Breaking News:

U.S. Electricity Prices Surge Amid Grid Strains and Rising Demand

The expected higher expenditures, as…

Rystad: OPEC's Oil Reserves are Much Lower Than Officially Reported

Rystad Energy’s latest research shows…

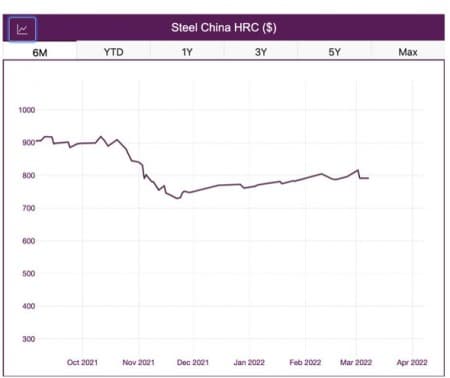

Sky-High Steel Prices Leave China In A Precarious Position

The ongoing Russian-Ukraine conflict has impacted metal prices, including steel raw materials, and ferrous products prices.

Metal prices, raw materials on the rise

Iron ore and coking coal gained the most over the previous week. Meanwhile, steel prices, week over week gained at the Shanghai Futures Exchange. A gradual pickup in Chinese infrastructure demand and the Russia-Ukraine war offered price support.

Russia and Ukraine are among the largest exporters of steel. A disruption in this supply chain saw buyers looking at other options.

One of those options? China’s, the world’s top steel producer.

Russian steel production reached an estimated 6.6 million tons in January, the World Steel Association reported.

Last week also saw prices of ferrous products going up while iron ore and coal futures, too, saw an upward trend. Both futures, as well as spot prices of hot-rolled coil (HRC), saw growth.

Steel, iron ore, coking coal jump

On March 2, 2022, steel futures in China touched more than a fortnight’s high riding on the belief that the Russia-Ukraine war would eventually pump up the demand for Chinese steel.

Related: War-Related Oil Price Volatility Leaves Shale Acquisitions In Limbo

On that day, the May contract for hot-rolled coil on the Shanghai Futures Exchange ended up 2.1% at 5,138 yuan ($814.06) per ton after touching 5,158 yuan in the session (the highest since Feb. 11).

Source: MetalMiner Insights

Construction steel rebar went up 1.8% to 4,860 yuan a ton, after touching the day’s high of 4,893 yuan (highest since Feb. 14).

This also boosted interest in steelmaking raw materials like iron ore and coal. Last Friday, benchmark iron ore futures in China registered their biggest weekly gain in over two years at nearly 20% because of expected supply disruption.

In fact, from the start of February, iron ore prices have been steadily going up because of anticipation of supply chain tightness before the Russian invasion of Ukraine and on its heels.

As the world looks away from Russia and Ukraine for its steel quota, China is the only one that has the capacity to step up on steel production, of course. However, that likely means increased pollution from the country’s coal-fired plants. Pollution is something the Chinese authorities have come down hard against in the past few years.

By AG Metal Miner

More Top Reads From Oilprice.com:

- Palladium Prices Are Soaring As Russian Sanctions Sting

- Volkswagen Chief: Ukraine War Could Be Worse Than COVID For Europe

- Gold Climbs Above $2,000 As Ceasefire Talks Crumble

Metal Miner

MetalMiner is the largest metals-related media site in the US according to third party ranking sites. With a preemptive global perspective on the issues, trends,…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B