|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 11 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 18 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 18 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 18 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 18 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

Rystad: OPEC's Oil Reserves are Much Lower Than Officially Reported

Rystad Energy’s latest research shows…

China's Rare Earths Strategy, Explained

China's recent discovery of new…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

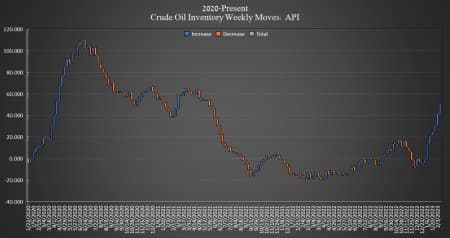

Oil Prices Fall On Another Major Crude Inventory Build

By Julianne Geiger - Feb 22, 2023, 3:44 PM CSTCrude oil inventories saw another substantial rise this week, with a 9.895 million barrel increase last week, the American Petroleum Institute (API) data showed on Tuesday.

This week, SPR inventory held steady for the sixth week in a row at 371.6 million barrels—the lowest amount of crude oil in the SPR since December 1983. But the Biden Administration recently announced that there would be further releases from the SPR in the amount of 26 million barrels, after the stockpiles dropped by 221 million barrels last week.

Oil prices traded down on Tuesday in the run-up to the data release. At 3:32 p.m. EST, WTI was trading down $0.29 (-0.38%) on the day to $76.05 $79.15 per barrel, and down nearly $3 per barrel from this time last week. Brent crude was trading down $1.06 (-1.26%) on the day at $83.01—a weekly decrease of about $2.50 per barrel.

U.S. crude oil production stayed at 12.3 million bpd for week ending February 10—the highest production rate since last April 2020. U.S. production is still 800,000 bpd lower than the peak production seen in March 2020.

WTI was trading at $73.91 shortly after the data release.

Gasoline inventories rose by 894,000 barrels after last week’s API data showed the fuel inventories rising by 846,000 barrels. Distillates rose 1.374 million barrels after rising by 1.728 million bpd in the week prior.

Inventories at Cushing, Oklahoma, increased by 781,000 barrels on top of the 1.954 million barrel hike reported last week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- WTI Loses Over 3% As Fed Minutes Fail To Calm Markets

- Controversial Cost-Cutting Measures To Blame For Ohio Derailment Disaster

- Philippines Looks To Replicate Indonesia’s Nickel Market Success

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com

Why Europe needs the USA to defend from a Russian failed aggression over Ukraine is quite the mystery. Turkaye need more USA money now too of course. *"Can't stop winning!"* be the ongoing hue and cry of not just all of Wall Street but all of New York now let alone Texas now as well.

Clearly the setup for Tesla to double its market cap by this time 600 billion US Dollars instead of the measly 300 billion US Dollars is at hand as well.