Breaking News:

Porsche Shares Slide as Sportscar Maker Slashes Revenue Forecast

Shares of the German sportscar…

Kuwait Looks To Nearly Double Production After Major Oil Find

Sheikh Nawaf al-Sabah, CEO of…

China Refines More Oil Than The U.S. For The First Time Ever

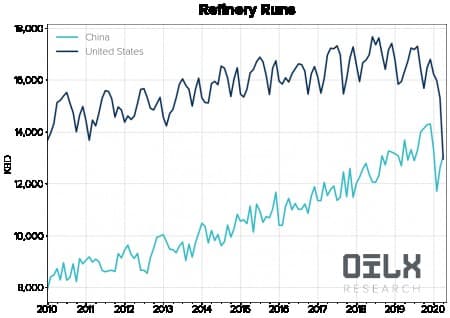

The unprecedented situation on the oil market these days has led to yet another industry first. For the first time ever, Chinese refinery throughput has surpassed refinery crude processing in the United States as China emerges from the lockdown. At the same time, U.S. fuel demand continues to plummet amid lockdowns in many states.

According to the chart below by OilX, Chinese refiners are cranking up runs as the country emerges from the two-month-long lockdown. In contrast, refinery runs at U.S. refineries are plummeting, to the point that China is currently processing more crude oil at its refineries than the world’s top oil consumer, the United States.

Source: OilX

China’s independent refiners, commonly known as teapots, began to restore some curtailed production in March, taking advantage of the cheap oil amid the oil price war as the country started to lift lockdowns and ease travel restriction measures gradually.

At the same time, U.S. refineries are lowering utilization rates as demand for gasoline is at its lowest in decades while people work from home and practice social distancing.

In the week to April 10, refineries in the U.S. processed an average of 12.7 million bpd of crude. This compares with 13.6 million bpd a week earlier and 14.9 million bpd three weeks ago, the EIA said in its weekly inventory report last week, which showed a record crude oil inventory build of 19.2 million barrels.

“We are seeing fast and furious gasoline demand destruction. The latest data reveals demand levels not seen since spring of 1968,” AAA spokesperson Jeanette Casselano said at the beginning of last week.

On Monday, AAA said that refinery rates dipped to 69 percent, a level not reported by the EIA in more than a decade.

“Despite lower run rates amid low demand, gasoline stocks increased. Total U.S. stock levels measure at a record 262 million bbl – the highest weekly domestic stock level ever recorded by EIA, since it began reporting the data in 1990,” according to AAA.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- A Massive Wave Of Shut-Ins Fails To Halt Oil Price Crash

- The Real Winner Of The OPEC+ Output Deal

- The Surprising Winners And Losers Of The Global Oil Glut

Tsvetana Paraskova

Tsvetana is a writer for Oilprice.com with over a decade of experience writing for news outlets such as iNVEZZ and SeeNews.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B