Breaking News:

Bad News From China Could Be The Harbinger For Lower Oil Prices

Despite some industrial sector gains,…

COP29 Host Aims to Raise $1 Billion for New Climate Fund

Azerbaijan is proposing a new…

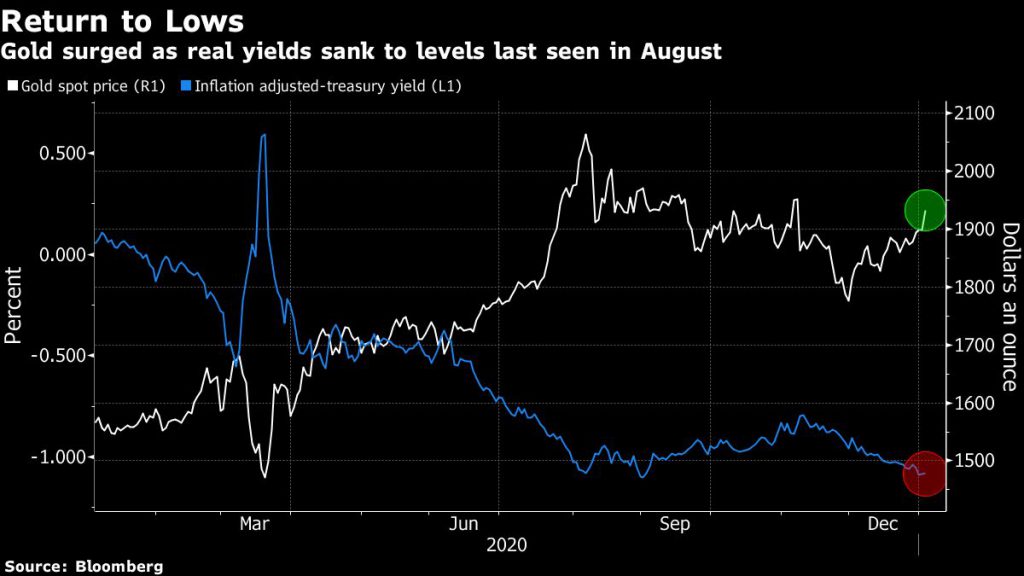

Gold Rallies Into The New Year

Gold is off to a good start in 2021 after recording its best yearly gain in a decade. Prices surged above $1,900 an ounce on Monday to the highest in almost two months as lower US real yields and a weaker dollar kept the yellow metal’s momentum up.

Spot gold advanced 2.1% to $1,939.41 an ounce by 11:40 a.m. EST. US gold futures were also up 2.6% to $1,945.10 per ounce.

Real yields — the difference between nominal benchmark bond yields and the rate of inflation — fell close to last year’s lowest point on Friday, boosting bullion’s appeal. The decline in real rates is being driven by a rise in inflation expectations, with the market betting on vaccine distribution, further central bank support and continuing government aid.

“Investors are looking for assets which benefit from higher inflation,” Giovanni Staunovo, an analyst at UBS Group AG, said in an interview with Bloomberg. “The reflation element is also supporting gold today.”

Meanwhile, the US currency continues to languish after sliding for three quarters, with the dollar index dropping to a 2-1/2 year low, thus making bullion cheaper for holders of other currencies. Gold is also being supported by renewed inflows into exchange-traded funds, following withdrawals in November and the first weeks of December.

“There is the likelihood that we will see significant stimulus, which will lead to further declines in the dollar,” Jeffrey Sica, founder of Circle Squared Alternative Investments, told Reuters.

Tuesday’s run-off elections in the US state of Georgia, which will decide which party controls the Senate, were also on investors’ radar. “The Senate election this week could turn out to be a major disruptive event so gold is rallying on that,” Sica added.

A unified government would increase president-elect Joe Biden’s ability to reshape the world’s largest economy, from rewriting the tax code to boosting stimulus and infrastructure spending.

Non-yielding bullion is widely considered a hedge against inflation and currency debasement that are likely to result from large stimulus measures.

By Mining.com

More Top Reads From Oilprice.com:

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B