Breaking News:

Solar Companies Forced To Borrow To Finance Growth

Solar companies raised $12.2 billion…

Could the UK’s Crown Estate Shake-Up Accelerate Offshore Wind Investment?

The UK government is proposing…

Analysts: Inflation Has Peaked, But Prices Likely To Remain High

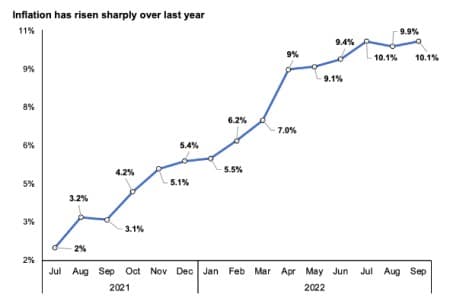

Inflation has peaked in the UK, but will take a long time to fall, a top investment bank has bet.

New data out from the Office for National Statistics on Wednesday will show prices rose 10.9 percent over the last year, according to Deutsche Bank.

While above September’s 10.1 percent reading and a 40-year high, “inflation will likely have peaked in October,” Sanjay Raja, an economist at the firm, said.

If his bet materialises, it will provide a welcome respite from what has been a rampant inflation surge over the last year or so.

Inflation has stayed above the Bank of England’s two percent target since summer 2021. It dropped back slightly in August, only to rise again in September.

Inflation has risen sharply over last year

Source: ONS

High energy prices, gummed up supply chains after the Covid-19 unlocking and rapid wage growth have all pushed prices higher. Russia’s invasion of Ukraine has also fuelled inflation by jolting international energy markets.

Raja said energy regulator Ofgem’s price cap rise to £2,500 – held lower by the government pegging household energy costs – drove October inflation higher.

However, he warned inflation would stay persistently higher.

“Emerging second-round effects and a tight labour market will likely keep price pressures sustained for a little longer heading into 2023, particularly with regards to services inflation,” he said.

The Bank of England has hiked interest rates eight times in a row to three percent, including a 75 basis point rise earlier this month, the largest increase in over 30 years.

The series of rate hikes are designed to make it more expensive to borrow money and more attractive to save, thereby curbing spending and, in theory, prices.

Central banks cannot tame present day price rises. Instead, they raise interest rates to prevent so-called “second-round” effects, in which workers demand wage rises and businesses hike prices steeply, creating an inflationary feedback loop.

By City AM

City A.M

CityAM.com is the online presence of City A.M., London's first free daily business newspaper. Both platforms cover financial and business news as well as sport and…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B