Breaking News:

Unaffordable Prices and Elevated Interest Rates Impact New Car Demand

Amid rising inventories and lackluster…

Tesla to Focus on Autonomy and AI as Earnings Disappoint

Tesla is facing a slowdown…

50% Of Hard-Rock Miners Are Losing Money As Lithium Prices Slump

Investment in battery manufacturing plants and electric vehicle factories continues to boom around the world, but for now the market for lithium shows no signs of emerging from its multi-year slump.

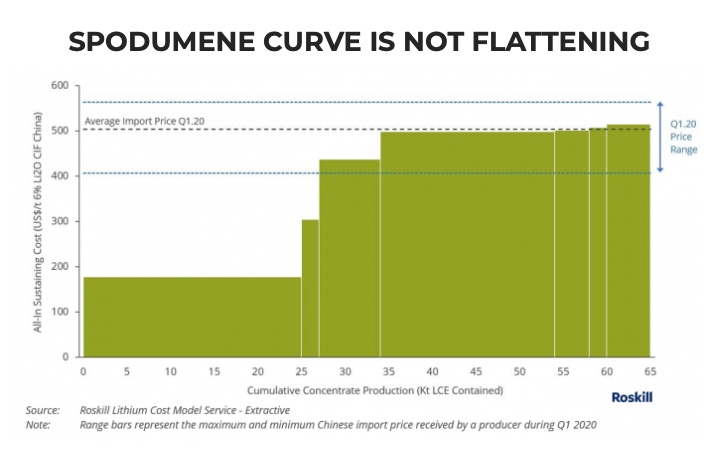

Hard rock miners have been hardest hit, with the price of spodumene concentrate (feedstock for lithium hydroxide manufacture) continuing to fall on the back of break-neck expansion in Australia, which quickly became the number one producer of lithium over South American brine producers.

Oversupply and a soft downstream industry in China, responsible for as much as 80% of global processing, have seen chemical-grade spodumene prices average just over $500 a tonne (6% Li CIF China) in the first quarter according to Roskill, a London-based metals and minerals researcher.

Roskill says, in a new industry outlook to 2030 report, this average is slightly misleading because Greenbushes, the largest and highest-grade mine of its kind, receives higher prices for its material owing to the integrated nature of the operation.

Excluding Greenbushes, the average spodumene import price into China was just $436 per tonne according to Roskill data, putting a full 50% of hard rock miners in a marginal to loss-making position on an all in sustaining cost basis during Q2:

Roskill is forecasting spodumene prices to remain subdued for the next 12-18 months – many producers look set to remain under pressure.

“Collectively, they face the dilemma of upping production (and utilisation rates) to generate the economies of scale needed to lower their cost base, while not exacerbating an already oversupplied market and deepening and/or prolonging the situation.”

By Mining.com

More Top Reads From Oilprice.com:

- Russia Wants OPEC+ To React To Oil Demand Recovery

- Oil Prices Jump On Major Hurricane-Driven Crude Draw

- OPEC Production Rises By 950,000 Bpd In August

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B