|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 5 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 13 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 13 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 13 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 13 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

A Critical Election Looms for Venezuela

The outcome of the presidential…

Solar Surplus: California's Renewable Energy Dilemma

California's excess solar power production,…

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

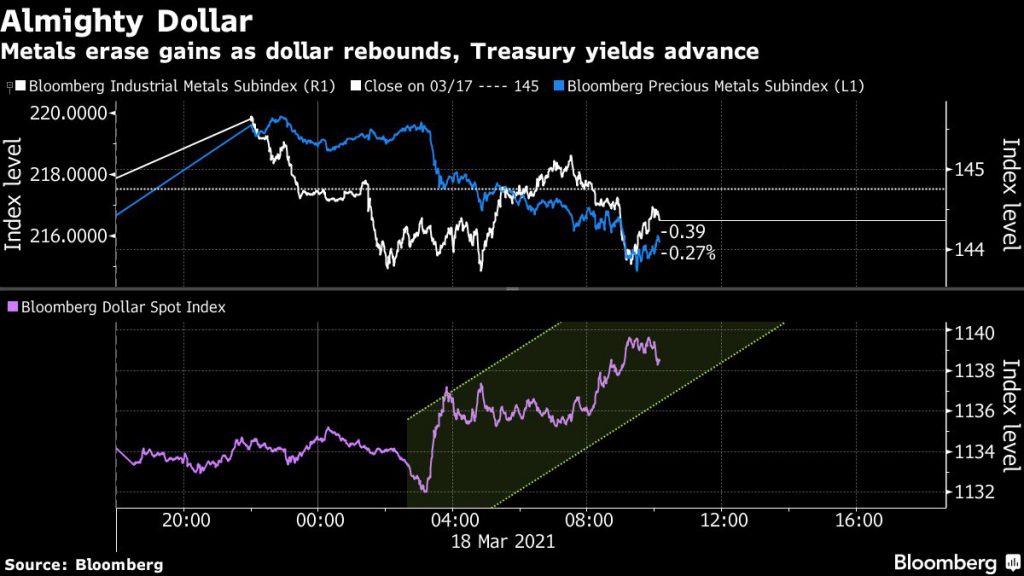

Climbing Yields, Stronger Dollar Weigh On Gold Prices

By MINING.com - Mar 18, 2021, 12:30 PM CDTGold prices reversed course on Thursday, dropping from a more than two-week high, as bullion’s appeal continues to be tarnished by climbing US Treasury yields and a firmer dollar.

Spot gold fell 1.1% to $1,728.96 per ounce by noon EST, while US gold futures for April delivery held steady at $1,728.80 per ounce.

Meanwhile, the benchmark US 10-year Treasury yield rose to 1.74% for the first time since January 2020, helping to lift the dollar from a two-week low.

The US Federal Reserve on Wednesday said the US economy was on track for its fastest expansion in nearly 40 years, but the central bank pledged to keep its ultra-easy monetary policy stance despite expected inflationary pressure.

This message helped briefly curb the relentless rise of bond rates, which have been putting pressure on non-interest-bearing gold this year.

“Gold has, despite the outlook for higher inflation as the Fed allows the economy to run red hot, traded lower today as yields continue to climb,” Ole Hansen, head of commodity strategy at Saxo Bank A/S, said in a note to Bloomberg.

The Fed allowing inflation to rise should support a turnaround, “but first we need to scale $1,765 an ounce which has become a level that many are watching,” he added.

“(The Fed) is getting more optimistic and that doesn’t bode well for gold and suggests that the trend lower is likely to continue,” DailyFX currency strategist Ilya Spivak, told Reuters.

By Mining.com

More Top Reads From Oilprice.com:

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com