Breaking News:

Why China’s Commodity Imports Rise amid Struggling Economy

Chinese purchases of LNG, coal,…

Unaffordable Prices and Elevated Interest Rates Impact New Car Demand

Amid rising inventories and lackluster…

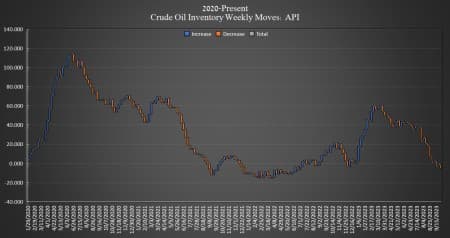

Huge Jump In Crude Inventories Sends Oil Prices Tumbling

The American Petroleum Institute (API) has reported a major inventory build of 12.940 million barrels in U.S. crude inventories, compared to last week’s 4.210-million-barrel draw.

Analysts were expecting a build for the week—although a much smaller one of 1.3 million barrels. The total number of barrels of crude oil moves so far this year is just 4.4 million, according to API data.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) stayed the same last week, with the SPR inventory still sitting at a near 40-year low of 351.3 million barrels, with total purchases for the SPR coming in at less than 4 million barrels since the Biden Administration began its buyback program.

Oil prices were trading down ahead of API data release, with Brent trading down 1.81% at $86.06 at 4:30 p.m. ET—a nearly $8 dip week over week, while WTI was trading down on the day at 2.64%, at $83.70. WTI is down more than $7 per barrel from this same time last week.

Gasoline inventories rose this week by 3.645 million barrels, on top of the 3.946 million barrel build in the week prior. Gasoline inventories are roughly 1% more than the five-year average for this time of year. Distillate inventories fell by 3.535 barrels, compared to the 349,000-barrel build in the week prior, and are now about 13% below the five-year average for this time of year.

Cushing inventories fell this week by 547,000 barrels, after climbing by 705,000 barrels last week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- China Saved $10 Billion By Buying Cheap Oil From Sanctioned Exporters

- Exxon To Offer All-Stock Deal Worth $58 Billion To Pioneer Natural Resources

- The Permian Oil Boom Isn’t Over Just Yet

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

refinery maintenance and the great people in the oil and gas sector in North America who kept North America running during covid and beyond with limited maintenance.

now we need maintenance

This couldn’t be a coincidence because coincidences couldn’t be so punctual. If so then the most probable explanation is a deliberate manipulation of the oil inventory to depress oil prices.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert