|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 6 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 14 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 14 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 14 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 14 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

Chinese Mining Operations in Tajikistan Spark Environmental Backlash

Chinese mining and agricultural companies…

Stock Market’s Short-Term Focus Threatens Energy Transition Goals

The problem that most companies…

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Auto Manufacturers To Brace For Turmoil Amid Supply Chain Disruptions

By ZeroHedge - Apr 14, 2023, 9:30 AM CDTWSJ cited data from multiple auto data providers that show the market shift and what appears to be an emerging discount wave on new vehicles, granted lending standards remain tight.

The number one reason auto manufacturers experienced a profit boom during Covid was due to supply chain disruptions that led to inventory declines, and cheap credit allowed consumers to panic buy anything on the dealer lot, driving prices through the roof. Now inventory lots are filling up.

According to data provider Cox Automotive, the weekly supply of vehicles at dealerships jumped to 740,000, or about 70% higher, in March than a year before.

More supply at dealers and a declining pool of creditworthy Americans means any remaining buyer has renewed bargaining power. This has led to increased vehicle discounts last month of 3.3%, up almost a percentage point compared with the same month the previous year, according to new estimates by J.D. Power.

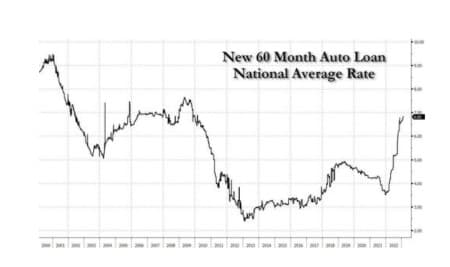

Combinate the flood of new supplies with an affordability crisis as new-car loan rates have nearly doubled, and it's becoming evident that a discount wave is only just unfolding, leading to a future profit bust for automakers.

Meanwhile, Paul Jacobson, Chief Financial Officer at General Motors, knows turmoil is coming, as he told journalists in New York this week that high cash flows are needed to fund new ventures into electric vehicle programs. Jacobson said cost-cutting efforts are underway.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Forgotten Equation Could Be Key In Recycling CO2

- Google Aims To Cut The Bureaucratic Red Tape In Green Power Procurement

- Russia's Oil Revenues Rebound As Exports Surge To Three-Year High

ZeroHedge

The leading economics blog online covering financial issues, geopolitics and trading.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com