Breaking News:

Iranian Oil Exports Have Risen Sharply, Facilitated By Malaysia

Whether or not the U.S.…

Stock Market’s Short-Term Focus Threatens Energy Transition Goals

The problem that most companies…

Crude Prices Rise On Surprise Inventory Draw

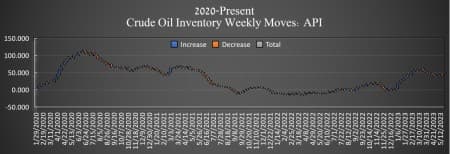

Crude oil inventories in the United fell this week by 6.70 million barrels, the American Petroleum Institute (API) data showed on Tuesday, with analysts expecting a 525,000 million barrel build.

The total number of barrels of crude oil gained so far this year is just over 35 million barrels.

This week, SPR inventory dropped for the eighth week in a row as another 1.6 million barrels of congressionally mandated crude oil was sold during the week ending May 19. There are now 358 million barrels—the lowest amount of crude oil in the SPR since September 1983. There are additional sales of crude oil from the SPR planned yet this month.

U.S. crude oil production fell during the week ending May 12, staying at 12.2 million bpd. U.S. production is now 900,000 bpd lower than the peak production seen in March 2020, but 300,000 bpd higher than this time last year.

The price of WTI and Brent were both trading up on Tuesday in the run-up to the data release.

By 3:11 p.m. EST, WTI was trading up $0.86 (+1.19%) on the day at $72.91 per barrel, and up more than $2 per barrel week over week. Brent crude was trading up $0.84 (+1.11%) on the day at $76.83—up roughly $2 per barrel from this time last week.

WTI was trading at $73.18 shortly after the data release.

Gasoline inventories fell by 6.398 million barrels after falling in the week prior by 2.46 million barrels. Distillate inventories fell by 1.771 million barrels after decreasing by 886,000 barrels in the week prior.

Inventories at Cushing, Oklahoma, rose by 1.711 million barrels—after rising by 2.87 million barrels last week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Chevron To Buy Shale Firm PDC Energy In $6.3-Billion Deal

- Alberta Wildfires Still Sapping Crude Oil Production

- Bank Of America Sees Oil Prices Heading Toward $90 This Year

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B