Breaking News:

Grid-Enhancing Technologies: The Answer to Growing Power Needs?

Grid-enhancing technologies offer interim solutions…

Canada Set To Delay Trans Mountain Pipeline Sale After 2025 Election

Canada’s federal government plans to…

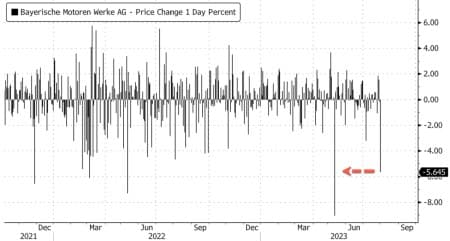

BMW Faces Headwinds After Tesla's Weaponized EV Price Cuts

Tesla's weaponized price cuts of its electric vehicles have fueled a global price war to maintain market share appears to be working yet again. Just last week, Ford announced it would suffer billion-dollar losses on EVs this year. Now, BMW AG shares are sliding after it warned of soaring costs for developing electric vehicles and snarled supply chains.

BMW now expects automotive free cash flow of above €6 billion ($6.6 billion) this year, from about €7 billion earlier.

Additionally, free cash flow in the Automotive segment is now anticipated to be above €6 billion for the full year 2023, taking into account higher investments in the transformation to electromobility as well as increased inventories to ensure the necessary supply of vehicles to the markets.

The German luxury car maker now expects "higher expenses for suppliers due to inflation and the supply chain to continue to be a headwind in the second half of the year."

A combination of soaring expenses due to EV production and supply chain headwinds sent shares of BMW in Frankfurt down as much as 6.7%, the most significant intraday decline since May 12.

Bloomberg added more color about the supply chain woes:

"After protracted semiconductor supply issues, several carmakers are now struggling with new logistics constraints. Volkswagen AG cut its delivery outlook last week after a lack of truck drivers left finished vehicles stranded at factories. Porsche AG had to cap sales of its electric Taycan after struggling to source certain components."

Jefferies analyst Philippe Houchois wrote in a note to clients that BMW's statement this morning is "confusing and negative."

Even though there were cautious comments on a potential second-half headwind, the car company raised its full-year earnings forecast on improving the availability of its premium vehicles.

Troubles at BMW's electric vehicle division come days after Ford announced it would lose $4.5 billion from its EV segment this year, a $1.5 billion larger loss than the company had forecast.

BMW and Ford's EV problems come after Tesla has spent most of the year lowering its vehicle prices to squeeze its competition. This strategy is working.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Gasoline: The Price Rally That Nobody Saw Coming

- Oil Prices Rise As Focus Returns To Supply Tightness

- U.S. Drilling Dips Slightly Amid Rising Oil Prices

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B