Breaking News:

Why China’s Commodity Imports Rise amid Struggling Economy

Chinese purchases of LNG, coal,…

EU Leverages Frozen Russian Assets for €1.5 Billion Aid Package to Ukraine

The European Union has transferred…

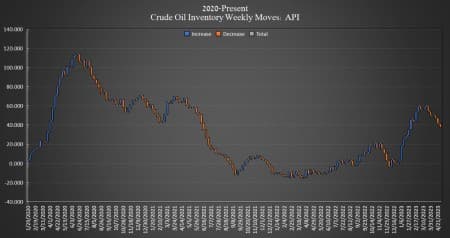

Oil Prices Continue To Slip Even As Crude Oil Inventories Decline

Crude oil inventories in the United fell this week by 3.939 million barrels, the American Petroleum Institute (API) data showed on Tuesday, with analysts expecting a 1 million barrel draw.

The total number of barrels of crude oil gained so far this year is still more than 34 million barrels.

This week, SPR inventory dropped for the fifth week in a row, losing 2 million barrels for the week to reach 364.9 million barrels—the lowest amount of crude oil in the SPR since October 1983.

U.S. crude oil production fell 100,000 bpd during the week ending April 21, to 12.2 million bpd. U.S. production is now 900,000 bpd lower than the peak production seen in March 2020, but 300,000 bpd higher than this time last year.

The price of WTI was trading down sharply on Tuesday in the run-up to the data release, below $72 per barrel on renewed market fears over unremarkable industrial data out of China and the possibility that the Feds could hike rates again later this week—both factors could have an impact on global oil demand.

Brent crude was also trading down on the day.

By 3:30 p.m. EST, WTI was trading down $3.95 (-5.22%) on the day at $71.71 per barrel, a loss of about $5.40 per barrel on the week. Brent crude was trading down $3.93 (-4.96%) on the day at $75.38—down roughly $5.40 per barrel from this same time last week.

WTI was trading at $71.62 shortly after the data release.

Gasoline inventories rose by 400,000 barrels after falling in the week prior by 1.919 million barrels. Distillate inventories fell by 1 million barrels after increasing by 1.693 million barrels in the week prior.

Inventories at Cushing, Oklahoma, increased by 700,000 barrels—after rising by 465,000 barrels last week.

By Julianne Geiger for Oilprice.com

More Top Reads from Oilprice.com:

- BP Has Paid $1 Billion In UK Windfall Taxes

- WTI Crude Falls 4% As Economic Fears Trigger Selloff

- Diamondback Energy Misses Q1 Forecasts As Oil Prices Slide

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

Until these fears subside, crude oil prices will continue under pressure. Even the hugely bullish China factor finds it very difficult to cope with such threats to the global economy and the global banking system.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert