Breaking News:

How to Prepare Your Portfolio for a Harris Victory

From an historical perspective, it’s…

5 Highest Paying Oil & Gas Dividend Stocks for This Summer

Income investors hunting for a…

The One Fuel To Watch This Winter

As the weather turns colder in North America, the refined products market focus turns to distillate products. The fall season typically brings diesel demand, seasonal refinery maintenance, and expectations for how winter heating demand will shape the distillate supply/demand balance. This year, the upcoming implementation of the International Maritime Organization (IMO) 2020 bunker fuel regulations adds another price-impacting factor to the mix, with the IMO set to lower bunker fuel sulfur specifications for ships globally from 3.5 percent sulfur to 0.5 percent sulfur on January 1, 2020.

Generally, the market expects that middle to heavy distillates, from consumer-grade ultra-low sulfur diesel (ULSD) to refinery feedstock low sulfur vacuum gasoil (LVGO), may be utilized as a replacement fuel for 3.5 percent bunker fuel, or used in bunker fuel blends to lower sulfur content. This blog is the first in a new series covering IMO 2020 – the past, present, and future – with an initial look at the state of the U.S. distillate supply/demand balance.

U.S. East Coast Inventories Fall

U.S. East Coast distillate inventories fell to 33.95mn bbls for week ending October 25, according to weekly EIA data, a record low for the fourth week in October. Conversely, EIA U.S. Gulf Coast distillate stocks rose to 43.6mn bbls for the same week, the highest seasonal levels since 2012 for the region. For week ending November 1, this disparity narrowed slightly, with PADD 3 stocks falling 2.8mn bbls from the previous week to 41.8mn bbls and PADD 1 inventories rising by 2.6mn bbls to 36.6mn bbls, led by inventory gains in the U.S. southeast (PADD 1C). However, weekly EIA distillate stocks for PADD 1B continued to fall for week ending November 1 to 16.6mn bbls.

This disparity between the two regions is unusual and related to several factors – distillate demand growth in PADD 1, reduced export levels out of PADD 3, PADD 1 fall refinery maintenance, and the shutdown of Philadelphia Energy Solutions’ (PES) 335,000 bpd Philadelphia refinery this summer following a fire. Colonial allocated its 1.2mn bpd Line 2 Pipeline starting in October, which carries distillate fuels from the U.S. Gulf Coast to destinations throughout the U.S. East Coast region. This is a typical seasonal occurrence exacerbated by reduced production and demand growth in PADD 1. With Colonial Line 2 full, the flow of distillates via pipeline into PADD 1B – the market hub for the Northeastern U.S. -- is at a maximum level, meaning that additional supplies may need to come via waterborne deliveries to balance the market if demand shocks occur.

Related: The Cure For Low Gas Prices Is Low Gas Prices

Figure 1: PADD 3 vs. PADD 1 distillate inventories. Source: EIA

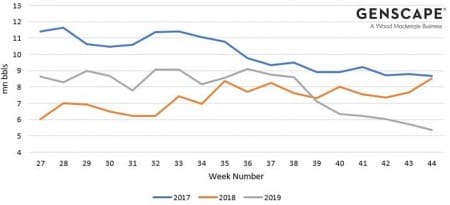

New York Harbor (NYH) heating oil/diesel inventories also fell to record seasonal lows in October, according to our data, which goes back to November 2013 when we first started monitoring. NYH heating oil and diesel stocks fell to 5.37mn bbls for week ending November 1, dropping below levels observed in 2017, when Hurricane Harvey impacted U.S. Gulf Coast refinery utilization and flows of refined products from PADD 3 to PADD 1. For week ending November 1, NYH heating oil/diesel storage capacity utilization dropped to just 29.2 percent, according to our data.

Figure 2: Genscape New York Harbor heating oil/diesel inventories, 2017 to 2019. Source: Genscape

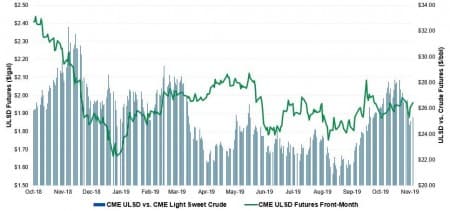

As a result of lower stock levels and expectations for increased distillate demand globally starting in 2020, prices for CME front-month NYH ULSD rose as high as $1.9863/gal October 24, up nearly $0.10/gal from the beginning of October. Spreads between ULSD futures and front-month CME Light Sweet Crude (WTI) futures stayed buoyant over the last year above $20/bbl, even in the summer when diesel demand is typically lighter than other periods of the year. In terms of time spreads, December 2019 CME ULSD futures widened to as much as $0.0564/gal premium to the March 2020 contract month October 8. Backwardation is typically seen in the winter, but this spread widened in recent months ahead of IMO 2020 implementation and expectations for increased diesel demand for both winter heating and bunker fuel blending. As of November 4, the December/March ULSD futures spread was $0.035/gal. A backwardated structure in commodity futures time spreads is usually indicative of a tightly supplied market, where prompter prices command a premium to forward prices.

Figure 3: CME ULSD futures and light sweet crude futures, October 2018 to present. Source: CME

Fall 2019 refinery maintenance season in the U.S. East Coast brought utilization rates to two-year lows, as 2018 rates for primary processing, middle distillate, and heavy product processing stayed near 100 percent throughout that year, according to our refinery monitoring data. Inclusive of the PES Philadelphia refinery, which remained fully shut since early August, primary processing utilization in PADD 1 dipped to a seasonal low of 59.7 percent on September 30, and middle distillates utilization fell to 43.4 percent October 1. Our Refinery Stream Monitor, which aggregates crude and downstream inputs to refineries based on crude unit operations and secondary unit impacts, calculated crude runs in the East Coast at a seasonal low of 700,000 bpd for week ending October 11.

Related: The EIA Is Grossly Overestimating U.S. Shale

Figure 4: PADD 1 refinery utilization and inputs. Source: Genscape Refinery Intelligence and Refinery Stream Monitor

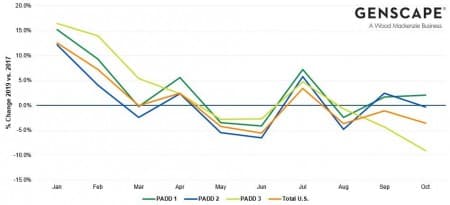

Distillate demand remained buoyant in PADD 1 for 2019 versus previous years. Our Supply Side Prime Normalized data – where daily rack activity is adjusted via EIA Prime Suppliers to reflect full rack market coverage – showed monthly demand up 1.7 percent and 2.4 percent for September and October, respectively, vs. EIA Prime Suppliers in 2017. Elsewhere in the U.S., fall distillate demand contracted in PADD 2 amid a weaker crop harvest season. PADD 3 experienced changes in demand due to declining rig counts and demand for diesel to transport drilling equipment, materials, and produced crude. As a result, total U.S. diesel demand for October was 3.6 percent below 2017 levels, according to our Supply Side data.

Figure 5: Supply side prime normalized No. 2 diesel 2019 vs. EIA prime suppliers 2017. Source: Genscape, EIA

Looking ahead, forecasts for winter temperatures in the coming months are varied. The 2020 Farmers’ Almanac is calling for colder-than-normal temperatures in the northeastern U.S. (PADD 1A and PADD 1B), along with above-normal precipitation. In contrast, the National Oceanic and Atmospheric Association (NOAA) is predicting warmer-than-average temperatures for most of the U.S. but warns that some areas may experience a colder-than-average winter. Above-average precipitation is expected to the northern tier of the U.S., according to NOAA, which, combined with swings in the Arctic Oscillation, could lead to large variability in temperature and precipitation.

Looking Ahead To January

The challenges in predicting winter heating demand for distillate, coupled with the uncertainty of how IMO 2020 implementation will affect distillate supply/demand balances and product flows in the U.S. and globally, highlight the importance of our near-real-time fundamental data. Any changes in supply and demand trends could have a significant effect on price. In addition, the crude oil supply market is changing, as the availability of heavy crude is decreasing and demand for lighter crude is increasing. These fundamental changes compound the complexity of refinery future margins.

By Genscape

More Top Reads From Oilprice.com:

- The Rig Count Collapse Is Far From Over

- Endless Economic Wars: A Major Threat For U.S. Oil Exports

- Saudi Arabia Inks New Mega Deals With The World’s Largest Oil Importer

Genscape

With the world’s largest network of patented and proprietary monitoring technologies, Genscape delivers unique, real-time fundamental data to provide market insight and intelligence. Visit Genscape.com…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B