $2,800/oz in current money value.

The latest leg of gold’s 2020 bull run has come fast, the WGC says, pointing out that it took about four months for gold to go from $1,650/oz to $1,800/oz, but less than four weeks to climb to $1,950/oz.

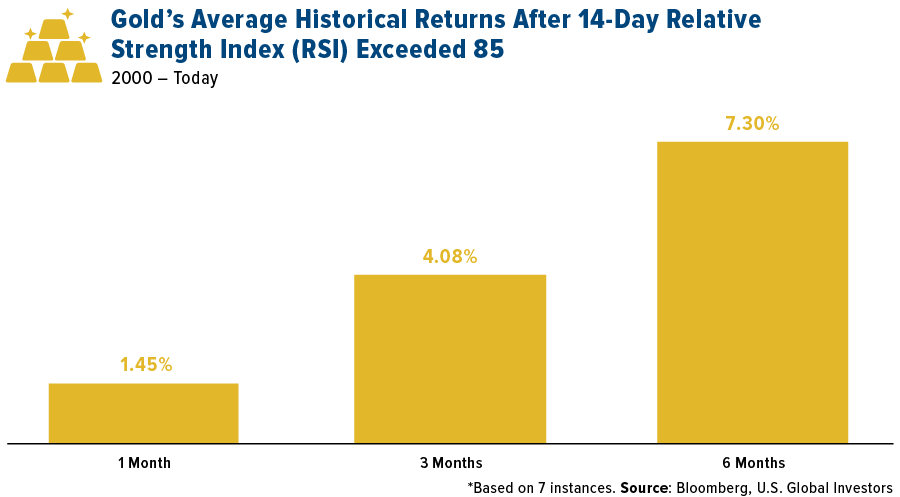

While this uptick was driven in good part by a sharp depreciation of the dollar, the WGC notes that the magnitude of the change is highlighted by gold’s 14-day relative strength index, which reached a high of 88 on July 27. The council says this is usually seen as a sign that the market could be overbought.

Frank Holmes, CEO of U.S. Global Investors, also analyzed gold’s 14-day RSI and concluded that “the conditions at the moment are highly supportive of gold and precious metals.”

“Besides negative real yields, we also see unprecedented monetary and fiscal stimulus running into the trillions of dollars and counting. The US economy is in uncharted waters, with GDP estimated to have shrunk a whopping 34.8% in the second quarter – the most on record going back to the 1940s.”

Frank Holmes, CEO, U.S. Global Investors

However, gold’s three-month and one-year rolling returns have moved by less than two standard deviations and are significantly below levels seen in previous periods of strong movements. According to the WGC, this alternative metric suggests that the cumulative magnitude of gold’s move is not unprecedented.

Although the WGC says nothing prevents an asset from outpacing some of these relative performance metrics, the speed of its increase may also result in a period of higher volatility.

In this regard, the council highlights that while gold has moved sharply higher in the past month and there is enough support for gold investment, the price may experience some consolidation.

By Mining.com

More Top Reads From Oilprice.com:

- Microsoft And Halliburton Are Building The Oilfield Of The Future

- Oil Prices In Limbo As Fears Of A Second COVID Wave Grow

- Is The Bottom Finally In Sight For U.S. Drilling Rigs?

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

-

Complete absence of physical demand for gold even after opening from lockdown is a big deag for gold prices which have rallied based on Gold ETF buying activity where ETFs dont buy any physical gold for backing up their gold futures investment.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B